Taking a quick walk down Wall Street, you’d be excused for thinking it’s playing tug-of-war with Bitcoin and other cryptocurrencies. There’s JPMorgan’s love-hate relationship, Oaktree Capital’s 180 turnaround, and Morgan Stanley’s measured acknowledgement. Now, major-league financial institution Goldman Sachs is joining the club. But they’re not stopping at joining the chorus. Instead, this powerful bank is scouting the possibility of adding Bitcoin and other cryptocurrencies as a trading option to investors’ portfolios.

Early stages

There are no indications (yet) that Goldman will definitely be opening a Bitcoin desk. As reported by the Wall Street Journal, the bank is in “early stages” as far as coming to a definite resolve, with the possibility of passing it up as a trading option.

A spokesperson for the company indicated that clients’ interests are what has prompted them to investigate, adding that “we are exploring how best to serve them in [the cryptocurrency] space.”

CEO Lloyd Bankfein added to the conversation by tweeting that there’s been no decision either way. He added that a fear of change also accompanied the replacement of gold with paper money. An indication of which direction he sways, perhaps?

Recently, a group of employed analysts stated in a Q&A report that an eye has to be kept on cryptocurrencies like Bitcoin.

“Whether or not you believe in the merit of investing in cryptocurrencies (you know who you are), real dollars are at work here and warrant watching.”

The bank also recently appointed a new Chief Technology Officer (CTO), technology veteran Mike Blum, to its electronic trading unit as part of an effort to streamline and expand its digital trading services.

The Google of Wall Street

Earlier this year, the bank’s Chief Financial Officer, Marty Chez, spoke at Harvard, stating that Goldman Sachs is the risk equivalent of Google as a search engine. Chez has previously been mentored by non other than Eric Schmidt, chairman of Google’s parent company, Alphabet.”A client has a risk they don’t want or wants a risk they don’t have, and we make it happen for them. This is the fundamental truth of Goldman Sachs. If the clients stop calling and talking to us about risks they have but don’t want or want but don’t have, then we have no business whatsoever.”

“A client has a risk they don’t want or wants a risk they don’t have, and we make it happen for them. This is the fundamental truth of Goldman Sachs. If the clients stop calling and talking to us about risks they have but don’t want or want but don’t have, then we have no business whatsoever.”

And thanks to the continued rise of cryptocurrencies, the company is doing just that.

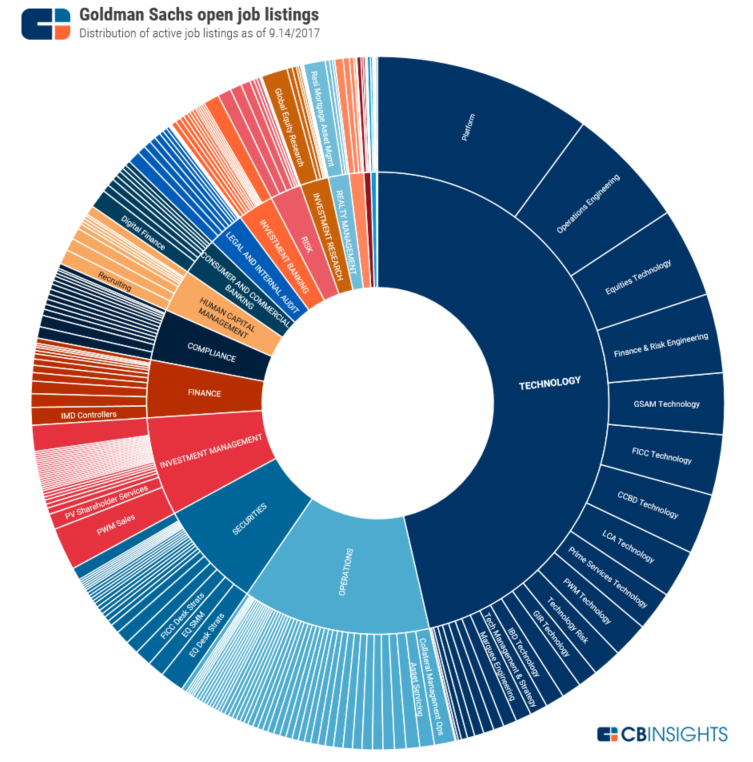

According to a CBT study, Goldman has shifted its focus to technology. 46 percent of new job listings (as of September 2017) is in the technological division. In India, the company jacked up engineering campus recruits by 2530 percent.

Blockchain on the horizon

While the organisation hasn’t been as outspoken about Bitcoin or as active in blockchain technology as rival JPMorgan, its company website is telling. It sports an explainer page about blockchain in action.

The world’s most influential company

Goldman Sachs has been nicknamed “the Vampire Squid“, and has far-reaching influence not only in the USA but all across the Eurozone. The bank has come a long way since it was first established in 1869. Nowadays, the company is sending former employees and advisors to all sorts of far-off government outposts, including:

- Mario Draghi, head of the European Central Bank,

- Mario Monti, former prime minister of Italy,

- Antonio Borges, former head of the International Monetary Fund’s European Department, and

Romano Prodi, former president of the European Commission and twice-elected prime minister of Italy.

It works both ways. Manuel Barroso, former president of the European Commission and erstwhile prime minister of Portugal, currently serves the bank as non-executive chairman.

Closer to home, the US government itself is running on a Goldman Sachs mill these days, with President Trump’s foremost advisors all laying a claim to fame to having at one time been on the bank’s payroll. The old boys’ club includes treasury secretary Steven Mnuchin, the man in charge of shaping the country’s economic policy.

The future of Bitcoin on Wall Street

It’s evident that Goldman has friends in high places, and diaspora everywhere it matters. While the news is in no way conclusive as yet, the fact that this formidable financial institution is considering dealing in cryptocurrency is no small feat. What the involvement of powerhouses such as Goldman Sachs and its blue-chip competitors implicates for the future of digital currency remains to be seen. But with Wall Street making the crypto news headlines almost daily these days, negating the pull cryptocurrencies are having on the mainstream financial industry is no longer an option.