Recent surges in the price of Ethereum have caused cryptocurrency traders on both sides of the Bitcoin vs Ethereum debate to question whether or not Ethereum may overtake Bitcoin as the most dominant cryptocurrency. In recent months the price of Ethereum has surpassed 30% of Bitcoin’s market cap at approximately $5 billion. And that’s quite the feat, considering Bitcoin had a six and a half year head start.

All the recent press surrounding Ethereum has many people wondering; what’s the difference between Bitcoin and Ethereum? The purpose of this article is to explore the key differences between Ethereum and Bitcoin –and what makes Ethereum special.

The Difference Between Bitcoin and Ethereum

Before investing into cryptocurrency for the first time, it is probably wise to have a firm understanding of what makes the two most popular cryptocurrencies different from one another. First, let’s look at some Bitcoin facts before we follow it up with Ethereum.

What Is Bitcoin?

Bitcoin is a globally recognized open-source digital payment system that works without a central repository or a single administrator. Bitcoin transactions are verified and recorded by several unique network nodes on a distributed public ledger called a blockchain to ensure redundancy and prevent fraud or counterfeit.

While the blockchain is the foundation of Bitcoin and many other cryptocurrencies — Bitcoin is purely a cryptocurrency and serves no other function. However, blockchain itself can serve countless functions (read our beginner’s overview).

When Was Bitcoin First Introduced?

Bitcoin was introduced on January 3, 2009 and it was the world’s first decentralized cryptocurrency. One doesn’t need to speculate too much to understand that its introduction was a direct result of the 2008 financial crisis. Someone, somewhere wasn’t too pleased with the world being plummeted into the throes of an economic breakdown and decided to do something about it.

The opportunities presented by Bitcoin appeal to both libertarians and professional traders alike.

Also read: 10 Bold Promises Of Bitcoin

Who Created Bitcoin?

The creator of Bitcoin is known today only as an alias; Satoshi Nakamoto. Satoshi is likely not one person, but a group of persons — and although some have claimed to be Bitcoin’s infamous creator, it’s safe to assume the true face behind Bitcoin is still unknown (read: the self-proclaimed creator(s) of Bitcoin are full of it).

How Many Bitcoins Exist?

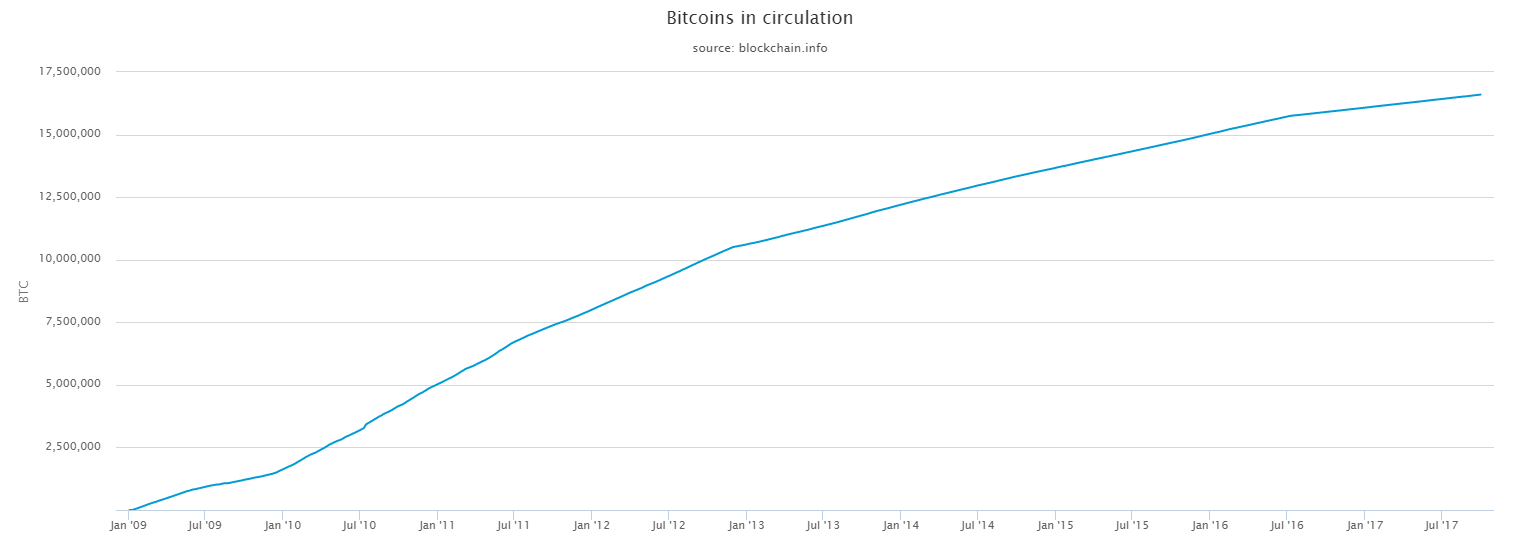

As of September 27, 2017 a total of 16,590,688 BTC have been mined and are theoretically in circulation –however with the number of Bitcoin wallets lost unknown, that number may not be a clear indicator of how many Bitcoins are in circulation. This also doesn’t reflect the number of coins which were lost or produced in the genesis block, as those cannot be spent.

In all, there will only ever be 21 million Bitcoins. The reason for this is to create scarcity, which gives Bitcoin the added benefit of being a deflationary currency. Bitcoin has a controlled supply.

What Is Bitcoin Mining?

When applied to cryptocurrency, all mining refers to the process of adding transactions to a given blockchain. In Bitcoin’s case, this is known as the public ledger.

Getting into the minutiae, Bitcoin’s block time is around 10 minutes. This is the time required to mine a block in the blockchain and confirm transactions.

Reputable Investment in Bitcoin

Bitcoin is a darling among investment firms, second only to Ethereum. Fidelity Investments is so supportive of Bitcoin they accept it in their cafeteria.

Other reputable Bitcoin investors include Marc Andreessen, Barry Silbert, Blythe Masters, David Rutter, Adam Back, and JP Morgan –the latter of which has also been accused of abusing the market.

In the curious case of JP Morgan, the CEO has publicly professed Bitcoin to be a bad investment (read: fraud) while his company has been helping clients invest in the cryptocurrency at a lower price due to the bad publicity their CEO is creating. Other firms are crying foul, and some groups have even filed lawsuits over their practice. Yes, this is the same JP Morgan which played a major part in the 2008 financial crisis, and we can only hope their comeuppance is drawing closer.

China is also taking part in the fear, uncertainty, or doubt (FUD) with almost weekly up and down claims that range from government adoption and regulation to making cryptocurrency exchange illegal for individuals. It’s safe to assume governmental bodies will be testing the boundaries of cryptocurrency –or just kicking its tires, for some time to come.

This is also why, going forward, you simply cannot believe everything you read.

What Is Ethereum?

Like Bitcoin, Ethereum is now a globally recognized open-source digital payment system that works without a central repository or a single administrator.

Ethereum transactions are verified and recorded by several unique network nodes on a distributed public ledger called a blockchain to ensure redundancy and prevent fraud or counterfeit. So far, it sounds the same as Bitcoin, right?

Well, the similarities end there.

Ethereum is also a platform where transactions aren’t the only thing it facilitates. What makes Ethereum both groundbreaking and unique is the introduction of “Smart Contracts”.

What Is a Smart Contract?

From Wikipedia: “A smart contract is a computer protocol intended to facilitate, verify, or enforce the negotiation or performance of a contract.”

In terms of Ethereum, you can almost consider them apps that run on the Ethereum protocol, capable of just about anything an application can do; a site like Air Bnb could run entirely on a smart contract with a website wrapper.

The entire internet could be reborn as a series of smart contracts — and it’d be better for it, too. Decentralisation of the internet would make net neutrality a moot point.

But back to Ethereum today; from real-world government contract bids, asset tracking (think Fedex or leasing), and even healthcare — after all, humans are trackable assets, why not use it to dispense birth certificates?

It’s mind-blowing at first, but once you understand it, you start to realize that Ethereum is much more than a cryptocurrency; it’s a platform for processing and tracking day to day business operations. They took what was working for Bitcoin and made it apply to just about any kind of digital asset. And any physical asset can have a digital signature –think serial numbers.

The goal with Ethereum smart contracts is to provide security and redundancy that is superior to traditional contract law while reducing other transaction costs associated with contracting.

When Was Ethereum First Introduced?

Ethereum was introduced on July 30, 2015 with a focus on going beyond existing Bitcoin technologies –the creator of Ethereum was interested in created decentralized applications and in his own way, fixing where Bitcoin fell short. He saw more potential in the blockchain.

Now that isn’t to say that Bitcoin is all bad. Some consider Bitcoin the gold to the US dollar; a tethered force that affects the value of all proceeding cryptocurrencies.

Who Created Ethereum?

The creator of Ethereum doesn’t hide behind a shroud of secrecy; its founder is a young Canadian-Russian, merely 23 today (born in 1994) and has been very clear about his role with the cryptocurrency. His name is Vitalik Buterin.

He maintains Ethereum with a group of peers, and he provides a level of accountability that Bitcoin can never have unless its true creator comes out of the closet.

Because Vitalik is so approachable, and there are checks and balances within the Ethereum camp, more governments and private organizations are willing to explore Ethereum. It’s accountability gives it legitimacy and the technology that underpins it is smart –which only makes it more attractive for investors to place their confidence in it.

How Many Ether Coins Exist?

Ethereum operates differently from Bitcoin in the sense that it’s not confined to a set number of coins, it’s set to a pace of coin production.

So while it isn’t quite like Bitcoin in the sense that there’s a finite number of coins –it isn’t like the Federal Reserve Bank where they have a license to print any amount of US currency they wish. This ensures that it retains value to some extent in a deflationary way. However, it will likely not be as deflationary as Bitcoin. It’s like a more controlled version of the US dollar –what the US dollar probably should have remained as, before they untied it from Gold.

What Is Ethereum Mining?

Ethereum has a few similarities to Bitcoin in a general sense; mining is the process of adding “transactions” –whatever they are, to the Ethereum blockchain. However, as previously stated, those transactions aren’t limited to a cryptocurrency like Bitcoin is –and they are no finite number of Ether coins.

Ether mining can apply to all assets and/or smart contracts that pass into the blockchain. It’s a little more advanced.

Rewards associated with mining Bitcoin is cut in half approximately every four years. It is currently valued at 12.5 bitcoins. To the contrary, Ethereum rewards miners based on a “proof-of-work” algorithm entitled Ethash. 5 ether is given for each block that is mined.

Ethash is a “memory hard hashing algorithm”, which promotes decentralized mining by individuals rather than the use of more centralized technologies which Bitcoin uses. This also makes it more secure.

“Bitcoin and Ethereum also cost their transactions in different ways. In Ethereum, it is called Gas, and the costing of transactions depends on their storage needs, complexity and bandwidth usage. In Bitcoin, the transactions are limited by the block size and they compete equally with each other” (Source).

Reputable Investment in Ethereum

Ethereum has a little more backing than Bitcoin these days. Like any younger sibling, Ethereum has had the opportunity to view the shortcomings of its older sibling and adapt to change.

There is an Ethereum Alliance which currently boasts an ever-increasing number of partners. And for the sake of this article, I won’t number them, I’ll encourage you to take a look for yourself.

You will recognize names like MasterCard, Deloitte, ING, Intel, JP Morgan (again), Microsoft, Scotiabank, and numerous other major, strongly financially backed businesses signing on to take part in this new crypto powerhouse. The lineup will change, although I only have seen it change for the better over the past 12 months.

Needless to say, it’s a safe investment and free of much of the FUD that Bitcoin has been subjected to over the years.

So, What’s the Difference Between Bitcoin and Ethereum?

Both cryptocurrencies, like all currencies, are ruled by trust. That doesn’t suddenly go out the window. It would be stupid to think there’s a lack of trust in either when you see the names that choose to associate themselves with either respective cryptocurrency.

However, crypto is the new kid in school. And all cryptocurrencies are either subject to courting or belittling by the most popular kids in #fintech school –the JP Morgans of the world. That shitty best friend when you’re trying to be a social climber.

If you know high school politics, you know where this goes. I’d suggest Mean Girls as a great insight for the Every Person, but we all know how Lohan turned out.

And then there’s the advent of smart contracts. I promise you this: they’re what you need to keep an eye on in terms of that investment portfolio. It is no longer about “my dad can beat up your dad” in the cryptocurrency world. There is no clear winner.

It’s about which smart contract has the scalability the world is looking for. Cryptocurrencies have followed Ethereum and taken its lead.

Ethereum heralds the first application of smart contract technology for cryptocurrency and blockchain, but it wasn’t the very first, ever, in the history of all smart contracts.

Smart contract technology actually dates back to 1996.

However, Ethereum is by far the most compelling application of smart contracts to date, that’s for sure. The blockchain solidified that.

Just like the iPhone didn’t create anything new, it just did it right. That’s Ether.

Final Thoughts

In summary, it’s safe to say that both Bitcoin and Ethereum aren’t going anywhere for the foreseeable future. It is this writer’s belief that Ethereum will one day surpass Bitcoin due to its scalability, even far beyond financial markets.

Anyone’s best bet is to buy and hold, however, experienced traders have the potential to make massive profits due to the ebbs and flows of these respective markets.

What’s important right now is to understand that both of these currencies have longevity. And any one person or organization raising FUD likely has an agenda. All currency is built on trust, and when trust wanes it creates superb buying opportunities. With enough followers (or drone investors) anyone can do that. YouTube bloggers can do that.

So, buckle up.

When the world is this close to upending the financial industry’s status quo, it’s war. But in the words of the immortal Gordon Gekko, “Greed is good” — and in this case, it is greed that is likely going to bring both Bitcoin and Ethereum “to the moon!”

This is a trader’s game. Many will ride this out and leverage the dips to their advantage. And if the JP Morgan’s of the world are doing it, it’s not so silly now, is it?

I speak for myself as a writer; Ethereum and Bitcoin will both die one day –but today, Ether is a clear winner. What do you think? Let us know in the comments, we’d love to hear from you.