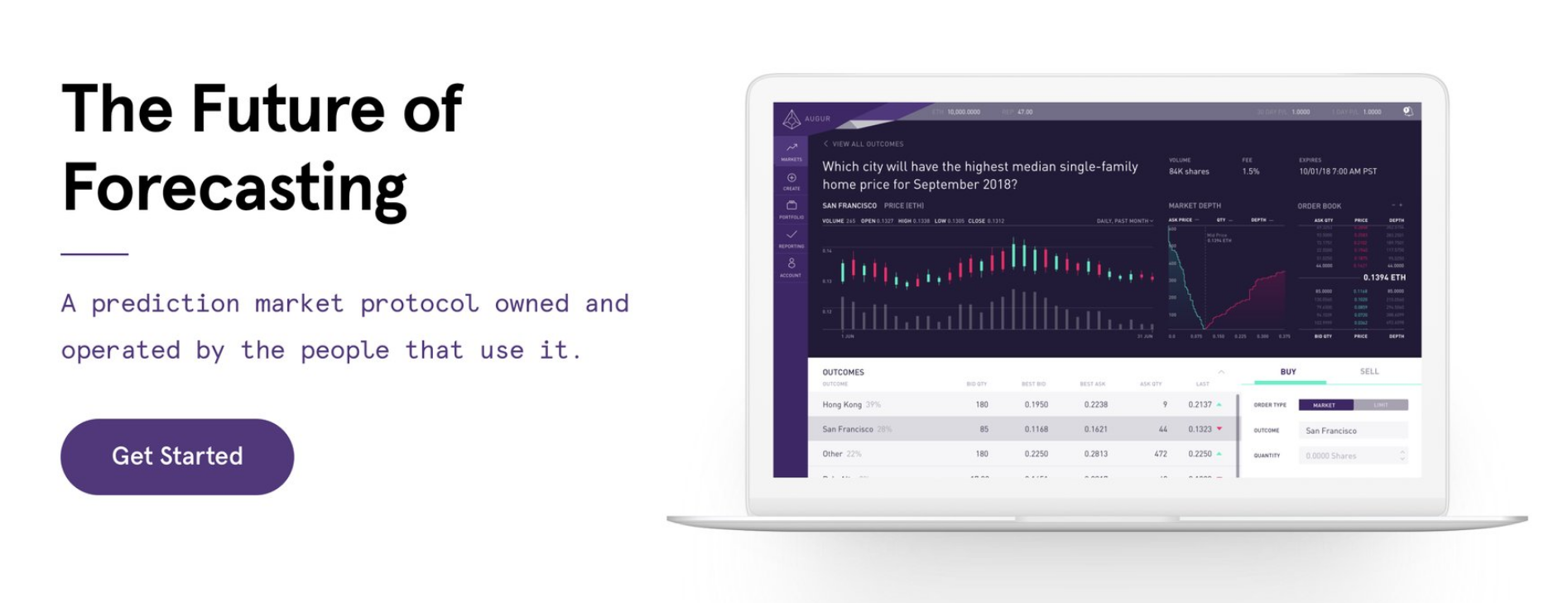

Augur is a decentralized prediction marketplace that allows users to create their own markets, make bets, and sell shares based on the outcome of any world event.

The Augur prediction market seeks to provide more accurate forecasting through the use of crowdsourced data and the decentralization of consensus. Markets can be created by any user, on any event outcome.

Centralized prediction markets have security vulnerabilities, and can be gamed. Single sources of information are vulnerable to bad actors seeking to release the funds of the smart contract. This is known as the “oracle problem” of a centralized prediction market.

Augur creates its consensus in a decentralized manner.

Decentralized consensus is created on Augur through the incentivized reporting of REP token holders. REP holders are rewarded from the reporting pool. Accurate reporters of market events are rewarded with REP tokens, while inaccurate or dishonest reporters are penalized.

Augur’s founders, Jack Peterson and Joey Krug imagine the platform as a highly liquid marketplace where users are able to “tap the wisdom of the crowd”, in order to make better decisions.

Augur is built on the Ethereum blockchain. It recently launched its mainnet on July 9, 2018. Here are 7 reasons why I’m excited about the future of Augur.

1. Augur’s Decentralized Method of Achieving Consensus

Decentralized consensus is superior to centralized consensus. Centralized markets operate by using a trusted party to maintain a ledger. This ledger determines the outcome of each market. Singular, trusted parties can be vulnerable to bad actors. This is why decentralization is so important in prediction markets!

The Augur decentralized oracle and prediction market platform gives its users the ability to create, bet, and report on events in a trustless system. The system is trustless, because its market consensus is determined by its own users. Its users are rewarded with REP tokens, for accurately reporting the outcome of the events.

Crowdsourced consensus is beneficial in prediction markets, because it makes the markets less vulnerable to manipulation from bad actors. It also tends to increase accuracy.

2. Augur Allows Access to Untapped Markets

Augur allows its users to tap into markets, which they otherwise could never access. This includes markets with a high financial barrier of entry, as well as markets that can’t be accessed due to geography, financial regulations, or citizenship.

Difficult to tap markets include real estate, cryptocurrency, or foreign stocks. They can even include unusual markets like celebrity events or space travel. If a user can think up an event, it can be created, bet on, and predicted by a crowd of Augur users.

3. The Token Economics of Augur

Holding REP tokens has benefits far beyond the appreciation of the currency.

Holders will receive a distribution of fees from the network. These fees include “oracle fees,” which are provided in exchange for participating in event reporting. REP holders are not required to be oracles, but they will be paid if they choose to be. “Oracle fees” are distributed between all accurate reporters on the network. This helps the network achieve its reporting consensus.

Holders have the opportunity to stake their REP, in order to participate and share in the dynamic settlement fee. This fee is determined by the amount of REP that is staked.

REP token holders are also entitled to 50% of the trading fees occurring on the market. The more successful the Augur markets become, the more fees that will be distributed to Augur holders.

4. Augur Provides Easy Access to Markets Requiring Large Amounts of Capital

Certain markets (like the real estate market) require significant amounts of capital to participate. Using Augur, you can make bets and predictions on real estate prices, with very little capital. For example, a user can create a prediction market on the total market cap of the U.S. real estate market. They can then stake a small or large amount of REP, in order to profit off real estate market price movements.

Users can risk whatever funds they feel comfortable with. This allows them to be involved in this expensive market, without having to fork up large amounts of funds to purchase a property. The Augur platform even provides the ability to short real estate prices, by creating a prediction market.

5. Prediction Markets Can Be Created to Hedge Risks

A user can manage the risk of a financial investment by creating an opposite market that will payout on the downturn of the original investment. Hedging risks is a way to ensure that you are able to cover your expenses, even if a market turns in the opposite direction.

Prediction markets let users create a market, in order to hedge against negative outcomes. Thus, the Augur markets provide a new way to protect oneself financially in the event of a market drop.

6. Augur’s Impressive List of Partnerships and Advisors

The Augur project has an impressive list of developers, partners, and advisors. It was one of the first projects on the Ethereum blockchain, founded in 2014 by developers Jack Peterson and Joey Krug.

Advisors of Augur include the developer of Ethereum and blockchain all-star, Vitalik Buterin. Peter Thiel, (one of Ethereum’s early backers), granted Augur the “Peter Thiel Fellowship.” This provided the startup with access to $200,000 in seed funding in 2014.

Krug has now joined the team at Pantera Capital (which is one of the largest crypto hedge-funds), after he had finished development on Augur.

Augur is now working with well-known companies like Microsoft, which has added it as a service to new Azure blockchain-as-a-service (BaaS) solution.

7. Augur’s Recent Mainnet Launch

The Augur prediction market platform recently emerged from its beta phase. Its mainnet launched on July 9, 2018.

Augur has the first mover advantage compared to its competitors, as it has been in development since 2014. Augur was one of the very first, and is now one of the top dapps on the Ethereum blockchain.

Augur’s competitors include: Gnosis, Bodhi (which is now live on the Qtum blockchain), Hivemind, and Stox.

As of July 2018, Augur has risen to the 35th highest ranked cryptocurrency with an almost $400 million market cap. As the Augur platform grows, token holders will see increased dividends as the volume in the marketplace increases.

The future looks bright for the Augur decentralized prediction marketplace!

Visit the Augur website to learn more about the project. The Augur App is available for download here. To keep up with project developments, here’s their blog and Twitter.

Related: Augur Price Analysis: REP Meets Resistance as Mainnet Launch Looms