With SALT, we see a future where virtually all of the world’s value is on blockchains, and lending is reflective of our globally-connected, digitized lives.

– Salt CEO Shawn Owen

Salt is a membership based lending and borrowing network which allows you to use your blockchain assets (Bitcoin, Ethereum, etc..) to acquire fiat currency cash loans. This allows you to leverage the value of your digital assets, offset tax events, avoid exchange fees and maintain your cryptocurrency holdings.

Let’s say, for instance, that you own some Bitcoin and you need some cash for the down payment for a house or to start a business. Salt allows you to put up your Bitcoin as collateral in order to secure a loan which you can use as you please. Salt is available to both individuals and corporate customers.

The great part about this business model is that is allows you to keep your Bitcoin, which will be returned to you once the loan has been repaid; it means you can reap the benefits if your Bitcoin holdings appreciate in value.

How Does It Work?

First, it is useful to explain how loans work today. Most traditional loans are either one or a combination of these three following types: credit-score based unsecured loan, a guaranteed loan, or a collateralized loan.

A credit card is a good example of a credit-score based loan because the main determining factor on your interest rate and approval for the card itself is based entirely on your credit history.

However, if you have poor history or if you don’t have any credit history at all, sometimes credit cards will require a co-signer in order for you to get approved for the card. This would be referred to as a guaranteed loan. Guaranteed loans are also very common in the case of larger purchases such as financing the purchase of a car.

There are many types of collateral-based loans out there but some common ones include auto equity loans, home equity loans, home equity lines of credit, payday loans, or pawn loans. A collateral-based loan is when you give up something of value which you only get back once the loan is paid off.

As described in the whitepaper, Salt financing offers non-purpose cryptocurrency collateral-based loans. This means that the borrower would only need to put up their own cryptocurrencies as collateral, completely removing the need for a credit check. In addition, since all the loans are non-purpose, the borrower will be able to see profits on any gains in the collateral itself.

Using cryptocurrencies as collateral has a few notable improvements over using traditional assets. If, for instance, the borrower took out a $1,000 loan and was only able to pay off $500, Salt would then only take back $500 worth of the collateral, and return the other half.

With cryptocurrencies, it is easy to do this but with traditional forms of collateral this can be impossible. It would be impossible to only sell off one room in your house or half of your car, if you defaulted on your loan. In the real world if this happens, the lender would be able to claim 100% of the asset, even if you had already paid off most of the loan.

For this reason, Salt’s website even states that “[b]lockchain assets are an ideal form of collateral because they are inexpensive to transfer, store, and liquidate when compared to traditional forms of collateral like real estate or stocks.”

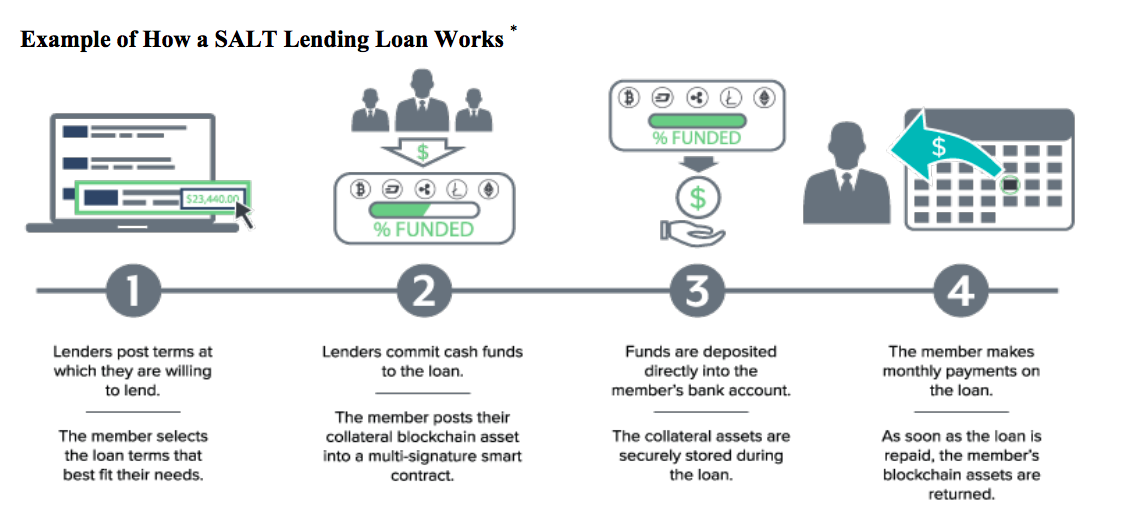

In order to get a loan through Salt, a borrower must first send their chosen collateral (let’s say Bitcoin) to Salt’s secure multi-signature wallet. Salt will require a collateralized ratio of 125%, meaning that in order to obtain a $1,000 loan, $1,250 worth of collateral would need to be provided. This is referred to as overcollateralization.

After this, the borrower would receive $1,000 of fiat currency sent to their account, at which time the borrower would also be required to start making monthly payments plus interest. The value of the monthly payment would depend on the length of the loan, which would have been agreed upon by all parties prior.

If, during the loan repayment cycle, the value of the collateral drops, the Salt oracle smart contract would automatically issue a notice requiring addition collateral to be provided or for the monthly loan payment to be increased. In the case where the borrower did not provide the additional collateral, the smart contract will issue an automatic liquidation contact.

Why the Token is Needed

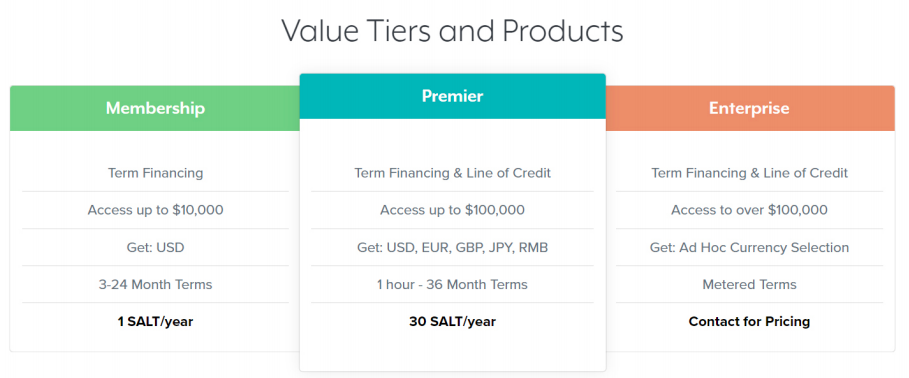

Salt will work on a membership-based model. The tokens are actually the memberships themselves, with a minimum of one Salt per year required for the basic membership or 30 Salt per year for the premier membership. They only offer an enterprise membership at custom rates.

There is a cap of 120,000,000 Salt membership coins in total. As popularity rises, so will the price.

Salt’s Membership Options: Source

History of Salt

Salt was originally founded out in Denver USA in 2016 and recently had a successful ICO in August 2017, where the company raised over US$55 million dollars. It was one of the most successful ICOs of all time, based on the amount raised at ICO.

The Salt coin is built off the Ethereum network. The loans themselves will be an Ecr20 smart contract.

Development is run by SALT Lending Holdings, Inc. They started out with 5 original members which has now grown to 25.

The Salt Team

Salt has assembled a strong team with notable experience in the cryptocurrency and finance world.

The team is led by CEO Shawn Owen, a self proclaimed serial entrepreneur and early Bitcoin advocate. Assisting Shawn is Josef Schaible, who has over 22 years of Fintech and entrepreneurial experience. Schaible is the co-founder of NexTrad, Matchbookfx, Anderen Financial and AtlasBanc Panama.

The development team is led by CTO Phil Cowen, who has over 17 years experience in application architecture development and design solutions.

The team also has some notable advisors and partners such as Erik Voorhees, the CEO and founder of Shapshift and previous founder of Satoshi Dice and Coinapult.

Full information on Salt’s team can be found here.

Competitors and Challenges

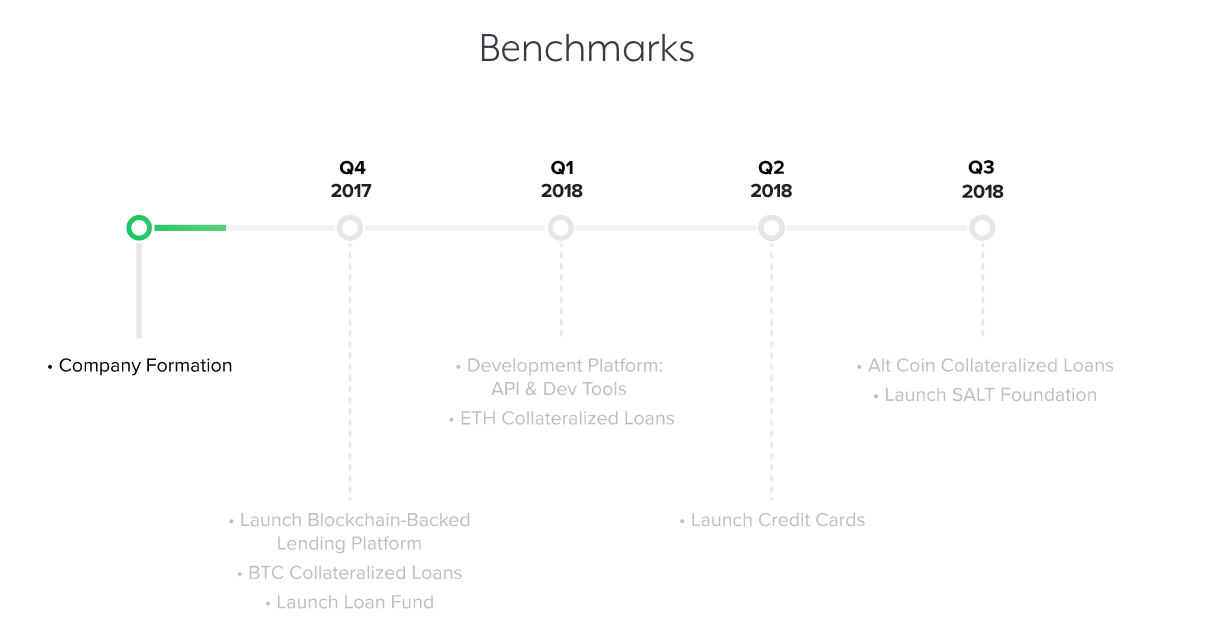

Right now Salt is in its infancy, with the ICO recently completed in August 2017. As seen in the roadmap below, Salt has yet to launch the platform itself, meaning that there is currently no real product to show.

According to the Salt roadmap, the lending platform is scheduled to be released by the end of this year.The Salt official twitter has also confirmed this, but as of now we’ll just have to wait.

Salt does appear to have been the first to break into the crypto lending world and would therefore have a headstart on many of its competitors. However, keep in mind that moving forward, it is still completely up in the air whether Salt will accomplish what they set out to do. Only time will tell.

The Salt roadmap: Source

How to Purchase and Store Salt

Salt in available on a few well-known exchanges such as Bitrrex and Binance. It can be purchased with either Ethereum or Bitcoin.

Right now Salt has yet to release their own wallet. But luckily there are a number of multi-token wallets which can support Salt such as Jaxx, Exodus or MyEtherWallet. These wallets also have built-in exchanges where you can obtain Salt coins as well.

Last Thoughts

Salt has a lot of good things going for it: they have assembled a strong leadership team and advisors, raised substantial start-up capital, and laid the groundwork for a successful company. In addition, I find their business a revolutionary idea with a lot of promise; it’s one that I really want to see catch on.

But at this point, Salt has little to show for its efforts. The lending platform is scheduled to be released by the end of this year, and at that time I expect to see Salt gain some more traction.

That being said, they appear to have a strong business plan and currently are without much competition. This puts Salt in a favorable position moving forward as they look to capitalize on the currently untapped market of cryptocurrency-backed lending.

Related: “Playing in the Riskiest Market of All: How to Mitigate Cryptocurrency Risk“.