The hype surrounding cryptocurrency trading appears to be waning. Bitcoin currently trades at just above $6,400, down more than two-thirds its peak value of nearly $20,000.

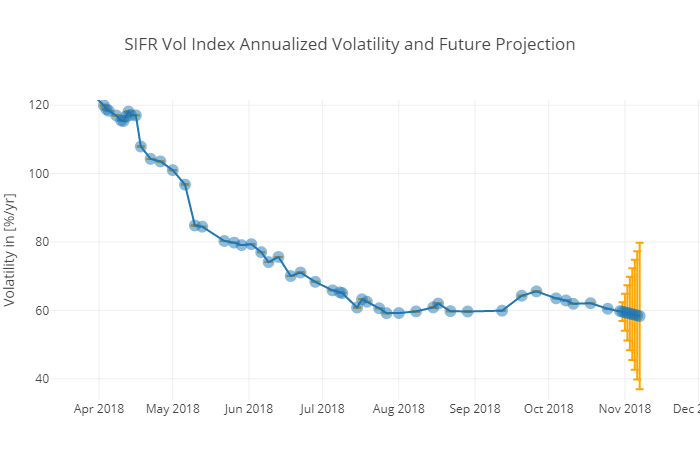

Recent trends show that volatility is also declining. Bitcoin has held its price consistently and its volatility index recently dropped to an almost two-year low. The major altcoins are going through the same thing, with global trading volume and market capitalization figures also holding steady.

Analysts believe that this low volatility could mean a longer bear market for crypto.

Source: Sifr Data

Source: Sifr Data

This, however, may be the opening blockchain platforms and decentralized applications (dapps) need to steer people’s interests away from speculation towards the practical applications of blockchain. Much of the interest has been in short-term trading since the high volatility provided opportunities for quick gains and profit.

But with volatility dropping, other crypto related efforts – like dapps — could take center stage.

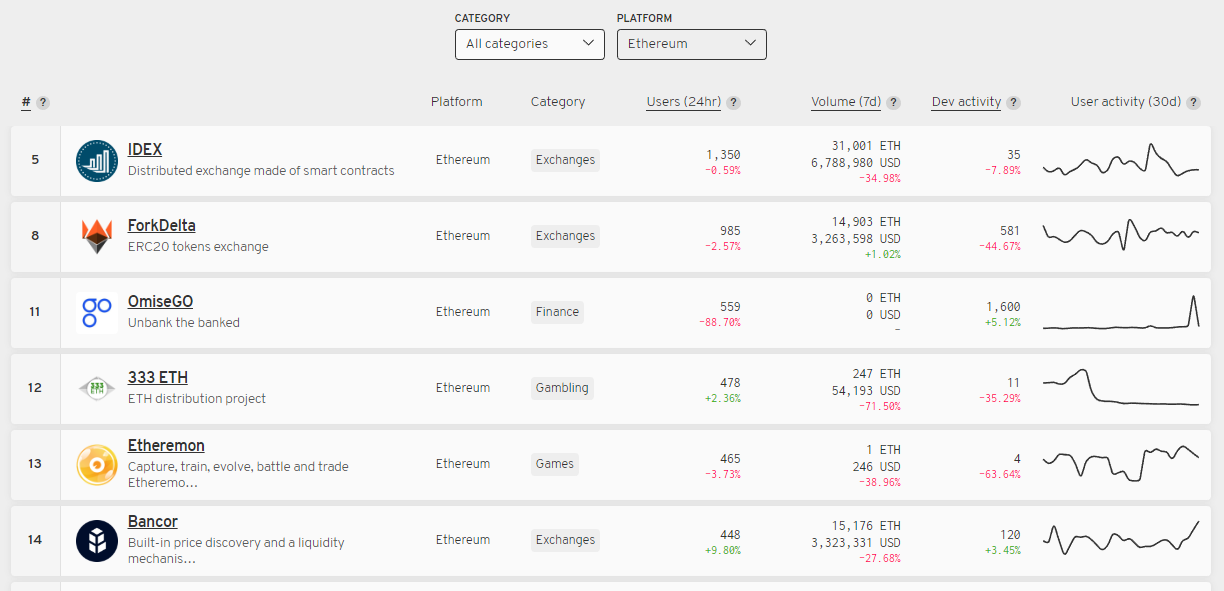

Many dapps that were showcased in the initial coin offerings (ICOs) over the past two years have yet to take off. Dapp ranking site State of Dapps shows that the top Ethereum dapps only attract a few thousand users — far from any indication of mass adoption.

Source: State of Dapps

Source: State of Dapps

These dapps’ utility tokens have primarily been used for trading rather than on their respective platforms. But with short-term trading having fewer upsides due to the bear market, investors and users could rethink how they could maximize the value of these tokens.

Fundamentals Over Speculation

Certain developments in the dapp space hint at how fundamentals are starting to matter in the crypto space. Here are two positive trends that suggest that increased adoption is likely to come.

Easier Access to Dapps

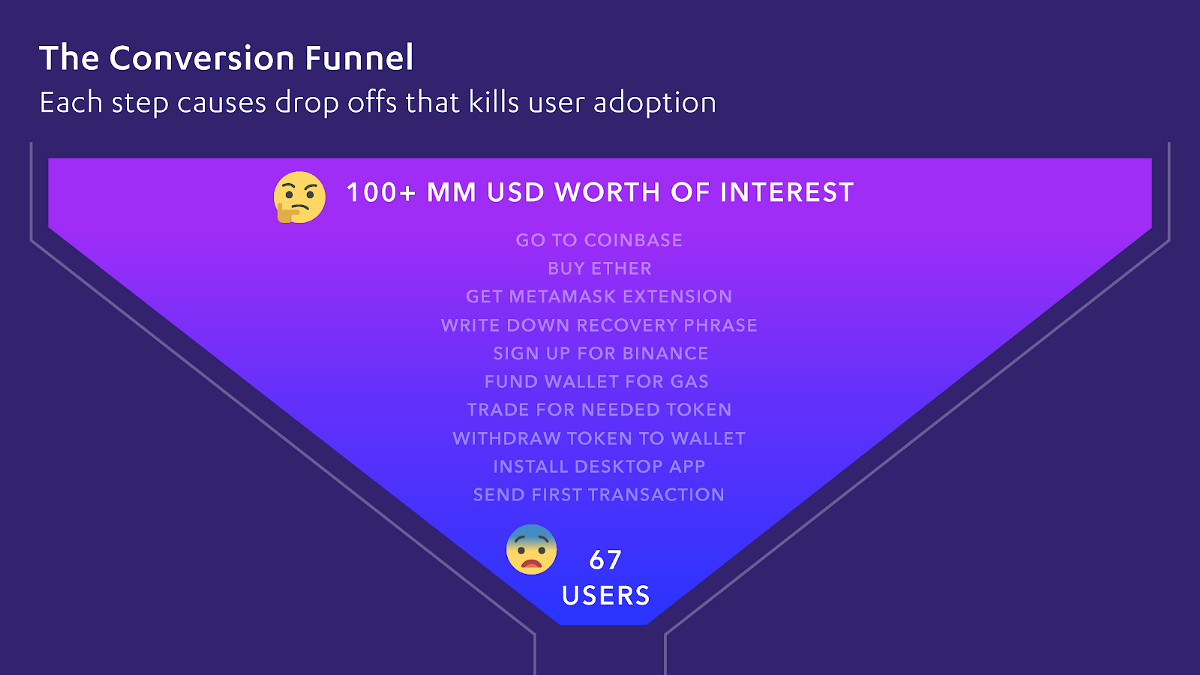

Developers have been working on ways to prove the usefulness of blockchain and dapps. For this to happen, they must provide ordinary users easier access by improving user experiences and simplifying the conversion funnel.

Blockchain and dapp orchestration platform Cardstack, for example, is working on means to have its CARD token function as universal gas meaning users do not have to purchase and store multiple tokens to test various dapps. Through CARD, the platform would be able to manage access to all supported blockchains and dapps which users can then integrate as part of their own workflows.

Source: Cardstack on Medium

Through orchestration, it would even be possible for dapp developers to easily promote their services by airdropping tokens to prospective users. To further lower barriers to access, Cardstack is also considering making CARD purchasable through conventional payment methods.

Such mechanisms conveniently allow ordinary users to discover how blockchain can provide benefits specific to their needs.

Measurable and Trackable Performance

If previously, traders only had charts and technical data to guide their trading decisions, live dapps could provide measurable ways for analysts and investors to evaluate these projects’ viability and performance. Since transactions are recorded on the blockchain, transaction volumes and revenues can easily be verified.

Projects with active development also provide regular news to their communities. These updates often include milestones and roadmaps which give insight concerning their progress.

Recently, decentralized file storage network Storj released the latest version of its whitepaper which outlines key improvements to the platform including better compatibility and scalability. Such updates help users differentiate it from its competitors such as Filecoin and IPFS, allowing users to weigh their investing or adoption decisions.

How Dapps Could Benefit

These developments indicate that dapp developers are making significant strides to push blockchain to the mainstream. Fortunately, the bear crypto market could prompt users to look beyond short-term profit-taking and focus on the value that dapps and their utility tokens could deliver.

Here are 3 ways dapps could benefit from the bear run.

Attract investors: For investors, a bear market provides opportunities to buy into projects that could offer substantial gains for the longer term. They may do well buying and holding onto utility tokens of projects that show solid fundamentals.

Encourage use: Unlike digital currency tokens, utility tokens provide holders with additional value since they can be used on their respective platforms. Dapps cover a wide array of use cases including categories related to personal interests such as productivity, entertainment, social networks, and gaming. Instead of buying tokens for trade, and interested investors and users could use their tokens instead for their personal use and satisfaction.

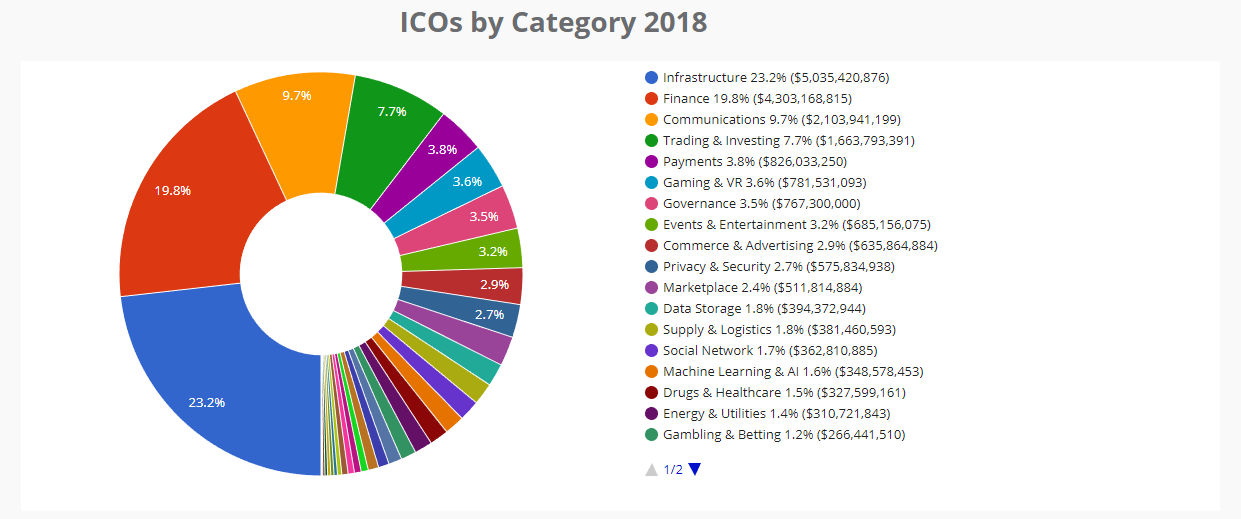

Source: Coinschedule

Drive competition: A rising interest in utility tokens and actual dapp users should compel developers and ventures to accelerate the launch and improvement of their respective projects. The list of past ICOs show that there are numerous projects competing in each vertical. Ventures would surely want to take the first mover advantage which could result in more dapps launching in the immediate future.

Success in the Longer Term

Markets eventually turn around so crypto stakeholders just have to weather this bear run.

What is critical for dapp developers at this time is for them to take advantage of the chance to refocus the attention from trading and speculation towards the value that their platforms offer. By demonstrating the value that they create, they may finally usher in mainstream adoption.

When that happens, dapp ventures should enjoy similar success to those of today’s tech giants by making blockchain integral to people’s daily lives.