It’s an incredibly interesting time to be involved in the cryptocurrency space. Prices have been plummeting, and many of the projects that were created during the latest bull market are facing strong adversity for the first time.

What’s more, the Bitcoin Cash hash war has shown us all the potential vulnerability of pure proof-of-work blockchains. As network values drop and fewer people can mine profitably, hash rates decrease across the space… all of a sudden, 51% attacks are not so expensive to pull off against one’s adversaries.

In fact, the constant threat of a malicious attack from the Bitcoin Cash SV camp has prompted the ABC camp to implement rolling 10 block checkpoints to prevent malicious reorgs from 51% attacks.

Of course, the still-nascent blockchain industry is full of experimentation, and proof of work is far from the only consensus model out there being tested.

In this article, we’ll be discussing some projects that aim to achieve decentralized consensus using a different method: masternodes.

Masternodes are full nodes that run 24/7 to validate transactions and are operated by the community members of the given cryptocurrency. To run a masternode, you must also be able to stake a sizeable sum of the coin or token. This large stake is necessary to ensure that the masternode operators have sufficient incentive not to attack the network and devalue their own holdings.

In return for their work to secure the network, masternode operators earn rewards similarly to miners in proof-of-work projects.

For anybody who’s passionate about contributing to these cryptocurrency projects and earning passive income from masternodes, here are 4 masternode projects for you to consider.

4 Masternode Projects You Should Know About

Dash ($DASH)

As the original masternode project and one that’s been around since 2014, Dash is an obvious inclusion in this article.

Dash is closely related to Bitcoin and both are proof-of-work coins.

However, Dash differentiates itself with a 2-tiered mining system that includes the Dash Masternodes, which are full nodes that provide some extra functionality to Dash users, including:

- PrivateSend for transactions with enhanced anonymity

- InstantSend for instantaneous transactions

- Decentralized governance and budget management through a masternode voting system

As a reward for running a masternode, operators earn 45% of the total block rewards. Another 45% goes to the miners, while the remaining 10% is designated toward the budget system.

In order to run a Dash Masternode, users must stake a minimum of 1,000 Dash and have a dedicated IP address that can run 24 hours a day. As of writing, 1,000 Dash is worth approximately $87,000 — quite a significant amount.

Having such high up-front requirements of masternode operators raises the common argument that masternode projects are not really decentralized, as not everybody can participate in mining them.

In fact, this isn’t all that different from the block size debate that led to the separation of Bitcoin and Bitcoin Cash. The argument for retaining the 1MB block size cap for BTC is based on the fact that larger blocks require better equipment and faster internet connections from miners in order for them to participate in mining.

On the other side of the masternode argument, people point out that mining power is typically more widely and evenly distributed for masternode projects as opposed to pure proof-of-work projects, which tend to have just a few mining pools in control of the majority of hash power.

It’s certainly an interesting debate, and both arguments have merit. Ultimately, we’ll all just have to wait and see how masternode projects fare as opposed to pure proof-of-work coins in the years and decades ahead.

If you don’t have ~$87,000 but are still interested in operating a Dash Masternode, you don’t need to wait until you strike it rich.

That’s because Dash Masternodes have been tokenized by a security token platform called Swarm (more on them below), which allows for fractional ownership of masternodes that splits the block rewards among each part-owner according to their proportion of the stake.

If this interests you, you can learn more on the Swarm investment page.

Swarm ($SWM)

Swarm is a project focused on democratizing investment and making high-yield opportunities available to the masses through tokenized securities.

Like many projects, Swarm initially operated the Swarm network nodes and validated transactions internally while awareness about the platform spread. After achieving a good deal of community growth, it finally came time to decentralize the Swarm network with the launch of Swarm Masternodes.

To have a masternode, users must sign up and stake at least 50,000 SWM, which is currently worth approximately $10,000. Of course, that’s a sizeable chunk of change that average investors probably can’t afford.

Fortunately, Swarm’s whole business is about making those kinds of exclusive investment opportunities available to anybody, and Swarm Masternodes themselves are no exception.

According to the masternode FAQ:

In the near future, you will be able to participate in fractional ownership of a Swarm Masternode through a Swarm Investment Opportunity called Swarm Masternode Token (SMT).

In other words, you soon won’t need to have the full 50,000 SWM to run a masternode and earn node rewards, as you’ll be able to band together with other community members to run nodes collectively.

Despite the poor performance of the crypto market lately, Swarm’s masternode program has been picking up steam of late. A huge payout to registered masternodes helped incentivize 30+ new sign-ups in the past couple of weeks alone, bringing the total number of masternodes in the network to 126 as of writing.

Swarm Masternodes earn 2 types of rewards: block rewards and Market Development Fund (MDF) rewards.

The former are rewards that are paid out at each block and evenly distributed amongst all eligible masternodes.

The latter come from a pool of capital managed by Masternodes through Swarm’s liquid democracy, which is used to fund investment opportunities on the Swarm platform. 30% of the annual returns from MDF investments go to participating masternodes, while 70% are used to purchase SWM from the market which is then added to the following year’s MDF pool.

Ultimately, masternodes allow Swarm to be secure and decentralized. They run Swarm’s Market Access Protocol (MAP), which provides a structure for offering legally compliant and easily tradable security tokens.

And with a current Annual ROI of nearly 40%, the Swarm Masternodes are one of the best passive income-generating assets out there.

VeChain ($VET)

Fair warning, this is going to get complicated!

VeChain is one of the players in the supply chain management space, widely seen as a promising area for blockchain to disrupt in the coming years. With tons of high-profile partnerships and a growing presence in the Chinese economy and abroad, VeChain seems to have a lot going for it.

The VeChain Masternode system is where things get complicated.

You see, there are actually many tiers of nodes that VET stakers can operate, with the level being determined by the amount staked. In exchange for running nodes, operators receive Thor, which is essentially the VeChain equivalent of Gas for Ethereum.

There are 2 general categories for nodes:

- Authority Nodes: These are the top-tier masternodes that are used to validate the blockchain.

- Economic Nodes: These are all of the lower-tier nodes that are not used to validate the blockchain and don’t require any hardware, but still reward users for staking their coins and providing stability to the VeChain ecosystem.

Authority (a.k.a. Thurdheim) Masternodes are evaluated and selected by the VeChain foundation and must go through a full KYC application. (All of the small blockers and masternode opposers reading this are probably shaking their heads already.)

Additionally, Authority Nodes must meet dedicated hardware requirements for validating the blockchain, and must stake a minimum of 250 million VET, worth approximately $1 million as of writing.

In exchange for meeting these high requirements, Authority Node operators receive the most Thor (30% of all Thor consumed by blockchain transactions) and get the best voting rights.

Economic Nodes, meanwhile, can be broken down into 7 types. The minimum amount of staked VET needed to run one of these nodes is 600,000, while the maximum amount needed is 15.6 million – worth about $3,000 and $78,000 respectively.

If you’re interested to look into the details of Economic Nodes, we recommend checking out VeChain Insider.

Techrock (formerly known as Walimai/蛙力买) ($WABI)

On December 4, Walimai rebranded itself to Techrock, but the fundamentals of the project remain unchanged.

Techrock is extremely similar to VeChain. Both are Chinese-based supply chain management projects, and both have implemented masternodes to secure their blockchains.

Techrock is actually only one half of the full supply chain cryptocurrency solution, however. This is A Tale of 2 Blockchains: WaBi (now Tael) and Walimai (now Techrock).

Tael is the project’s consumer-incentivization token, used to reward users for purchases, scans, and other actions within the Techrock ecosystem. Techrock, meanwhile, is where the retail transactions are recorded and the actual supply chain tracking and management occurs.

The masternodes are used as transaction auditors for the public Techrock blockchain, which is based on Hyperledger software.

In order to be a Techrock masternode, users must meet the following criteria:

- Hold a minimum of 5,000 WABI tokens (worth just under $700 as of writing) in a private wallet

- Have a dedicated computer running on Linux Ubuntu 16.04 and above with support for Docker. Minimum specifications are: 2 Cores, 4 GB RAM, HDD 40 GB.

- Register the private wallet with 5,000+ WABI through the WaBi Verification Bot.

- Fill out a Google information form.

The 30 wallets with the largest WABI stakes are then selected to run the Techrock masternodes, with others being placed in a “backup queue” to replace any masternodes who stop meeting the requirements.

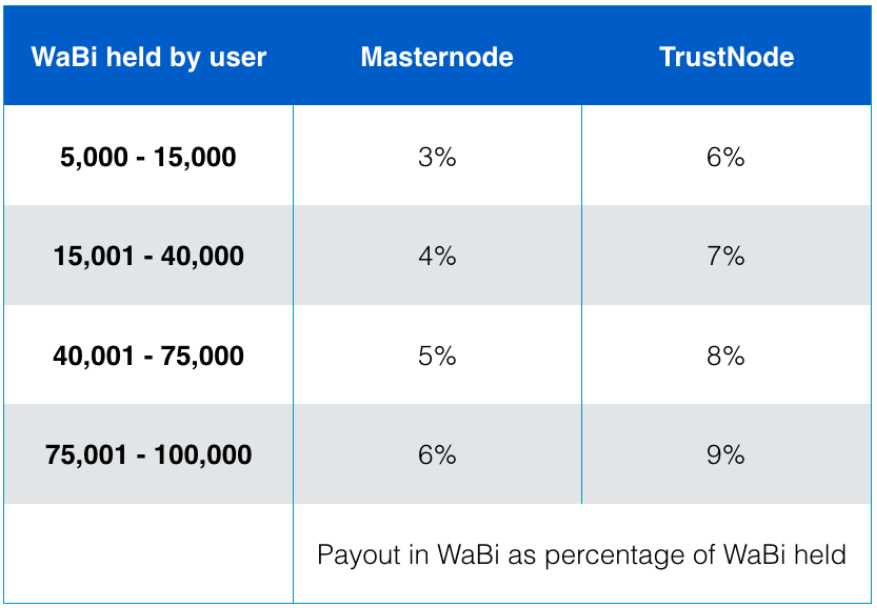

The reward for running a masternode depends on the amount held and the type of node. There are 2 tiers: regular Masternodes and TrustNodes.

The Payout structure can be seen below.

Techrock/Tael is already a working product being used in the liquor, baby food, and cosmetic industries, providing peace of mind to millions of Chinese consumers. Given the prevalence of counterfeit goods in China, there’s a ton of potential for growth here.

Conclusion

Masternodes have their advantages and disadvantages like anything else. While operating a masternode isn’t permissionless like mining Bitcoin, having a network of independent masternodes can provide robust, decentralized security for any project that chooses to go that route.

Dash, Swarm, VeChain, and Techrock all utilize masternodes for this purpose while having vastly different participation requirements, particularly in terms of the USD value of the staked coins.

If you can afford the upfront cost of becoming a masternode, it can become a valuable asset that pays consistent passive income.

And if the requirements are too high, keep an eye on Swarm for more opportunities to purchase partial ownership in a tokenized masternode.