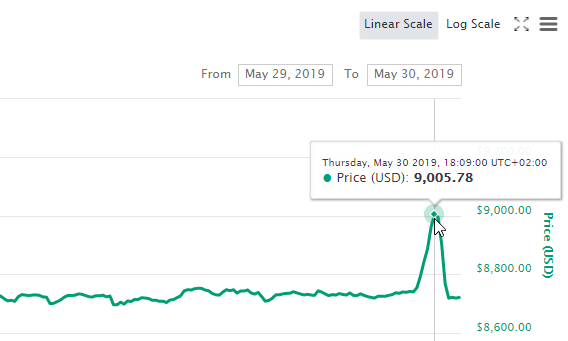

The price of Bitcoin (BTC) just exploded beyond the $9,000 level in a matter of minutes. At 17:00 (UTC+1), Bitcoin spiked above the $9,000 level and held there for around 10 minutes before the market fell back below the level.

Source: Coinmarketcap

Bitcoin has now seen a 16% price increase over the past 7 trading days, with a further 71% price surge over the past 30 trading days.

The cryptocurrency now holds a $159.70 billion market cap value as it edges near to the $160 billion level.

After spiking above $9,000, the price of Bitcoin quickly fell back beneath, causing a whole heap of volatility as sell orders above $9,000 were triggered, causing a sell-off toward the downside.

Bitcoin Price Analysis

BTC/USD – SHORT TERM – 4HR CHART

What Has Been Going On?

Taking a look at the 4-hour chart above, we can see that Bitcoin recently managed to surge higher above the $9,000 mark to reach a high of $9,090. Before this, we can see that Bitcoin was struggling to make any movement above the $8,888 level, causing BTC/USD to drop into support at $8,490.

Bitcoin rebounded at this level, which led to the spike above $9,000. The market has since dropped slightly as BTC currently trades around the $8,773 level.

What Is the Current Trend?

The current trend remains bullish. For the bullish trend to be invalidated, we would need to see BTC drop and fall beneath the $7,400 level.

Where Can We Go From Here?

If the buyers can continue to break back and close above the $9,000 level once again, we can expect immediate higher resistance to be located at the $9,200. This is then closely followed up with more resistance at the short-term 1.272 Fibonacci Extension level (drawn in blue), priced at $9,326.

Above $9,326, further higher resistance is then located at the $9,500, $9,600, and then at the short-term 1.414 Fibonacci Extension level (drawn in blue), priced at $9,810. If the buyers can continue to breach above this level of resistance, they will be clear to make an attempt at the $10,000 level.

Alternatively, if the selling pressure proves to be too strong to hold above $9,000, we can expect support toward the downside to be located at $8,600, $8,490, and $8,265.

Conclusion

The recent spike above the $9,000 level has, in turn, caused a whole heap of volatility. As Bitcoin exploded above $9,000, traders started to exit their positions causing the volatility to increase and price action to fall.

However, the recent breach above $9,000 provides further evidence that this bull run still wants to travel much higher, which could result in traders seeing the $10,000 level at some point during early June 2019.