Little needs to be stated here about what Satoshi Nakamoto (whomever he, she, or they may be) has gifted the planet. The name and the person or persons are an enigma. There’s been much speculation on who this entity was, or is. In nine short years a vast infrastructure has emerged. Where we go from here is anyone’s guess. Make no mistake, the legacy of this ghost, whether considered gift or curse, looms large. For just a few moments, set your mind free and let’s take a walk, exploring where the Ghost of Satoshi Nakamoto has visited and where a visitation may be imminent.

What Can be Measured

Writing for such a fast-paced and volatile market as blockchain and cryptocurrencies is both a joy and a frustration. It’s a joy to literally see the world changing before your eyes with new technologies that benefit mankind. It’s a frustration in that the change is so swift that sometimes in the time it takes to write, edit, and publish an article, the information—for example, how the cryptocurrency market cap now exceeds $300 billion, leap-frogging over some of our most venerated corporate names—will sometimes be obsolete by the time you read it. Sorry ‘bout that. It can go up or down in a heartbeat, as market volatility is notorious.

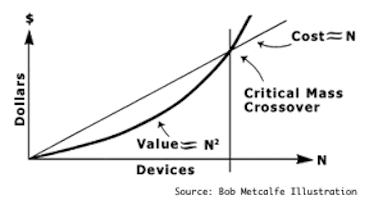

Since cryptocurrency is still a relatively young industry, let’s consider what’s going on in relation to Metcalfe’s Law, introduced by the co-inventor of Ethernet Robert Metcalfe, regarding adoption of electronic technology, which states:

The value of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

Does Metcalfe’s Law apply to the adoption of cryptocurrency? Possibly, if the law is restated to read:

Metcalfe’s Law states that a network’s value is proportional to the square of the number of users.

The key words here are “value” and “users”.

In graphic form, it looks like this:

What can definitely be measured here is that less than 1% of the global population own cryptocurrencies. Plug that into Metcalfe’s Law. I can hear the song We’ve Only Just Begun playing in my head. Not too bad for a ghost, ya think?

Leveling the Playing Field

Something that’s less measurable, simply because we’re still so early in the adoption phase, is blockchain’s potential to level the playing field—and, dare we add, to elevate the playing field as well! Our world is cram-packed with gatekeepers, cartels, businesses, corporations, associations, and groups who control and oftentimes bottleneck access to a smorgasbord of commodities and services. Is there anyone reading this who loves their local ISP, for example? What about money and banking? What about a decent return on investment these days?

On this walk we’re taking, imagine a world with freedom, access to whatever you may need without having to go through a gatekeeper. If you live in the UK and you want to send some financial energy (i.e., money) to someone in Indonesia, you process the transaction on the blockchain and in a matter of minutes the recipient has it. No bank needed. No need to convert from pounds to rupiah. This system works whether you’re standing next to each other or you’re halfway around the planet. This is the world Satoshi Nakamoto envisioned when bitcoin was born. When one gives birth—to children, ideas, works of art or technology—from the moment these material or intellectual manifestations leave us, they assume a life of their own.

There’s more. There’s a LOT more. Blockchain has surpassed what anyone could have predicted and gone into areas unforeseen in the beginning. But before exploring some of these areas, let’s stop to consider why the Ghost of Satoshi Nakamoto visited us in the first place.

There’s a Reason We Have a Ghost

We haven’t left the path we’ve been walking, dear reader. We’re just sitting on a bench for a while to ask the question, Why now? There’s a reason why we’re where we are.

Around 1998 I read a fascinating work by William Strauss and Neil Howe entitled The Fourth Turning. Its authors were the ones who coined the phrase “Generational Theory”, and this book is where the term “Millennial Generation” originated. The book is a great read if you haven’t already read it.

Instead of explaining their theory, let me offer an analogy instead. Let’s picture in our mind’s eye someone born in 1900 in London. That person learns from their environment. They’re given life-lessons by their parents based on the learning and environment the parents were born into, around 1880 or so. This person is growing up during the Victorian Era; their environment is stable and secure, and many people prosper. By and large, for this generation life is good.

Now, let’s move ahead to London in 1940. What would be the life-view of an individual born that year? Europe is at war. The enemy can invade or drop bombs at any second. Fortunate children are sent away from the city as the chaos and destruction intensifies. Fear and survival instincts rule.

What Strauss and Howe discovered in their historical research is that patterns emerged. A generation born with certain attributes gave birth to children who had other attributes, who then gave birth to children who had different attributes, and so on, in semi-regular, repeating patterns. Strauss and Howe went back all the way to the 1100s and were astounded at the accuracy of these “generations”, as they called them.

“With mushrooming technological innovations proving to be disruptive and in a way adding to the decay of the current social order, this puts Millennials not only at the forefront, but in the driver’s seat of this tectonic paradigm shift.”

Per their Generational Theory, we’re in the middle of a “winter” period triggered, many have theorized, by the financial collapse of 2008 (there’s always a “crisis” during these periods). With mushrooming technological innovations proving to be disruptive. and in some ways exacerbating the decay of the current social order, Millennials are not only at the forefront, but in the driver’s seat of this tectonic paradigm shift. Winter periods in the US, for example, include the Revolutionary War, the Civil War, and the Great Depression/WWII era. Each of these periods witnessed the breakdown of the current social order until a crisis occurred, uniting the population to fight. This cycle, it’s the Millennial generation who must fight in the trenches to help society rise from the ashes, creating a new social order. Don’t shoot the messenger here. My generation was born to rebel (1960s), and we did our part.

As the old social order crumbles, I’m not convinced the generational crisis needed to bring people together was, in fact, the financial collapse of 2008. My theory is that Satoshi Nakamoto’s white paper, first released to the world in late 2008, just after the collapse, sowed the seeds to rebuild the social order—but the “crisis” has yet to occur. Only time will tell if this theory is true.

Speaking of which, now is the perfect time, dear reader, to continue our walk. The most important of all is yet to come.

Hope

We now completely leave the tangible world, that which can be measured and graphed, and enter the intangible, the world of emotion and feeling, which can’t be measured but which is the most important of all.

Do I have to mention pain? Dare I remind folks about how many jobs were destroyed, how many homes lost, how many people forced to watch their life savings evaporate not too many years ago? Should I talk about having to work two or more jobs just to scrape by? Do you need to be reminded that for a tiny fraction of the population life is the grandest it’s ever been, but the rest feel mired in unforgiving chains of debt and drudgery, stuck with no way to get out?

What would you say if I told you blockchain can bring financial energy and economic activity to billions across the planet who don’t have access to banks as part of the peer-to-peer safety and security of sending funds? But this is only the beginning. You wanna apply for a job and need to certify your credentials? Blockchain can do that. No more filling out forms and waiting days or weeks to get what you need. In many parts of the world, clear title to land ownership is a huge issue—never mind that no matter where we live, verifying and certifying title ownership is a cumbersome process. Blockchain can fix all this. If you’re an artist of any kind who wants to be properly paid for your work, or if you’re concerned about identity theft or online privacy, look to the blockchain to resolve, protect, or benefit you in innumerable ways. What about using blockchain to enhance human conscious evolution, even?

For those of us who can feel how wrong our world is today, the Ghost of Satoshi Nakamoto reaches out to give hope, and maybe some joy, with some happiness tossed in for good measure. I, for one, don’t feel stuck any longer. I see a way forward.