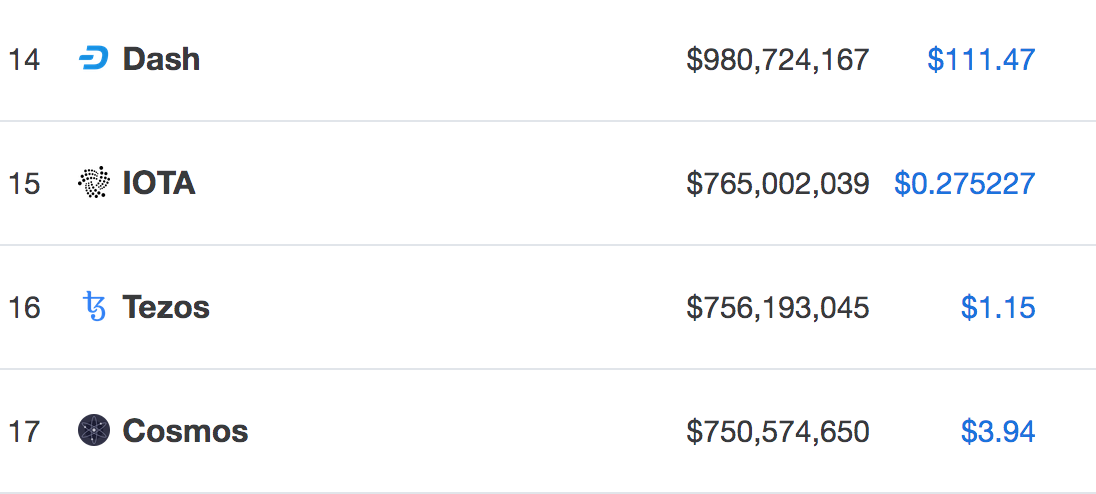

IOTA has remained pretty neutral over the past 3 trading months after the coin moved by a small margin of -2% to bring the current price for the coin down to around $0.2752. The cryptocurrency has seen a rough time over the past 30 trading days as the market fell by a total of 23%.

IOTA is now ranked in 15th position amongst the top coins, as it presently holds a $765 million market cap value. However, 16th place holder, Tezos, is quickly catching up as it sits less than $10 million away from taking over.

The 23-month-old project has had a very static 2019, as price action was unable to make further movements above $0.40 at the start of the year, and continued to fall slightly ever since.

In this article, we will take a look at the possibility of IOTA rising by a total of 17% to reach a target value of $0.32. Realistically, the possibility is pretty slim. However, if the coin can break back above the $0.30 resistance, then it has a strong chance to continue toward $0.32.

Let us take a look at the IOTA market over the long term and highlight some potential areas of support and resistance on the way toward $0.32.

IOTA Analysis

IOTA/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

IOTA has pretty much been trapped within a wide sideways range of $0.10 between $0.25 and $0.35. In April 2019, the cryptocurrency managed to break above the 100-day moving average for the first time since May 2018. However, this was short lived, and price action continued to collapse beneath the 100-day moving average as the month progressed.

The coin found support at the $0.26 level toward the end of April 2019, which allowed price action to rebound into the 100-day moving average once again. However, the coin reversed and began to slide low to where it is presently trading at support around the $0.27 level.

What Is the Short-Term Trend?

The short-term trend for IOTA/USD is presently neutral. If the coin was to slip further lower and break beneath the $0.26 level, then we could consider the market to be bearish. For this market to turn bullish, we would need to see IOTA break above the $0.38 level and continue higher.

Where Can We Go From Here?

The market is currently sitting at strong support at the $0.27 level. We can expect the bulls to attempt to defend this area aggressively moving forward. However, if the sellers do continue to cause IOTA to drop beneath the $0.27 level, initial support below is located at the short-term .786 and .886 Fibonacci Retracement levels (drawn in green), priced at $0.2502 and $0.2299, respectively.

What If the Bulls Take Control of the Market?

Alternatively, if the bulls manage to defend $0.27 and allow IOTA/USD to rise once again, we can expect immediate resistance above the market to be located at $0.2843, which contains the bearish .618 Fibonacci Retracement level (drawn in green). Above this, higher resistance then lies at $0.30.

If the buyers can continue above $0.30, higher resistance is then to be expected at the target level of $0.32. The resistance at $0.32 is further bolstered by the 100-day moving average level, which floats around the same level.

Above $0.32, further resistance can then be expected at the $0.35, $0.3681, $0.38, and $0.40 levels.

What Are the Technical Indicators Showing?

The RSI has recently broken beneath the 50 level, which indicates that the bears have recently established control of the market momentum. If we would like to see IOTA hit the target price of $0.32, we would need to see the RSI reverse and break back above the 50 level.

Conclusion

IOTA certainly does have the potential to reach the $0.32 target level before the end of the month. However, the bulls will firstly need to battle to hold the support at $0.27 and then continue to climb higher and break above significant resistance at $0.30. After $0.30, the resistance at the target level, $0.32, is strong due to the 100-day moving average being located in this area.