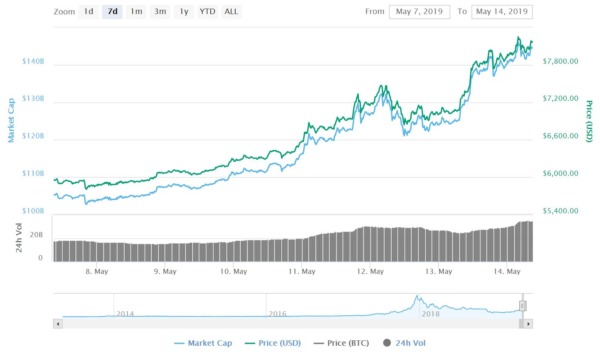

The price of Bitcoin (BTC) has gone parabolic in the past 5 days, climbing from $6,000 to over $8,000 with ease. It sliced through the biggest resistance level at $6,400 like it was butter, and continues to push higher towards next major resistance at $10,000.

Many people are in disbelief as to how fast and high Bitcoin has climbed, however, there are plenty of reasons to explain this parabolic bull run.

Bitcoin Is Very Bullish, Here’s Why

One of the primary reasons Bitcoin has experienced such an extreme move to the upside is because of its price action. Once Bitcoin experienced its first surge upwards from roughly $4,000 to $5,000 at the beginning of April, the price blew past the 200-day moving average, which traditionally signals bull season.

With this move, investor confidence lifted and a lot of money entered the market, pushing the price higher and higher.

Explaining the significance of the 200 DMA is Willy Woo, a prominent cryptocurrency analyst who shared an explanation via Twitter:

In BTC's 10yr trade history, crossing above the 200 day moving average (blue line) for any sizeable time (say 8wks+) has signaled bull season. Even a super conservative trend line support puts us above the 200DMA.

Bull season is now 99%. pic.twitter.com/g433INi4pA

— Willy Woo (@woonomic) May 14, 2019

While crossing the 200 DMA and staying above it is super bullish and instilled a lot of investor confidence, there are a lot of other things that contributed to Bitcoin’s surge from $6,000 to $8,000.

3 More Reasons Bitcoin Exploded Over the Past 5 Days

Apart from Bitcoin’s bullish price action being above significant resistance levels, the number one cryptocurrency’s price rise can be attributed to a number of fundamental factors as well.

1. Front-Running Institutions

The first of these are announcements from front-running institutions like Bakkt and Fidelity Digital Assets. Bakkt announced that they are prepping their users for User Acceptance Testing (UAT) for their physical Bitcoin futures contracts.

Fidelity also contributed to Bitcoin’s price rise when they announced they will be offering Bitcoin trading in a few weeks’ time. Another institution getting involved is ETrade, who announced at the end of April that they will be bringing Bitcoin and Ethereum trading to their 5 million customers.

2. Bitcoin Acceptance

A collaboration between the payments startup Flexa and the Winklevoss Gemini exchange has led to the acceptance of Bitcoin at major retail giants, including Crate and Barrel, Nordstrom, Amazon’s Whole Foods, Starbucks, and more.

Adding to this, eBay is rumored to soon be accepting cryptocurrency payments, as an advertisement at the Consensus 2019 conference in New York has said as much.

3. Coordinated Buying by Whales

It’s been speculated that this recent run-up in price was not started by retail investors but was driven exclusively by large Bitcoin whales. Sharing these thoughts via Twitter is economist and trader Alex Krüger.

What drove $BTC up this week?

A handful of large players, that started buying in waves. Systematic buying.

Clues to reach that conclusion can be found in volume, price action, funding, and futures basis and term structure. May expand on this later.

Not retail driven.

— Alex Krüger (@krugermacro) May 12, 2019

Following his initial tweet, Krüger noted that these whales were likely motivated to buy large amounts of Bitcoin due to the following reasons:

- Front-running institutions like Fidelity/Bakkt/Ameritrade/Etrade

- Front-running news

- Coordinated buying

Final Thoughts

All in all, we can say with almost 100% confidence that the bear market is over and we’ve entered a bull run. The coming weeks will be very telling as to where this market is heading in the long term.

With the Consensus 2019 conference wrapping up tomorrow, we can expect to hear even more big news before it ends that could potentially push the Bitcoin price even higher.

How high do you think Bitcoin’s price will go before it sees a correction? When it does correct down, how big of a correction will it be? Let us know what you think in the comment section below.