Basic Attention Token has seen an enormous 20% price increase over the past 24 hours of trading, bringing the token’s current price up to $0.3412 at the time of writing. The recent price increase comes after a 7-day trading period where BAT fell by a total of 11%. However, despite this, BAT has seen a glorious 90-day trading period, in which price action increased by a total of 183%.

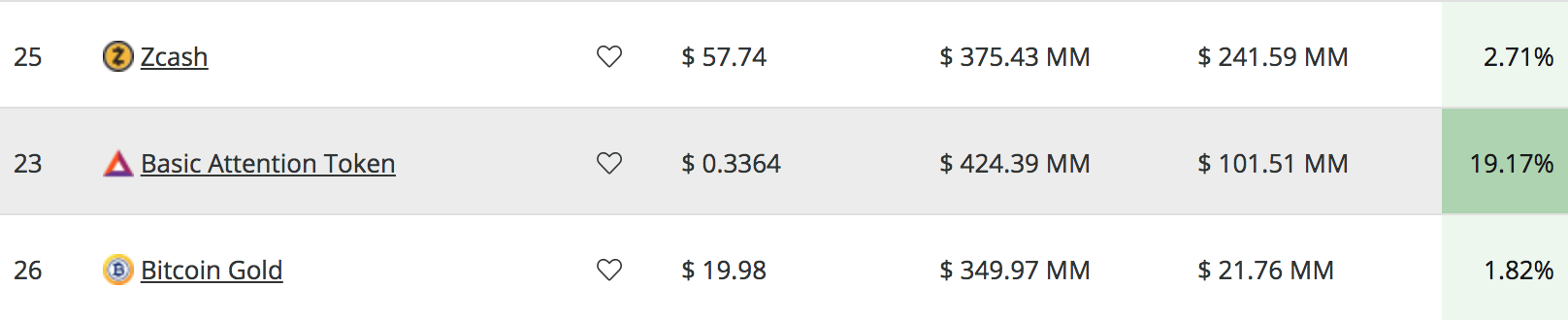

BAT is now ranked in 23rd position among the top cryptocurrency projects by market cap value. BAT currently holds a market cap value of around $424 million as the 23-month-old project now trades at a value that is -61% lower than its all-time high price.

With the recent price increase, we decided to take a look at some of the resistance ahead as BAT makes its way back toward the $0.40 level. To reach $0.40, BAT will have to increase by a total of around 18% and overcome some significant levels of resistance.

Basic Attention Token Analysis

BAT/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Taking a look at the daily BAT/USD chart above, we can see that toward the end of February 2019, BAT/USD managed to break above the 100-day moving average level, as it began an epic bull run higher. After breaking above the 100-day moving average, BAT continued to climb further higher at an aggressive rate, until meeting higher resistance at the $0.50 level during May 2019.

More specifically, the market managed to spike into the $0.50, but met significant resistance at the $0.45 level. After reversing, BAT/USD continued to drop throughout May 2019, dropping a total of almost 36% from high to low. However, we can see that the market managed to find support around the $0.27 level. This level of support is significantly increased by the 100-day moving average level.

In today’s session, BAT/USD has managed to rebound greatly from this level of support and is now trading around the $0.3412 level.

What Is the Current Short-Term Trend?

The current short-term trend for BAT/USD is presently neutral. If the market was to break beneath the 100-day moving average, we could then consider the trading condition to be bearish. For this market to be considered bullish, we would need to see BAT/USD rise and break above the $0.45 level.

Where Can We Go From Here?

If the buyers continue to cause BAT/USD to rise further higher, we can expect immediate resistance above the current market price to be located at $0.3419, $0.35, and $0.36. Above this, further resistance can then be located at $0.38 and $0.3952. If the bulls can clear the resistance at $0.3952, they will be free to make an attempt at the $0.40 target.

Above $0.40, further higher resistance is then located at the $0.43, $0.45, and then at the long-term bearish .382 Fibonacci Retracement level (drawn in red), priced at $0.477.

What If the Sellers Regain Control of the Market?

Alternatively, if the sellers group back up and start to push the market lower once again, we can expect immediate support beneath the market to be located at $0.30 and then at the $0.27 level, which contains the 100-day moving average level.

If the bearish pressure causes BAT/USD to break beneath the 100-day moving average level, further support below can be located at the $0.25 and $0.23 levels.

What Are the Technical Indicators Showing?

The RSI has recently risen quickly and approached the 50 level to indicate that the previous selling pressure has faded. However, if we would like this little bullish streak to continue, we would need to see the RSI rise further higher and break above the 50 level to indicate that the bulls have taken charge of the market momentum.

Furthermore, the Stochastic RSI is in an extremely oversold area and is primed for a crossover signal above. This would signal to the buyers that the sellers have finished with this round of selling, allowing them to start to buy up the market once again.

Conclusion

With the recent 20% price increase today we can expect BAT to continue to travel further higher and reach the $0.40 level pretty soon, over the next few days. BAT has been on an extraordinary 183% price increase over the past 3 months, and we can expect this to continue further.