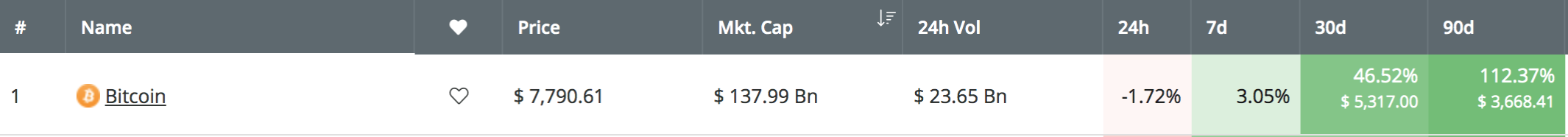

Bitcoin has seen a wonderful price increase over the past 30 trading days which amounts to 46%, allowing price action to rise to the $7,804 price level. The cryptocurrency even managed to climb to a high of around $8,265 before meeting resistance and rolling over.

Furthermore, Bitcoin currently holds a market cap value of around $138 billion and has seen an extraordinary price increase totaling over 112% throughout the previous 90 trading days.

In this article, we will take a look at the potential for Bitcoin to reach the $10,000 level before the end of Q2 2019. There is little over one month left in Q2 2019, and for Bitcoin to reach the target level of $10,000, the coin will need to increase by a total of 27% from the current price.

Considering that Bitcoin has increased by 46% over the past 30 days alone, it is entirely possible for Bitcoin to increase by 27% in the remainder of Q2 2019. The cryptocurrency will need to break above significant resistance at $8,265 and $9,000 before making an attempt at $10,000.

Let us take a look at the BTC/USD market and highlight some levels of resistance on the way up toward the $10,000 level.

Bitcoin Price Analysis

BTC/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Taking a look at the daily BTC/USD chart above, we can see that Bitcoin has been surging ever since breaking above the 100-day moving average level during early April 2019. During May 2019, the coin managed to surge by a total of 56%, reaching the resistance at the monthly high at around $8,265, provided by a short-term 1.618 Fibonacci Extension level (drawn in purple).

After reaching this resistance, BTC/USD dropped into the support at $7,300 and rebounded higher. However, BTC/USD is still unable to break above the resistance at $8,265.

What Is the Current Trend?

The current medium-term trend remains bullish after the 112% price explosion over the past 90 trading days. However, until Bitcoin can break above the $8,265 level, the trading condition will remain neutral in the short term.

Where Is the Resistance On the Way Toward $10,000?

If the bulls can make an attempt higher once again, we can expect immediate resistance above the market to be located at the $8,000 and the $8,265 levels. If the bullish pressure can cause BTC/USD to climb above this strong level of resistance, we can expect further resistance above to be located at $8,490 and $8,600.

If the buyers continue above $8,600, we can then expect significant resistance above to be located at $8,888 and $9,000. If BTC/USD continues to drive further above $9,000, higher resistance can then be expected at the short-term 1.272 and 1.414 Fibonacci Extension levels (drawn in blue), priced at $9,326 and $9,810, respectively.

If the bulls can clear the resistance at $9,810, they will be clear to make an attempt at the $10,000 target level. Above $10,000, further resistance above lies at $10,505, provided by the short-term 1.618 Fibonacci Extension level (drawn in blue).

What If the Sellers Regain Control?

Alternatively, if the sellers regroup and begin to push the market lower again, we can expect immediate support toward the downside to be located at $7,600, $7,383, and $7,000. If the sellers continue beneath $7,000, further support then lies at $6,790, $6,515, $6,290, and $6,000.

What Are the Technical Indicators Showing?

The RSI has recently started to slowly head toward the 50 level, which indicates that the previous buying pressure has started to diminish. However, if the RSI can remain above the 50 level this would indicate that the bulls still remain in control of te market momentum.

Furthermore, The Stochastic RSI has recently reached overbought territory which suggests that a push higher will occur over the next few days.

Conclusion

Bitcoin can easily hit the $10,000 level before the end of Q2 2019, but will need to break above the strong resistance at $8,265 before being able to do so. The technical indicators are beginning to suggest that the buyers may try another attempt to push the market higher which could result in a push above the initial $8,265 resistance on the way toward $10,000.