Depending on who you talk to, Cryptocurrency is either going to replace fiat currency the world over, or crash and burn until each and every one of them is completely worthless.

Which is it?

Well, there is a surprisingly easy way for you to decide for yourself. Keep reading to discover it.

However, first we must define what a bubble actually is.

Definition of a bubble

According to Investopedia:

“A bubble is an economic cycle characterized by a rapid escalation of asset prices followed by a contraction. It is created by a surge in asset prices that is unwarranted by the fundamentals of the asset and is driven by exuberant market behavior. When no more investors are willing to buy at the elevated price, a massive selloff occurs, causing the bubble to deflate.”

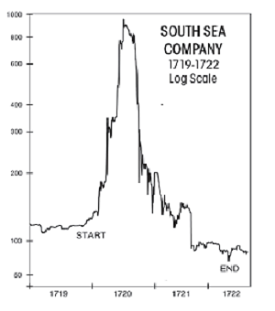

It happened with the South Sea Company in the 1700s:

It happened with Japanese economy in the 1980s:

It happened with the dot-com bubble in the 1990s:

There are huge parabolic rises followed by a steep crash.

Why this could be different

Now, let’s looks at cryptocurrency. The graph below shows the total market cap for all cryptocurrencies. Including Bitcoin.

Does that graph look similar to the ones above?

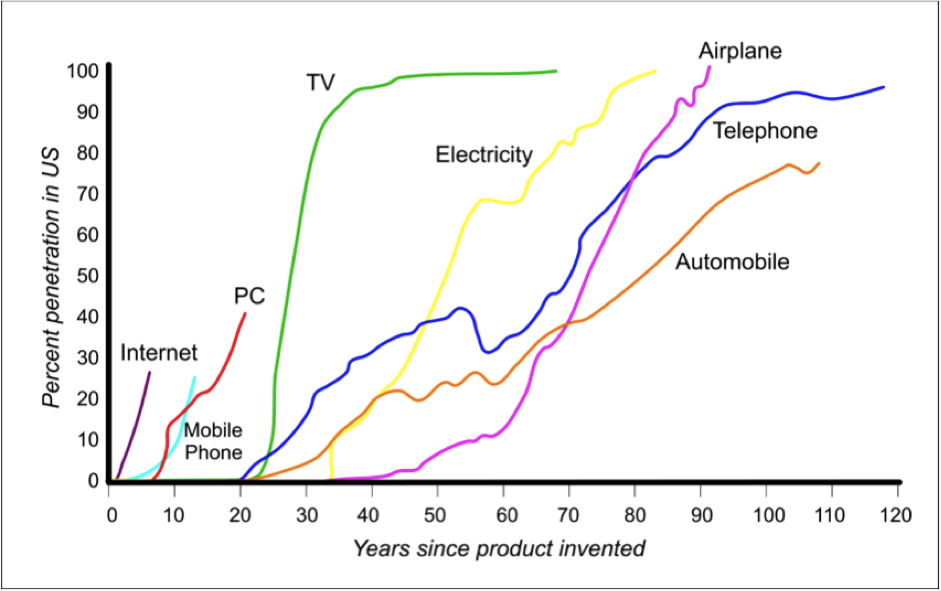

Or does it look more like one of these………

Personally, I think it looks more one of these. Perhaps electricity or the telephone?

This is called the s-curve graph.

Practically all technological breakthroughs go through similar upward trends before they are fully adopted by the masses.

Everyone has a telephone, right?

There are small boom-bust cycles (this could be one of them) but the overall trend is up; until we eventually get to mass adoption.

See, the s-curve is the key.

The start of a wild ride?

If cryptocurrencies are on the s-curve then this is just the beginning of a very wild ride.

We WILL continue to go up until every Man, Woman and Child is making it rain with Ethereum, Ripple and Dogecoin. Or whatever the hot ones are named once we reach mass adoption.

The key question then is: is cryptocurrency enough of a technological revolution to allow it a place on the money train that is the s-curve?

Can owning cryptocurrency eventually become as common as owning the latest model of iPhone?

To answer these questions I think the best thing we can do is look at what the big investors are saying.

From their knowledge and insight we can form our own opinions.

What the big investors have to say

We will look at two investors who are against cryptocurrency mass adoption and two that are for it. So there is some balance.

Against Crypto

Jamie Dimon (Head of JP Morgan, Net Worth $1.13bn): Jamie believes that cryptocurrency is only “fit for use by drug dealers, murderers and people living in places such as North Korea”.

Ray Dalio (Manager of the world’s largest hedge fund, Net Worth $17bn): Ray doesn’t believe that bitcoin TODAY is not fit for mass adoption. He said “Bitcoin today you can’t make much transactions in it. You can’t spend it very easily … Bitcoin is a bubble”.

This is a more interesting take because it suggests that if the number of transactions go up it could eventually be a currency.

He even went on to say that “It’s a shame, it could be a currency. It could work conceptually, but the amount of speculation that is going on and the lack of transactions [hurts it]”.

For Crypto

Tim Draper (Venture capital investor, $1bn): Tim Draper has been a firm supporter of Cryptocurrency. He has personally made over $110 million since 2014 with his Bitcoin investments.

He said “There’s a whole ecosystem being built that’s going to make commerce much easier with much less friction and safer.”

This is a strong case that it could be adopted on a mass scale. If it does indeed make commerce easier then it will have real utility.

Tyler and Cameron Winklevoss (Venture capitialists, Net Worth $500m): The twins are big supporters. They are in the process of launching a bitcoin exchange traded-fund. This would be known as a “bitcoin ETF”.

If granted it would somewhat legitimize bitcoin. It would make it far easier for big institutional traders to get involved.

It could be the catalyst for bringing cryptocurrency into the mainstream.

What we can gather from investor opinions

You may have noticed that the net worth of the investors against cryptocurrency FAR EXCEEDS those who are for it.

I think the opinions of people that “have their money where their mouth is” is far more important than anything else. This is why I chose to take this approach.

I looked everywhere for larger (in excess of a Net Worth of $1bn), more “famous” investors that are pro crypto. But I could not find them (if you know of any feel free to comment below).

This is not necessarily a bad thing.

It could just mean that the big investors do not have the time to analyse and look into the situation thoroughly enough. That they are “missing a trick”.

Arguably the smaller investors know the technology better. They have been in it for longer. And, they understand the dynamics and benefits of it on a deeper level.

This could be the start of a generational “transfer of weath”. Whereby money goes from the bigger more traditional investors to the early adopters of cryptocurrency.

If, and only if — cryptocurrency does indeed go mainstream.

Short term boom-bust vs long term prospects

We could very well be in a short term crypto “bubble”. The boom phase that will shortly be followed by a bust.

However, where we go from here in the long term depends on whether or not cryptocurrency is a revolutionary enough technology to place it on the s-curve.

If it is not — or if a major event (governments banning it outright) occurs — then the next big bust will be a permanent one and there will be no recovery. Like the tulip bubble in the 1600s.

Take into account what others have said and the merits of the underlying technology to judge for yourself. If you think it is something that could eventually reach mainstream adoption then invest accordingly.

Personally, I think the underlying utility of things like smart contracts, decentralized dapps and secure identification are enough of a technological advancement to place cryptocurrency on the s-curve.

And, although there may be a short term bust coming….the long term trend is upwards.