Before: High fees or long wait

Imagine this. You’re in the United States, you’re trading bitcoin, and the price dips. China has just banned ICOs or JPMorgan’s CEO let his mouth run. This is the ideal time to buy in because, crypto being crypto, it won’t be long before the price shoots back up. It’s heading for that almighty $5,000, after all. (And as of press time, it’s at US$5,700.)

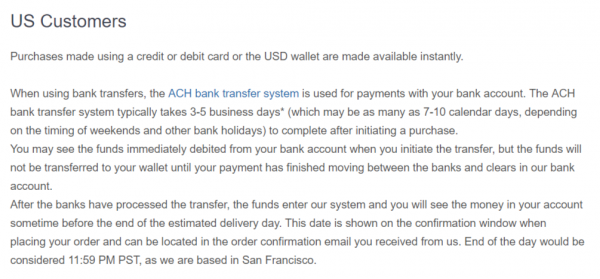

But the buying process isn’t as kind to you as the markets are. Using your debit or credit card, fees are high, lessening your intended capital gains. And cryptocurrency is all about cutting out (or at least down) your fees, right? Wiring money is not only expensive but time-consuming. And transferring money from your bank account, which is the cheapest option…takes a user-reported average of 8 days. In this day and age. By the time your money is cleared, you’re buying in high again.

Inevitably, this means that many investors are so put off by this waiting period that they end up not investing, or not investing as much as they intend when they intend it.

Coinbase announces instant bank transfers

Coinbase, the most popular exchange in the States, just changed this. They made an announcement today that, effective immediately, purchasing bitcoin, ethereum, and litecoin via bank transfer will be instantaneous. This will be valid for purchases up to US$25,000. While the exchange used to offer this service a few years ago, its absence has been sorely felt, and investors are raving about the implementation. Card purchases and their premium fees will no longer be a necessity to get in on the markets timeously. Instead, anyone with a bank account can process a transaction while the iron is still hot.

Trading geared to climb

This is big news. The barrier to entry to buying and selling bitcoin and other cryptocurrency has just been bulldozed over, making buying low and selling high – or just buying and selling, period – a whole lot more accessible to greater numbers of investors.

With Coinbase having some of the largest cryptocurrency support bases in a country that carries many crypto-investing enthusiasts, this is set to change trading volumes in an upward stream.

According to venture capitalist and Coinbase backer Fred Wilson, the exchange is a force to be reckoned with.

“If you look at what they are world-class at, it’s security, trust, safety … all these things that, frankly, banks are good at. They’re like JPMorgan or Goldman Sachs for blockchain.”

And where Coinbase sets a trend, other exchanges are sure to follow. Coinbase is deemed by many users to be the country’s safest and most trustworthy exchange. Their move paves the way for even more widespread adoption of cryptocurrency speculation, as less die-hard investors are set to step where before they feared to tread. Hopefully, this trend is adopted not only by US-based exchanges but by those in other countries, too.