2018 has been tough on us HODLers. Not much more needs to be said about that, but the question on many minds remains whether hodling is still worth it after all these red months. We may have reached the bottom, but we also may have not. Nobody knows.

Obviously, selling low is in no way the best investment or trade strategy. However, it still is very important to assess whether the asset you’ve invested in will go back up in the long run.

In this article, we take a look at Binance’s BNB token and the reasons why we believe BNB is an asset that is worth hodling.

Before digging into these reasons, it’s important to understand the function of Binance’s native (ERC-20 based) token BNB within the exchange’s ecosystem.

BNB is used for discounted trading fees, meaning that trading BNB pairings can save high-frequency traders a lot of money. Currently, using BNB for trading saves traders 25% on Binance’s already relatively low (0.1%) trading fees. There is a newly released vesting schedule for this, outlined here, which presents a reduction of the trading discounts over the next 5 years and also indicates that users with large BNB token holdings will be granted specific perks.

The price of Binance’s BNB token depends on the demand for the token, which the discounted trading fees of large token holder perks are designed to strengthen. Let’s take a look at the the other factors that could potentially drive demand for BNB.

Binance is Chasing Big Money

As indicated by Binance’s new Tiered Trading Fee Discount Program, a user’s 30-day trading volume should surpass 100 BTC. This is not the average portfolio of a retail investor, and that’s only to reach the first tier.

Another indicator that Binance is going for the big bucks is the recently established joint venture with the Liechtenstein-based exchange LCX. This is an exchange that specifically targets institutional investors by providing all the institutional-grade products, services, and requirements in terms of liquidity and security needed by these organizations to be able to invest in the crypto space.

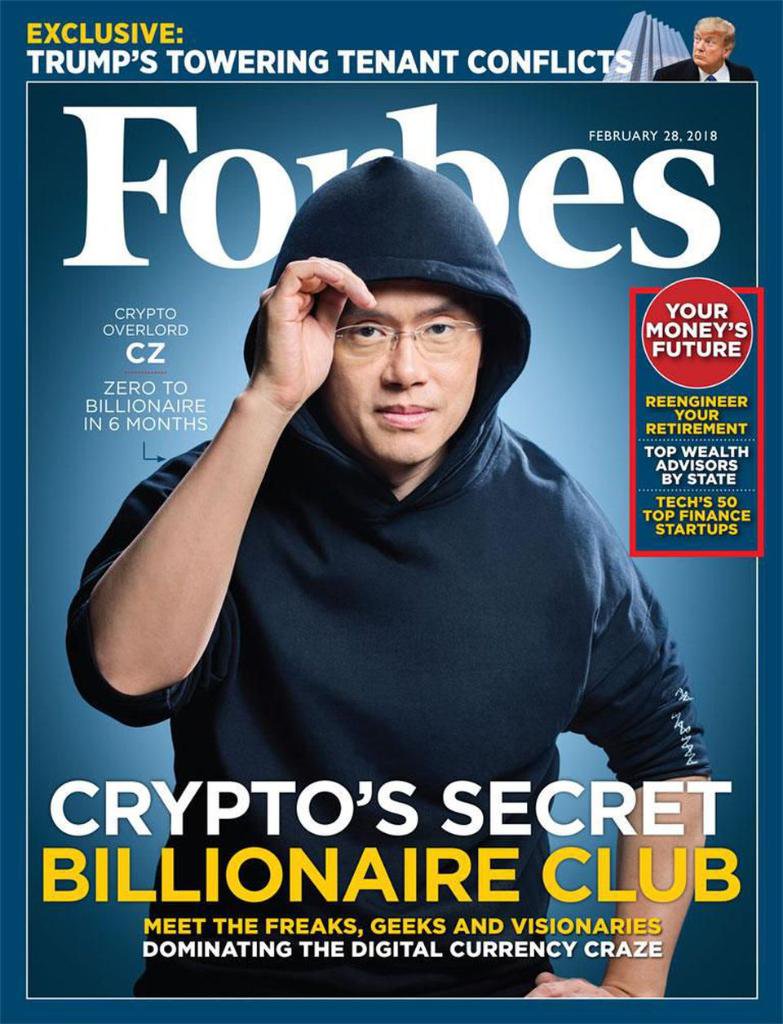

Binance CEO Changpeng Zhao also specifically mentioned in an event in Singapore that even though the exchange was previously more focussed on the retail investors, they are observing the willingness of institutions to enter crypto and are eager to facilitate this.

Binance is the #1 Exchange

Binance has been the number 1 cryptocurrency exchange for a few months now in terms of both transaction volume and in the number of active users. The popularity of the exchange is immense, indicated by multiple parameters, such the the 240,000 new users within one hour after Binance had closed new registrations due to the fact that they simply couldn’t hire enough servers to support the traffic coming through the exchange.

Binance has built a strong reputation in the crypto community as being very supportive of the decentralization and tokenization ideology, something that is often underscored by CEO Zhao’s strong pro-cryptocurrency attitude backed by informed arguments.

For instance, in an interview with Bloomberg early 2018, CZ stated the following:

Warren Buffett is a guy I truly respect from an investment point of view, but I do not think he understands cryptocurrencies at all. It is what it is. I still respect him in other parts of his expertise. But I think on cryptocurrencies he’s making a big mistake.

What’s even more impressive about the fact that Binance is the #1 cryptocurrency exchange in term of volume and active users is the fact that the exchange doesn’t even support fiat deposits and withdrawals yet, which many of its biggest competitors do. However, a change is coming in this regard.

Binance is Going to Facilitate Fiat-Crypto Transactions

Binance is very serious about onboarding fiat transactions on its exchange, and as stated by Zhao:

We don’t offer fiat gateways and so we rely on others to do that. But through discussions with different regulators across the world, we now have those channels. We want to make it easier for fiat currency to get into the crypto world.

Zhao added that Binance is planning to have 3 fiat-crypto gateways opened up in 2018 and expects this to go to 10 before 2020, with the ultimate goal of having at least 2 fiat-crypto gateways in every continent.

The previously mentioned partnership with LCX has been established with the exciting announcement that the Binance LCX joint venture will be launching a fiat-to-crypto exchange in Liechtenstein. The to-be-launched exchange will support fiat deposits, withdrawals, and trades for both the Euro and the Swiss Franc and more are to be expected in the future, depending on regulatory approval.

From left to right: Monty C. M. Metzger (CEO of LCX), Adrian Hasler (Prime Minister of Liechtenstein) and Changpeng Zhao (CEO & Founder Binance).

Additionally, Binance announced to facilitate fiat-crypto trading in its current residential jurisdiction Malta and is close to beta testing its fiat-crypto exchange in Singapore.

These fiat-crypto gateways can give an incredible boost to the transaction volume traded through Binance as investors unfamiliar with the workings of sending crypto around can now directly buy crypto with fiat. The collaboration with institutional investor tailor-made exchange LCX is expected to bring institutional capital to both exchanges. These investors will definitely want to take the financial advantages provided by the BNB token.

The Binance DEX

For an industry that is all about decentralization, it’s pretty counterintuitive that nearly all gateways to the decentralized industry are centralized exchanges (Ethereum founder and “decentralize everything” proponent Vitalik Buterin even stated he hoped they would all burn in hell).

Even though decentralized exchanges offer serious advantages over their centralized counterparts — especially in terms of security (no platform-wide hacks possible), zero downtime, full control of the digital assets by the user, and anonymity — current decentralized exchanges have been running into multiple technical issues, as well as limitations in terms of advanced trading options and liquidity. Binance is planning to tackle these issues head-on with the scheduled launch of its own decentralized exchange, of which the demo was released on August 9.

Zhao believes that decentralized exchanges are the future and is not planning to miss out on this opportunity, having committed a sizeable team to develop the Binance DEX. Even though the CEO has set no date or period in which the DEX will be released, he did state that they are planning to release the public beta of the decentralized exchange later 2018 or early 2019.

Binance already bought Trust Wallet, a decentralized wallet for Ethereum and Ethereum-based tokens and has indicated that the wallet will be integrated in the decentralized exchange as the default wallet.

With Binance’s vast experience in the industry and their impressive active user base, their DEX has a lot of potential and could release the industry’s pro-decentralization community from their dependency on centralized exchanges whilst serving the needs of institutional capital on their existing centralized exchange.

BNB will most likely be used in a similar manner on the DEX as it’s currently used on the Binance platform, giving the token another pool for demand.

BNB Token Economics

All the previously described events for the Binance exchange are reasons why the demand for BNB could increase, but this wouldn’t be worth much if the token economic model behind BNB wasn’t strong, which it fortunately is.

First of all, there is the previously mentioned trading discount when trading through BNB. BNB is paired with most of the substantially sized market cap coins such as Bitcoin, Ethereum, and Cardano, but also include smaller tokens such as AdEx, SingularityNET and Nexus, just to name a few. Click here for a full overview.

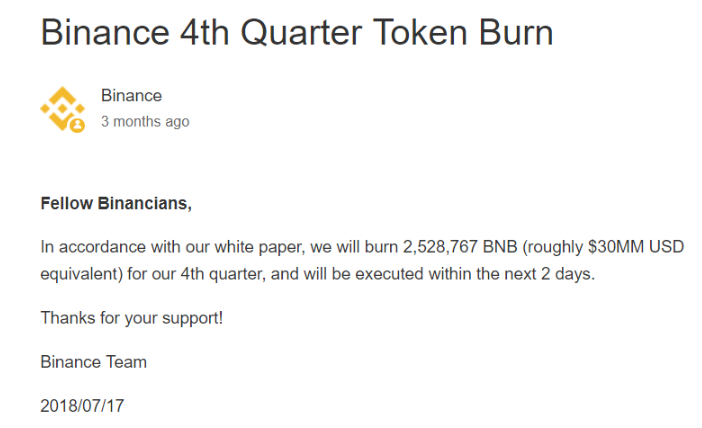

The basic foundation of prices are demand and supply — and also on the supply side, BNB has an interesting dynamic. Binance has committed to a quarterly token burn based on 20% of the trading fee profits of the preceding financial quarter with the ultimate goal to burn the 100 million BNB tokens sold during the ICO.

The most recent token burn was the fourth quarter token burn.

Concluding Remarks

You don’t need to be an academic to understand what a reduction of the supply on an asset while the demand is increasing will do to the price of that asset.

A great aspect of the BNB token is that the market’s volatility, whether it goes up or down, is actually good for the demand of the token, as volatility leads to more active traders who will want to take advantage of the discounted trading enabled by the BNB token.

An important prerequisite for this is that the absolute trading volume will have to grow, which is hard to tell, especially with the now almost year-long bear market and strong decrease in interest in the space as a result of this. Some might even say that BNB is a stablecoin in its own way because it is unaffected by the market’s volatility. However, the stability is still highly dependent on the total transaction volume.

Binance is actively trying to capture institutional capital, is creating fiat-crypto gateways all over the globe, will launch a second and decentralized exchange, has a token economic model based on increasing demand whilst reducing supply, and is the industry’s favorite exchange position. This all provides the BNB token with a strong case as to why it still is a solid token to hodl even though times are tough for the industry financially.

It will be an even more exciting coin to hodl once the bulls will return and institutional capital will start flowing into the space through Binance.