Only 8% of Americans own cryptocurrency, according to a 2018 survey conducted by Finder.com, and 5% of the holdings belonging to that 8% are Bitcoin.

It makes sense that a small percentage of people (which still equates to 26 million individuals) have skin in the crypto game, and it makes even more sense that they’re picking the presumably lowest-risk option.

For the remaining 3% invested in altcoins, the opportunity to make even greater gains outweighs the heightened risk. The question then becomes, which of these coins will rise while the others stay put, or fall behind?

If increased market-cap position equates to increased risk, and increased risk equals fewer players, many will dabble in the top 10, some will branch out into the top 100, and even fewer will look into the crypto abyss that is the rest of the market.

However, coins break into the top 100 all the time, and in this article, we’ll look at a few altcoins in the top 400 that stand a legitimate chance of making that happen.

5 Altcoins That Could Move Into the Top 100 in 2019

SingularityNET (AGI) — Rank #132

Some time over the last 5 years you might’ve stumbled upon a robot named Sophia casually joking about taking over the world. The team responsible for this frightening yet impressive combination is Hanson Robotics, and together their CEO (Dr. Ben Goertzel) and robotics lead (Dr. David Hanson) founded SingularityNET.

After their December 2017 ICO ended in a matter of minutes, the newly founded team had raised $36 million dollars, and have since built up an impressive team to bring the idea to life.

The driving force behind the company, as described on their blog, is to allow anyone to:

Create, share, and monetize AI services at scale. It’s a full-stack AI solution powered by a decentralized protocol.

SingularityNET in 2019

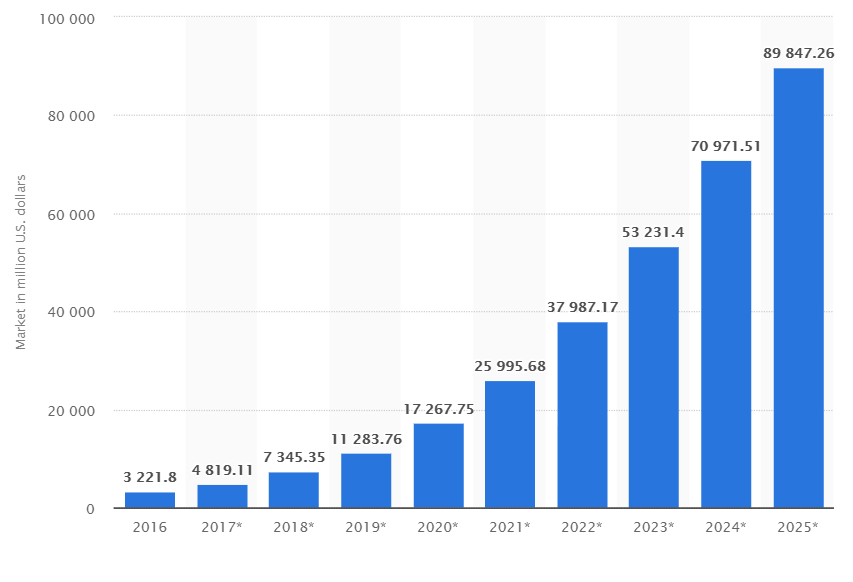

Determining how well SingularityNET does during 2019 is largely based on how much the AI market grows, and how well the team capitalizes on that potential. From what I’ve found so far, the team is more than capable of executing successfully, and according to Statistica, the AI market is estimated to grow by 60% in 2019, and continue growing from there.

In addition to the above, SingularityNET has also forged many partnerships with other blockchain companies — including their biggest competitor, DeepBrain Chain — and has also begun working with the Malta government, helping to develop their AI strategy.

It’s not a perfect equation, but growing industry value, plus an incentivized native token, plus a competent team, could equal a top 100 altcoin, and is definitely worth keeping an eye on.

Request Network (REQ) — Rank #156

Request Network is aiming to become “PayPal 2.0” by creating a payment bridge between all types of currency, fiat, or crypto, in a variety of ways. The end goal is to allow users to request a payment that can be paid by the recipient in a secure, convenient manner.

In this sense, it’s very similar to PayPal. The difference lies in how the platforms are structured, and since Request Network’s information will be stored in a decentralized manner, transactions have the potential to be less expensive and more secure.

Their ICO took place during October 2017, and by December of that same year the team had released a functioning product, which works seamlessly today with MetaMask.

Without getting too deep into the technicalities of the project, Request Network also offers identity protection, cross-currency transactions, invoicing, and more.

Request Network in 2019

The Request Network roadmap doesn’t specify deadlines, but the company does well in keeping their community updated through their blog, putting the progress they make on constant display. In the “Up Next” section of their roadmap, they plan to begin working on their cross-currency functionality, as well as their accounting and smart-audit beta applications.

The successful implementation of these features, combined with support from partners like Y Combinator (Silicone Valley startup accelerator that backed Coinbase, Dropbox, Airbnb, Reddit, and others) and PricewaterhouseCoopers (second-largest professional services firm in the world), the value of Request Network’s idea and execution could very well make them worthy of a top 100 spot.

Everipedia (IQ) — Rank #211

Chances are, if you’ve been using the internet at all, you’re aware of Wikipedia. What you may not know is that it’s a website that relies on user submissions and donations to stay useful and afloat. If a reader notices a factual error, or otherwise feels compelled to edit the information on Wikipedia, they can submit an edit easily.

This exact method of collaborating ideas is being used by Everipedia, with the added benefit of financial compensation for editors and contributors. Instead of asking for donations a few times per year, the token model will reward accurate contributions, and penalize false contributions or malevolent activity.

What’s particularly interesting about this “Wiki-Upgrade” is how the information is stored and governed. By using a decentralized, Proof-of-Stake consensus model, the system is able to organize itself in a way that combats censorship, while allowing users to vote on the accuracy of information.

Furthermore, since the purpose of blockchain technology is to offer immutable and transparent storage, the implications of this are historically significant.

It is said that history is written by the victors, but if history were written onto a distributed ledger, then all participants would have a voice, and that voice would be permanently available for reference.

Since the number of people turning to the internet for information is clearly on the rise, a verifiable way to document the truth on a grand scale is possible now more than ever.

Everipedia in 2019

Everipedia still has a lot of work to do before their project is up to par. They do, however, allow users to add and edit information on their website. It’s also worth noting that this is one of the more promising projects in the EOS ecosystem so far.

Their 2018 roadmap has led to a functional, fully decentralized, ad-free product. While there hasn’t been a roadmap released for 2019, they have announced it will be released by the end of 2018. This blog post details improvements to their user interface, increased scalability, increased language support, and the creation of new dapps.

On top of the successful team they’ve been working with in years prior (including the founder of Wikipedia itself), they will also be expanding their teams in Santa Monica, Stockholm, South Korea, and China. You can learn more by reading the details in their latest press release.

SelfKey (KEY) — Rank #300

After their 11-minute ICO ended in January 2018, the SelfKey team walked away with a cool $21.7 million dollars and began bringing their whitepaper’s vision to life. In June 2018, the team released their beta wallet, and continue to make progress with their roadmap.

So what is SelfKey? Think blockchain-empowered digital security.

The truth of the matter is, as our lives are made more convenient by the internet, our personal information is exposed to increased risk. In response to the digital age, SelfKey is in the process of creating a personal identity management platform based on self-sovereign identity technology.

In a nutshell, users would have complete and secure access to their digitized personal information, with the ability to delegate access to loan officers, government institutions, or whoever they need to verify their identity with.

Instead of sending copies of their passport to each agency individually (and increasing their risk of becoming an identity-theft victim), they would temporarily grant each agency access to their personal information. The goal is to make personal data transfers more convenient and more secure.

SelfKey in 2019

SelfKey has done a fantastic job in displaying the progress they’ve made, although the last couple of months their reports have slowed down. Still, they’ve made significant progress on their goals for 2018, and have scheduled a busy 2019.

Now that the brunt of their desktop web application beta version has been built, the team will begin building out the extended functionality of their service.

According to their website, their 2019 goal list includes building out support for institutional communications (the ability to delegate access to loan officers and the like), a mobile wallet alpha version, multisignature functionality, and more.

On top of the technological advancements the team has been making, and the timing of their efforts, SelfKey has an impressive list of partnerships with other actors in the crypto space.

For those who are justifiably concerned with the Facebook data breaches and the ever-present threat of identity theft, solutions like SelfKey are important to consider. The progress made in 2019 could fall right in stride with this growing concern, leading SelfKey to rise as less useful, higher market-cap cryptocurrencies fall before it.

Hydrogen (HYDRO) — Rank #324

The Hydrogen Platform is a series of application-programming interfaces (API) that allow fintech applications to be built, updated, and controlled globally. The project was founded by twin brothers Michael Kane and Matthew Kane, who have an established experience in the fintech industry.

In 2009, the Kane twins founded Hedgeable, which is a mobile application that allows investors of all backgrounds to customize and implement their own investment portfolios.

Fast forward to 2018, when the duo released their free Hydro mobile app, which introduced the Raindrop feature, designed to protect accounts from hackers and phishing attacks.

Having a working product differentiates the Hydrogen Platform from many of the cryptocurrencies available right now, and to further differentiate themselves, they’ve heavily invested in forming partnerships with industry leaders.

This includes 3 impressively large enterprises that are responsible for the management of more than $2 trillion in assets: Principal Financial, CI Investments, and TD Bank Group.

Hydrogen in 2019

Like many of the projects that have made it to Q4 2018, the next year hasn’t been mapped out quite yet, although Hydrogen has provided a general guide to what the future holds.

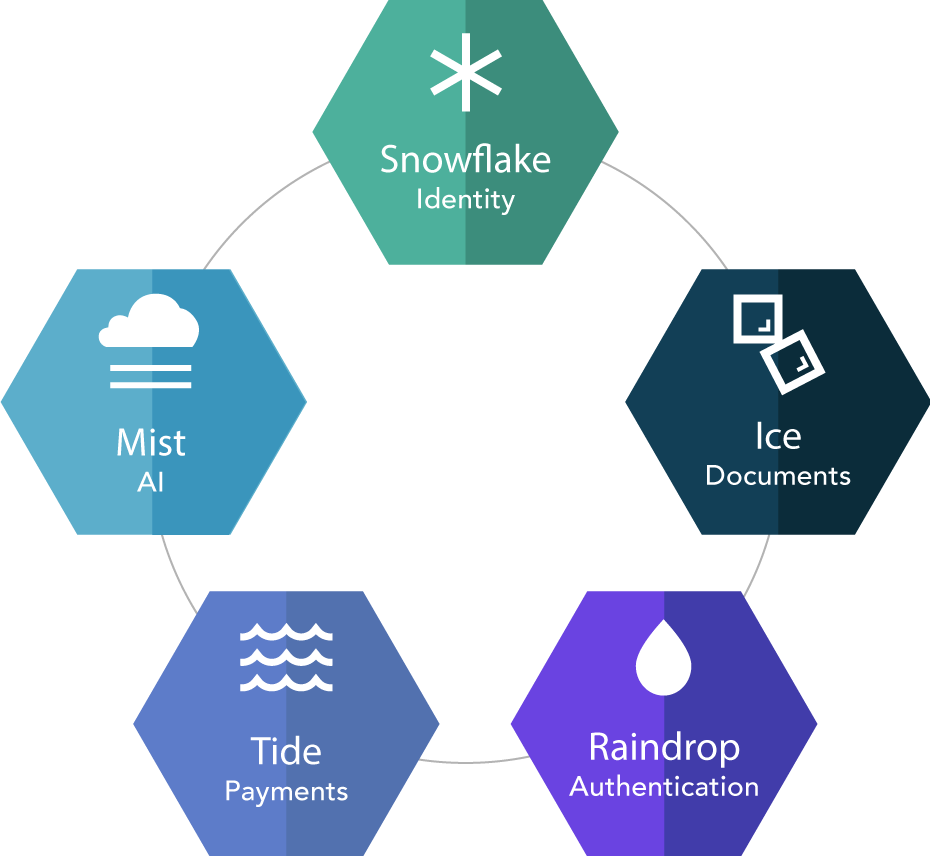

The 1st phase of Hydrogen’s 5-phase plan began with the release of Raindrop, which focuses on user security and 2-factor authentication, seed-based recovery.

The 2nd phase, Snowflake, adds an identity-management feature, while Ice, the 3rd phase, will allow users to view, authenticate, and sign documents securely.

The last 2 phases, Tide and Mist, haven’t been articulated yet with a technical whitepaper, and they have higher aims than their foundational precursory phases. Tide will provide users the convenience of a multi-currency wallet, and the last phase, Mist, will add machine learning and data-management capabilities powered by AI technology.

Quick note: The first 3 phases each have their own designated whitepaper, which you can access here.

Which phases see the light of day in 2019 remains to be seen, but the Hydrogen team has proven their ability to come up with an idea and quickly release a working product. Furthermore, the founding twins’ connections within the massive fintech industry have proven to be a boon for Hydro, which could lead to greater access and higher market-cap position in a relatively short timespan.

Final Thoughts

Finding solid projects when there are so many to choose from is no easy task, but doing the research is required if you’re looking for a legitimate chance to make massive returns.

Therefore, it makes sense to always be assessing how you find new projects, who is bringing them to light, and finally, how useful the low market-cap coin is likely to be in the next decade.

Many people have made insane amounts back on their initial investments, and many more have lost more than they could afford to lose.

While the market is correcting, now is a great time to buckle down and perform your due diligence. Stay sharp and keep a skeptical eye — it could be the most profitable thing you’ve ever done.