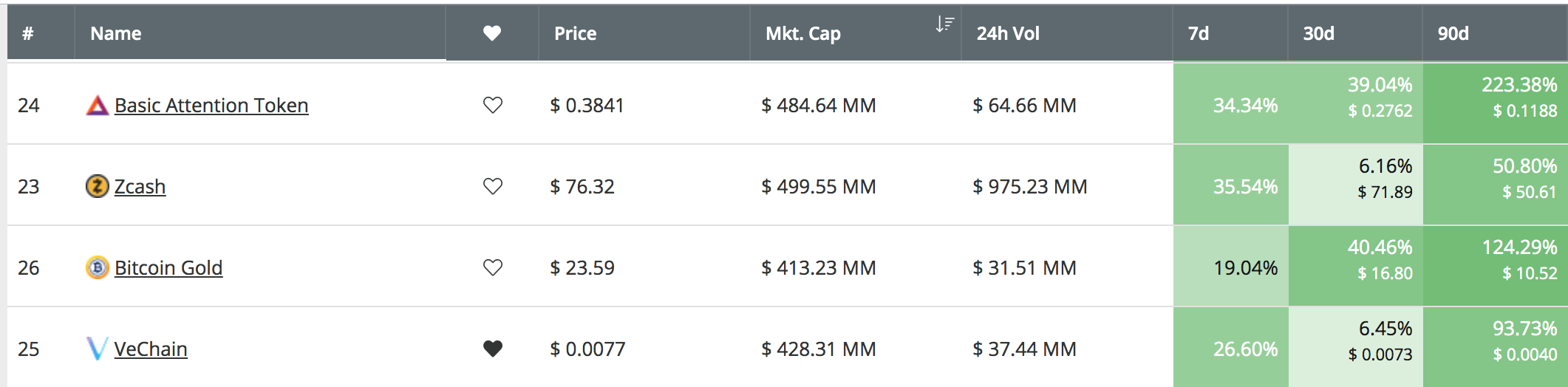

Basic Attention Token (BAT) has most certainly been enjoying the latest cryptomarket pump after surging by an enormous 223% over the past 90 trading days. The cryptocurrency has seen a further 34% price surge over the past 7 trading days, allowing the price to rise to the $0.3841 level.

BAT is the cryptocurrency that goes hand-in-hand with the Brave browser, now ranked in 24th position in the market cap by rankings. BAT currently holds a $484 million market cap and has recently been overtaken by ZCash, which holds a $499 million market cap.

In this article, we will take a look at the resistance ahead for BAT to reach the $0.5 price level. The cryptocurrency managed to penetrate above the $0.50 level during April 2019, but then fell through the remainder of the month. For BAT to reach $0.5 from today’s current price, the market will need to increase by a total of 30%.

Let us take a look at the BAT/USD market and highlight some potential areas of support and resistance moving forward.

Basic Attention Token Price Analysis

BAT/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Taking a look at the daily BAT/USD chart above, we can see that the cryptocurrency managed to break above the 100-day moving average during February 2019, and continued to surge further higher by a total of 237% to a high of $0.05045 in April 2019.

After reaching this high, the market reversed and started to fall throughout the rest of April 2019. The market continued to fall during May 2019 until bouncing at support around the 100-day moving average level.

We can see that the market bounced at this support, around $0.2784 and continued to trade higher to where it currently rests at around $0.3820.

What Is the Current Short-Term Trade?

The current short-term trend is presently neutral until BAT/USD breaks above the $0.50 level and creates a fresh 2019 high. If BAT/USD was to fall beneath the 100-day moving average, then we could consider the market as bearish.

Where Is the Resistance On the Way Up To $0.50?

If the buyers regroup and begin to push the market up higher once again, we can expect immediate resistance above the market to be located at $0.3952 and $0.4074. Above this, higher resistance can then be expected at $0.4313 and $0.45.

If the bullish pressure can continue to push BAT/USD above the resistance at $0.45, further higher resistance is then located at $0.4639 and $0.47703. The resistance at $0.47703 is provided by a long-term bearish .382 Fibonacci Retracement level (drawn in red), measured from the January 2018 high to the February 2019 low.

If the bulls can clear the resistance at $0.477, they will then be clear to make an attempt at the $0.4927 level and then the target level of $0.50.

Above $0.50, further higher resistance can be expected at the short-term 1.414 and 1.618 Fibonacci Extension levels (drawn in blue), priced at $0.5193 and $0.5575.

What If the Sellers Regain Control?

Alternatively, if the sellers group up and begin to push the market lower, we can expect immediate support beneath the market to be located at $0.36 and $0.35. Beneath $0.35, further support then lies at $0.3418 and $0.3042.

If the sellers continue to push the market further below $0.30, we can then expect more strong support to be located at the 100-day moving average at around $0.2870. Beneath $0.28.70, more support lies at $0.2784, $0.2489, and $0.23.

What Are the Technical Indicators Showing?

The RSI indicator is currently hovering around the 50 level which indicates that the market is in a period of indecision at this current moment in time. However, the recent price surge higher has allowed the RSI to return to a neutral zone after reaching extreme oversold conditions, which may suggest that the sellers are done with their previous round of selling.

Conclusion

BAT has seen wonderful price growth of 223% over the past 90 trading days, making it one of the strongest performers in the top 25 projects. For BAT to reach the target level of $0.5, it will have to increase by a total of 31%. This is most certainly achievable, considering that BAT has increased by 39% over the past 7 trading days alone.