2018 has been a horrible year for cryptocurrencies. The bear market has seen over 80% declines for BTC and over 90% for most altcoins.

With this in mind, today we ask, what can we expect for 2019? More of the same or a market recovery?

Here I present to you my top 5 predictions for next year.

1. The BTC Bear Market is Over, No New Highs and No New Lows

I believe either the bottom of the bear market has already happened, or we are very close to it.

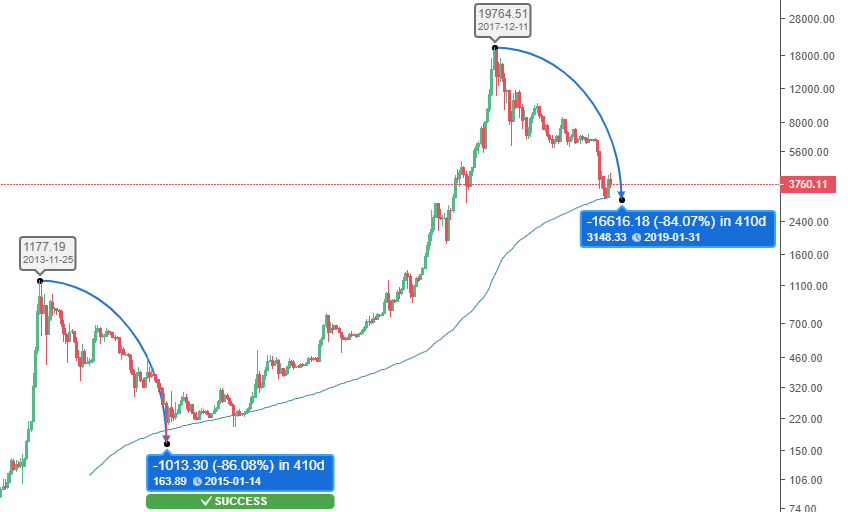

Bitcoin has dropped approximately 84% (depending on which exchange you check) from its high set in December 2017. If you compare the bear market of 2013/14, we are extremely close to the same pace of decline in the time period given.

The price has also bounced off from the 200 Weekly Moving Average. If you compare the previous bear markets, this decline and the number of days we have been in correction, you can see we are around the average expected number of days in correction.

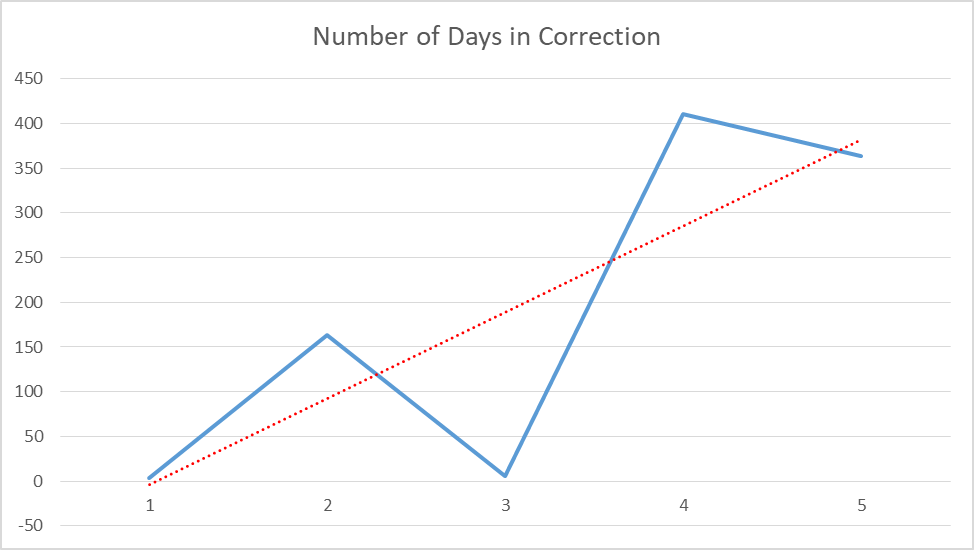

This can be seen more easily if we plot an average trend line on the number of days in correction:

As the market matures, it is reasonable to expect that the price will move slower as the market cap grows. As you can see, the recent low of BTC puts us exactly on the expected trend for the number of days in correction.

Market sentiment has also turned ultra-bearish. Back in July, when we were holding the $6,000 support line, most traders and holders were calling for new all-time highs by the end of the year, or at least an end to the bull market and a push above $10,000.

Fast forward to today and that picture has been completely flipped. The bears that were late to the party are now calling for sub $1,000 prices. This is market psychology in action, and it tells me we are much closer to the end now.

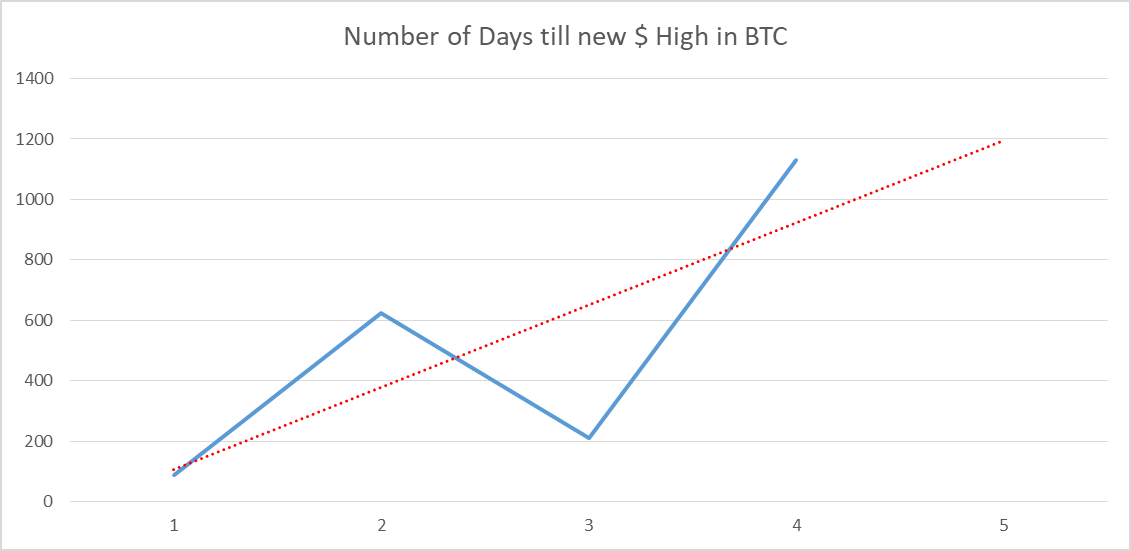

That being said, I am not expecting a resumption of the bull market in BTC, more a slow grind sideways for much of 2019. We can use the same bear market data to predict the number of days until a new BTC high:

According to this prediction, we should not expect new highs and a resumption of the bull market until early 2021.

This is not necessarily a bad thing, if you consider my second prediction.

2. Some Altcoins Reach and Exceed Their Previous All-Time Highs (in BTC)

In the early days of crypto, Bitcoin market dominance was above 90%, with no other coins really adding any new use cases.

As the market has evolved, several coins have been created with specific use cases, aimed at tokenization of assets, privacy and security, to name a few.

This is a sign that the market is maturing. It makes no sense that one coin dominates the entire market, just like it makes no sense that Microsoft is the only tech stock available.

There will be multiple coins that cover each sector of the market where a genuine business case exists.

That being said, 2017/18 brought in a lot of ICO tokens and scams. As one of my previous articles suggested, I think these coins will struggle to deliver anything soon, and the price is unlikely to ever recover for some teams.

The market will now move back to real projects that are in accordance with new regulatory rules. Non-ICO, fair-launch projects will do well in this environment.

Ubiq is my number 1 pick for 2019.

Drowned out by the money ICOs spent on flashy marketing with little substance through 2017/18, Ubiq has been hard at work changing their hashing algorithm from Ethash to Ubqhash to protect their users from the rising threat of 51% attacks, making key improvements to the infrastructure of the ecosystem, and establishing Ubiq as a key contender for the most Enterprise Stable platform that businesses are slowly adopting now.

The UBQ/BTC chart looks to have bottomed now, forming a range in the 6,000 to 8,000 Satoshi price level:

These price declines are set against the MACD indicator making higher lows on the daily timeframe. This is usually another indicator of the price being ready to make a move higher.

The first obstacle to overcome is the 200 daily moving average at 9,500 sats, then several resistance lines after that. My final price target is above the previous all-time high at around 97,000 sats, as I expect Ubiq to outperform the market in 2019.

3. Regulators Target Some Big-Name ICOs, Refunding Investors

As I suggested in my “ICO apocalypse” article, regulators are catching up with the slew of ICO projects launched in recent times. The SEC has warned about participants running ICOs in the past and are now threatening to unwind many of them.

Until they make a big example, it is unlikely that this activity will stop.

Recently, celebrities DJ Khalid and Floyd Mayweather Jr. were fined by the SEC for not disclosing payments for promoting ICO tokens. High-profile celebrities are an easy target to make an example of, and you can expect to see some big ICOs instructed to refund investors.

As my previous article suggested, some good picks for surviving the ICO apocalypse are Bitcoin, Ravencoin, Ethereum Classic and Ubiq, as none of these originated from an ICO and all are fairly launched via Proof-of-Work.

4. Ethereum Goes Proof-of-Stake

Vitalik Buterin has made no secret he is not a fan of Proof-of-Work.

Whilst I disagree with a pure Proof-of-Stake model, it seems fairly obvious that Ethereum will implement this as soon as humanly possible. They scheduled the Constantinople hard fork in Ethereum for January 16 which will introduce a reduction in the block reward for miners, who are already feeling the squeeze from the bear market. [Editor’s note: The Constantinople update has been delayed, with no new date set at the time of writing.]

My bet is that this is not the last hard fork for Ethereum this year, and that PoS is pushed out some time in 2019.

What this will do to Ethereum is yet to be seen — however, I am more bullish on the prospects of other Ethereum-based coins.

A lot of hash power will leave the Ethereum network and will have to find a new place to mine.

With the recent hard fork on the Ubiq network, they seem well positioned to take advantage of this with their new hashing algorithm, Ubqhash, aimed at mitigating the threat of 51% attacks while separating themselves from other Ethash coins. Ubiq would be a logical place to enjoy this switch.

This also leads me nicely on to my final prediction.

5. 51% Attacks Increase on “Shared Hashing Algorithm” Coins

When Ethereum transitions to Proof-of-Stake, a lot of hashing power will be freed up from rental services such as nicehash. This will make the cost of attacking coins with shared algorithms much easier and potentially cheaper.

With this in mind, I think the likelihood of 51% attacks increasing is high. Coins with active defences against this are likely to be safer places to invest and outperform the market in 2019.

Coins with independent hashing algorithms like Ubiq will also do well as this gives an extra layer of security against these threats.

Contributed by Kris Lester

Contributed by Kris Lester

Kris has been working in the tech industry for over a decade, with new and innovative technologies, most recently becoming a fan of the revolutionary potential of the Blockchain. He is Ubiq’s Community Manager and a long-standing member of their community.