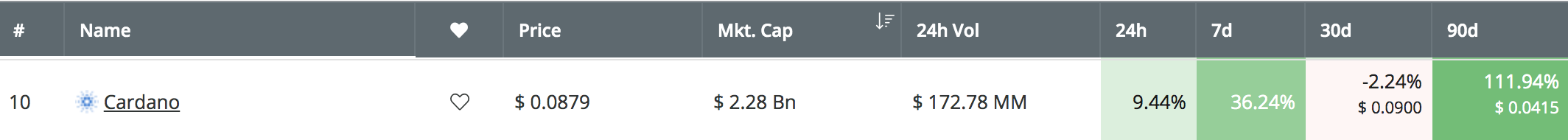

Cardano has seen an epic price surge totaling 111% over the past 90 trading days, and has managed to keep pace with Bitcoin’s price growth of 117% over the same period. Furthermore, the market has seen a 36% price increase over the past 7 trading days and a further 9.5% price increase over the past 24 hours of trading, which has allowed Cardano to reach a price of $0.088.

Cardano remains ranked in 10th position, as it presently holds a $2.28 billion market cap valuation. However, the cryptocurrency is quickly closing in on 9th position holder Stellar, as it sits just a small $7 million behind.

In this article, we will take a look at Cardano’s potential to rise and hit the $0.2 level by 2020. For Cardano to reach $0.2 by the end of the year, the cryptocurrency will need to increase by a total of 125% from today’s price. Considering that Cardano has managed to surge by a total of 111% over the past 90 trading days alone, it is entirely possible for the cryptocurrency to increase by 125% during the remaining months in 2019. The last time Cardano was at the $0.20 level was in June 2018, over 11 months ago.

Let us take a look at the ADA/USD market and highlight some of the resistance on the way up toward the target level of $0.20.

Cardano Price Analysis

ADA/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Taking a look at the ADA/USD daily chart above, we can see that the cryptocurrency managed to break above the 100-day moving average during March 2019, and has continued to climb further. ADA/USD managed to climb up and reach a high of $0.1 during April 2018 before the market met resistance and rolled over.

More specifically, we can see that price action struggled to break above the resistance at the long-term bearish .382 Fibonacci Retracement level (drawn in red), priced at $0.0918. This bearish Fibonacci Retracement level is measured from the July 2018 high of $0.1966 to the December 2018 low at around $0.027.

After rolling over at this level of resistance, Cardano went on to fall during April 2019, finding support at the 100-day moving average around the $0.06 level during May 2018. After reaching this level of support, we can see that ADA/USD rebounded higher and is now trading at resistance around the $0.088 level.

What Is the Current Trend?

The current short-term trend is now bullish once again after rebounding at the 100-day moving average. For the bullish trend to continue, we would need to see price action rise and break above the $0.1 level.

In the long term, the trend is now also considered to be bullish after rising above the $0.056 level, which is 2x from the bottom price.

Where Is the Resistance On the Way Up To $0.2?

If the bullish pressure persists and pushes ADA/USD higher, we can expect immediate resistance above to be located at the bearish .382 Fibonacci Retracement level (drawn in red), priced at $0.0918. Above this, higher resistance is then located at $0.093 and then at the $0.1 level.

If the bulls continue to push above $0.1, further resistance then lies at $0.107, followed by resistance at the bearish .5 Fibonacci Retracement level (drawn in red), priced at $0.1120. Above this, resistance is closely located at the short-term 1.272 and 1.414 Fibonacci Extension levels (drawn in purple), priced at $0.1177 and $0.1268, respectively.

Above this, more resistance lies at the bearish .618 Fibonacci Retracement level (drawn in red) priced at $0.1318. If the bulls can continue to break above the $0.15 level, further resistance above is then expected at the bearish .786 and .886 Fibonacci Retracement levels (drawn in red), priced at $0.1608 and $0.1779, respectively.

Resistance above $0.18 is then expected at $0.19, and then at the target level of $0.20.

Conclusion

Cardano will need to increase by a total of 125% to reach the $0.20 level by the end of the year. This may seem like a big task, but it most certainly seems more achievable after considering that Cardano has increased by 111% in the past 90 trading days alone.

The bulls will need to break above strong resistance at $0.1, $0.11, $0.13, $0.15, and $0.18 before being clear to test the $0.2 region. However, the market still has over half a year to break through these levels of resistance.