A country endowed with incredible oil reserves and even the Miss Universe pageant is on the verge of collapse, plagued with blackouts and food shortages and without the slightest opportunity to pay its debt obligations.

Venezuela, once a thriving economy that attracted migrants to its shores, is now one of the most unsafe countries in the world, where the drastically devalued local currency – the Bolivar – is good for little more than confetti thanks to hyperinflation. Meanwhile, its citizens are starving, going on strike, and hoping that Bitcoin help ease their protracted economic crisis.

Fall of Socialism

The socialist future promised by the ex-president of Venezuela, Hugo Chavez, was ultimately not so bright. Trying to balance the well-being of poor citizens, the president did not take into account the wishes of the wealthy and influential population.

His anti-American position added fuel to the fire of foreign policy: Venezuela began to actively support Cuba’s refining industry, sending them 160,000 barrels of oil daily, and an attempt in 2002 to take control of the state-owned oil company Petroleos de Venezuela SA (PDVSA) provoked serious protests and rallies. Moreover, all the workers who disagreed with this state of affairs (and there were 19,000 of them) were dismissed by Chavez, who appointed as corrupt officials who were not shy about putting money on the black market.

The president also decided to tightly control the entire money turnover in the state, setting 3 official rates – for citizens, for the import of essential goods, and for the rest of imported goods. For those who did not go abroad, to acquire currency was prohibited. Such a regime spawned the heyday of speculators and the explosive growth of black market volumes. As a result of such actions, the official rate of the national currency, the Bolivar, was 4 times different from the real one.

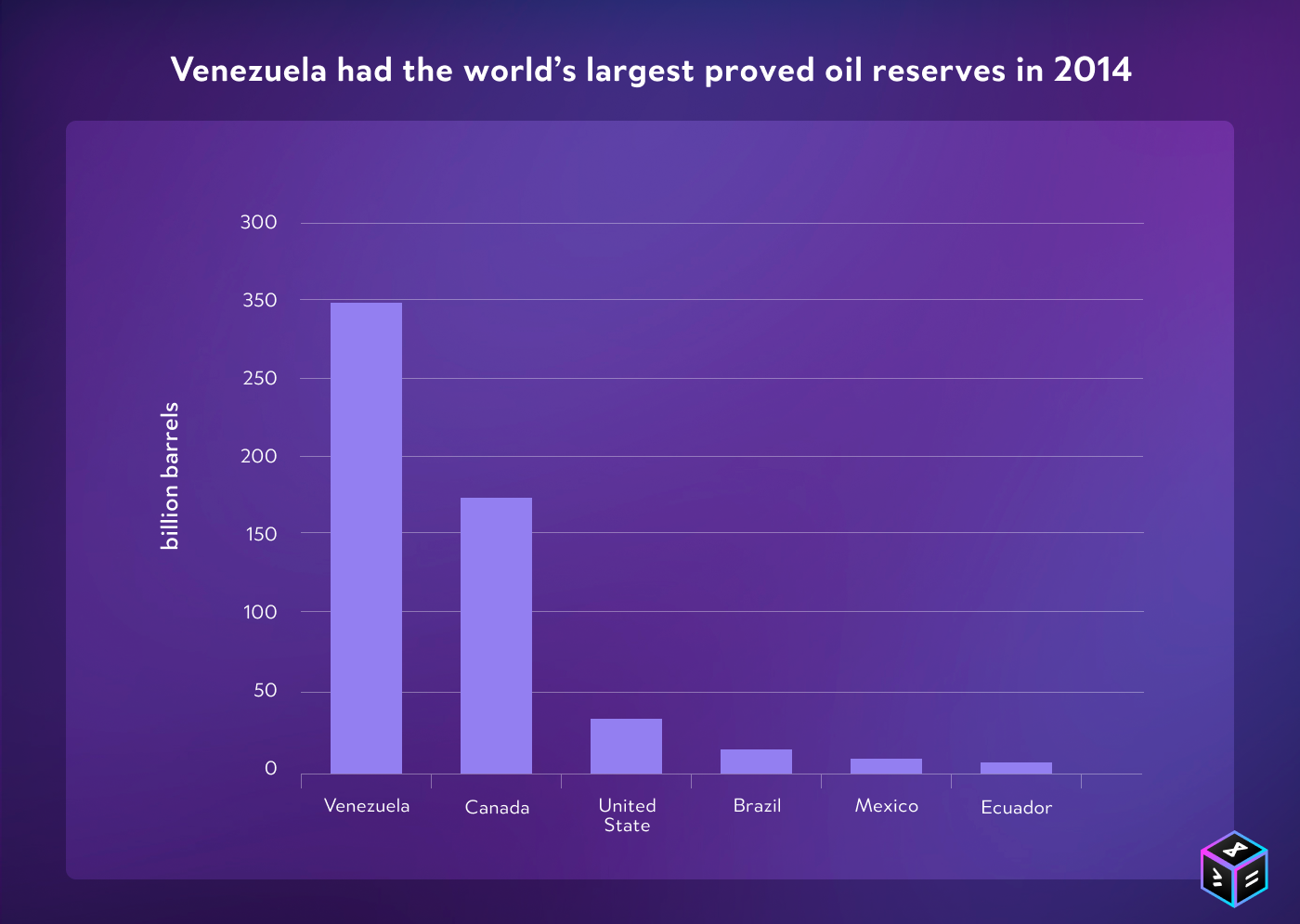

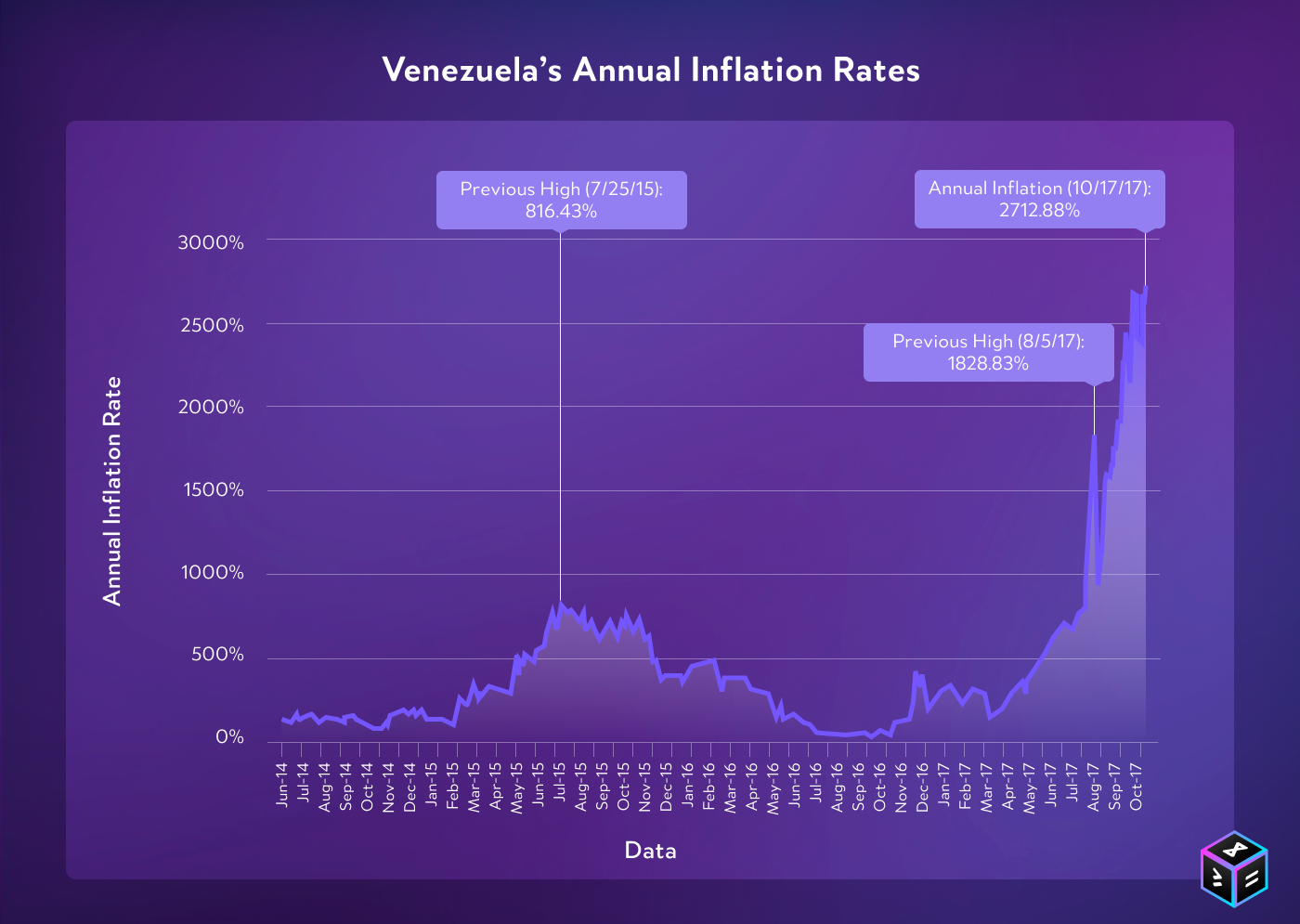

Such impressive figures for the reserves of black gold for 2013 clearly do not correlate with the situation in the country, or with the level of inflation in 2018 (Graph 2).

The data reflecting the rather strange situation of 2013 fully comply with the policy of Nicolas Maduro, Chavez’s political protege who had come to power by then. Against the backdrop of his unconventional political decisions, Venezuela has sunk in crisis. A surprising fact is that relatively recently (1970-1980), Venezuela was considered the most prosperous Latin American country, since any product could be bought for petrodollars.

However, the shortage reached such an absurd apogee that McDonald’s suspended the sale of hamburgers due to a shortage of bread, and only drug dealers and smugglers could afford it. Of course, on the basis of such a financial collapse, crime is actively developing and mass protests are being held, which, unfortunately, took the lives of dozens of citizens.

2016 will be remembered as the year Maduro declared a state of emergency, in an attempt to combat food shortages and inflation. However, his newfound power to make decisions without approval by the parliament provoked a lightning-fast decline in the rate of the bolivar. Inflation of the Bolivar skyrocketed, hitting 1.37 million percent in 2018 according to the IMF, to the absurd point that citizens count their money not by individual banknotes, but in huge packages.

Hyperinflation of the Bolivar completely spoiled diplomatic relations not only with the USA but also with the EU. Maduro at last attempted to stabilize the spiraling situation, and for the first time in 15 years, Maduro announced a regime of weakened currency control and allowed the commercial exchange of funds.

At the same time, among the slums, gunshots and hunger, frightened residents invest the last funds in digital assets, trying to at least somehow save the last property. Bitcoin is considered as a lifeline.

On the basis of worldwide cryptocurrency popularity, Maduro relieves the Bolivar of five zeros and releases the national oil-backed cryptocurrency, the Petro.

Scam on a National Scale

I specifically described the picture of what is happening in Venezuela in order to provide context for how cryptocurrency has come to be perceived as a necessary measure to solve the country’s accumulated problems. For example, the Venezuelan cryptocurrency exchange Surbitcoin has expanded from 450 to 85,000 users from 2014 through 2016.

Bitcoins were purchased not only by young people who were active in the digital age, but also by pensioners and representatives of the poorest segments of the population. Entrepreneurs picked up the trend, and soon both shops and universities began to accept Bitcoin.

It is worth noting that in Venezuela electricity is quite cheap, and it’s not hard to guess how the residents took advantage of it: mining fever settled on the streets and basements, providing the country with new opportunities to reach a better standard of living.

Taking note of the enormous economic potential of the digital assets market, Maduro decided to join the general trend and announced the launch of the national cryptocurrency El Petro, which should be directly tied to Venezuela’s oil reserves. The price of one token was supposed to equal a barrel of oil (about $60). Despite such valiant intentions, the National Assembly considered that such a step does not comply with the Venezuelan Constitution and may contribute to a new surge in corruption.

Let’s go back a few paragraphs above and recall that Nicolas Maduro doesn’t need permission from the National Assembly to launch a cryptocurrency, and their criticism was clearly not seen as an obstacle. As a result, a private pre-sale was announced, and the total issue amounted to 100 million Petro (an unsubstantiated claim made by Maduro himself).

Absurdly, it is unknown who stands behind the Petro, both from the technical and legal sides. The project’s 14-page whitepaper did not reveal any names, and consisted more of loud statements about how this decision could fundamentally change the affected Venezuelan economy.

Moreover, the community is not so easy to cheat – the Petro’s fundraising campaign, including the distribution of funds, was presented only by Maduro and did not find logical confirmation in the documents. For example, the head of the Venezuelan government proudly announced that on the first day of the ICO, the token had attracted an incredible $735 million, and the total collection amounted to $5 billion.

It is not surprising that such loud figures (even unconfirmed) made the United States worried, since such an influx of money into Venezuela could easily reduce economic sanctions to zero. As a result, President Trump forbade Americans from investing in the Petro. But, instead of influencing the decline in popularity of the Venezuelan project, such actions by the American government were perceived as a new push in its global advancement, acting as a free PR campaign.

One after another, Venezuelan stores and even banks announced that the Petro was accepted as a means of payment; moreover, citizens could pay state duties and taxes in the national token. Entrepreneurs pledged to pay their employees a certain part of their earnings via Petro, but the fact that Maduro did not take into account was a huge difference in the courses. The fact is that the cost to register for a Venezuelan passport was equal to two tokens, which amounted to 7,200 bolivars. For the people, it was a very heavy sum equal to four salaries. According to Maduro, linking the national currency to the token could cope with such a problem.

Attempt to Gain International Acceptance

After the Petro entered every Venezuelan store, bank, and institution (according to the headlines widespread in the media), Nicolas Maduro thought about international expansion. In the autumn of 2018, the Venezuelan leader made an attempt to enter the global market. Without embarrassment, he said that the token is already being used to convert other currencies, it lists on the 6 largest exchanges, and that the Petro should become the main cryptocurrency of OPEC. The catch is that no one is certain in which countries the token has been converted, or on which platforms the Petro is listed, as it has not even been implemented yet. But the fact was confirmed that the Ayacucho field, the oil from which was supposed to be the provision of the token, is not even being developed, the code on GitHub is not presented, and wallets that hold the Petro cannot be found anywhere.

And then more: all 100 million Petros are under the control of the one address, which has not conducted any transactions – the tokens simply exist lifelessly. The reality is that Maduro’s statements about the Petro’s massive acceptance are just smoke and mirrors – Venezuelans informed independent journalists that no stores are accepting Petros, nor is there anywhere to sell tokens. Thus, part of the hard-earned money, which was supposed to be converted into the national cryptocurrency, simply flowed into the state treasury. In fact, the Petro is worthless, and the money saved on wages flowed into the pockets of Venezuelan officials.

Scam of national scale – this is what Maduro’s sensational attempt to cash in on an already exhausted country can be called.

Course of Cruelty

Interestingly, in such circumstances, the citizens of Venezuela did not turn away from cryptocurrencies, but on the contrary – they began to trust Bitcoin even more, which remained the most stable solution to preserve their savings. This mood was clearly reflected in the indicators of the LocalBitcoins exchange, where now, on average, more than 1,000 BTC worth more than 20 billion bolivars are bought per week.

However, the Venezuelan government does not seem to enjoy the population trusting the decentralized Bitcoin over the Petro. In turn, the cryptocurrency boom, which resulted in the emergence of mining farms, was cut short by officials in a tough form – from accusations of illegal activities to the removal of mining equipment by aggressive means. At the same time, the corruption inside the country once again spread to the masses – for exemption from suspicion, miners paid off from law enforcement officers and continued their activities.

The tightening of the screws continues to this day – from 2017 the Venezuelan government requires Bitcoin miners to register with the state, handing over all information about themselves, including their farms’ location. Another obstacle Venezuelans are confronted with when trying to buy cryptocurrency is a 2-step registration process on the exchanges – after passing KYC requirements, the user’s information is carefully studied in the offices of the Venezuelan electoral register. Without the permission of this body, the account can not be activated.

Another stumbling block the Venezuelan government has placed in front of the crypto industry is its monitoring of citizens’ bank accounts in order to find speculative actions. The government justifies this action by citing the strong volatility of the bolivar paired with the US dollar with such active crypto-trading in the country. As a result of monitoring, $50,000 have already been frozen, and the activity of 2 crypto exchanges has been terminated.

Not wanting to miss out on a chance to replenish the country’s treasury (or government officials’ wallets), at the beginning of this year the local regulator introduced a 15% commission to carry out cryptocurrency transactions by Venezuelan residents. Moreover, citizens are faced with restrictions on the size of transfers and crypto rates in Bolivars (the regulator has the right to independently set prices for cryptocurrency assets). At the moment, Venezuelans are allowed to carry out cryptocurrency payments in the amount of no more than 10 Petro, which is equal to $600. Failure to comply with all the above rules and restrictions will result in a fine of up to $18,000.

Fidelity and Faith in BTC

To date, Venezuela continues to suffer from a political crisis that has erupted with a new force. In May 2018, Nicolas Maduro won a second term as president, despite claims of electoral fraud from the opposition party. In January 2019, opposition leader Juan Guaidó then proclaimed himself Venezuela’s interim president, in a direct challenge to Maduro’s power grab, until the point in time that fair elections can be held.

Amid chaotic protests and devastating power outages, Maduro continues to assert his authority and plans to stay in the presidency until 2025. The confrontation between the old and the new government continues to erupt, catching Venezuelan citizens in its fallout. The Venezuelan banking system is bursting at the seams, and the utopian idea of introducing the Petro token, which depends directly on oil, exists only in words.

Experts believe that the very concept of this crypto asset, given the circumstances, would not have had any positive results, even if Maduro acted honestly. The economic loophole provided by Bitcoin, which the authorities have been vigilant in trying to close, would be able to provide the country with a stabler and more secure way to make transactions and operate in the global market. First, BTC is completely apolitical, which means its value can’t be manipulated by a corrupt government motivated by its own financial gain. Second, Bitcoin does not depend on trust in international banks, which is especially important in Venezuela’s case. Third, it is by design inflation-proof, and has helped alleviate the damage done by hyperinflation in countries, such as Zimbabwe, in the past.

At the same time, Venezuelans do not lose hope for a bright future, since Juan Guaidó is a longtime crypto enthusiast and believes that Bitcoin is able to help the country out of its catastrophic state. However, such a scenario is possible only if Guaidó achieves new and fair elections in Venezuela and takes Bitcoin out of its underground status and into the realm of the legitimate.

Vladimir Malakchi. CMO of 482.solutions

Vladimir Malakchi. CMO of 482.solutions