“Nothing important has ever been built without irrational exuberance”

– Alan Greenspan (referring to the 2000s dot com bubble)

The world of cryptocurrencies has seen an unprecedented explosion in activity over the past year. It is easy to get caught up in the hype, with promises of fabulous returns on your initial investment.

But in truth, there is no such thing as a “safe” investment and you are always running the risk of losing your money.

In this article, we share a list of simple techniques you can use to mitigate your own risk while navigating through the uncharted waters of cryptocurrencies.

Do Your Own Research

It is amazing how many people will throw their own money into something without doing their due diligence first. This is a step which all too frequently gets skipped.

Here are a few questions you should be able to answer before buying any tokens. This is in no way an all-encompassing list; it is just a place to get started.

What does this coin look to do?

This is one of the most basic and the first things you should find out about any token, platform, currency etc. Ask yourself: could you explain what it is to someone else? And for god’s sake, read the whitepaper!

As the famous Peter Lynch quote goes:

Know what you own, and why you own it.

What is the potential reach?

You should be able to answer with some certainty exactly how big the potential market is for this coin. What service are they trying to provide and to how many people? Could this be used by everyone, or just a specific market?

For instance, Metalpay focuses on the the unbanked industries of nutraceuticals, adult entertainment, and cannabis. On the other hand, Litecoin aims to be used in a much broader application, like how fiat currencies are currently used for day-to-day transactions.

Also take a look at whether the platform is currently being used as intended. It is a good sign when other coins have been based off the coin you’re looking into.

What about the community?

One of the greatest things about the crypto world is how much of a role the community plays. Look for coins which have strong community-driven development, and a vocal development team or founder who is out there showing everyone why their platform is worth your money.

At the same time you should look at where their funding came from. Is it community-backed, or are there angel investors? This can help give you an idea to where the organization’s loyalties truly lie.

In addition, you should look at the development team. Do they have other relevant experience? If so, how much? Are the developers active on the forums and responsive to any technical issues?

What are the downsides?

You should be looking for the negatives in any coin or for reasons why the coin might fail. Are there other successful competitors who are trying to do the same thing? Have there been any drama or community outrages? Is the founder(s) a good leader and a spokesperson for the community, or is the team silent?

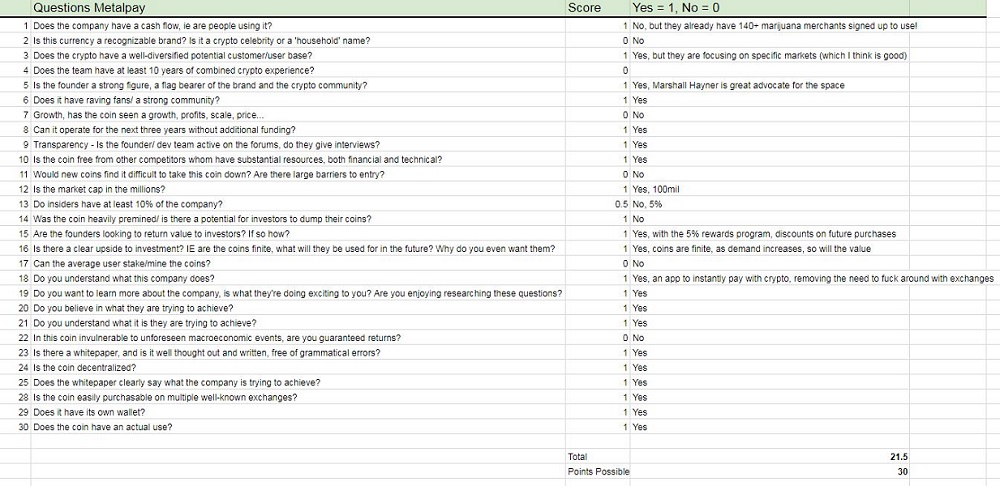

Here’s an example of the questions I answer before purchasing a coin. This was done before I decided to invest in Metalpay. I totaled the the points, and the higher the points the “safer” the investment. This gives me a frame of reference, but in no way is a complete assessment of a coin.

If any of you reading this do something similar or if there are some questions missing which you think are important (which I am sure there are many), I would love to hear from you.

This spreadsheet can be downloaded here.

Remove Your Emotions

Charlie Lee, founder of Litecoin, put it nicely in this tweet when he said: “I bought my first BTC at $30 and watched it tumble to $2 in the next year. If you can’t stomach a 90% drop in crypto, don’t adopt early”

This is easier said than done. Humans are emotional beings, and we can’t help but be enticed by the prospect of huge gains and equally demoralized by the 25% daily price swings which have been too common this past year.

A well-known method to reduce investment risk is “dollar-cost averaging”. All this means is purchasing a pre-defined amount of a certain coin at a certain time no matter what the cost is. What’s important is that this has been decided beforehand, not after looking at Bitcoin’s current price on Coinmarketcap.

Traditional investment portfolios have used this technique for years with 401k or employee stock purchase programs by automatically deducting a certain amount from your paycheck each time you get paid.

You will purchase at the highs, but more importantly you will purchase them at the lows. Assuming the price generally trends upward over time, you will see nice positive returns.

You can do this on your own with any coin. This takes a great deal of self control.

But an easier way to do this automatically with one of the most popular cryptocurrency exchanges in the world: Coinbase. You can do this in a few minutes by following the steps below.

Step 1:

Sign up for a Coinbase account.

Step 2:

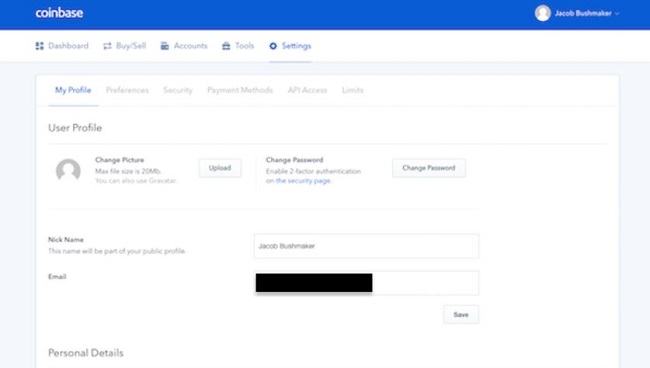

Go to the Settings tab and confirm your identity either by passport or alternative means (it will look different than this as mine has already been confirmed).

Step 3:

Go to the Payment Methods tab and add a method. The fees for each vary slightly depending on your chosen method and country of origin.

Step 4:

Go to the Buy/Sell tab at the top of the page and set up an automated payment.

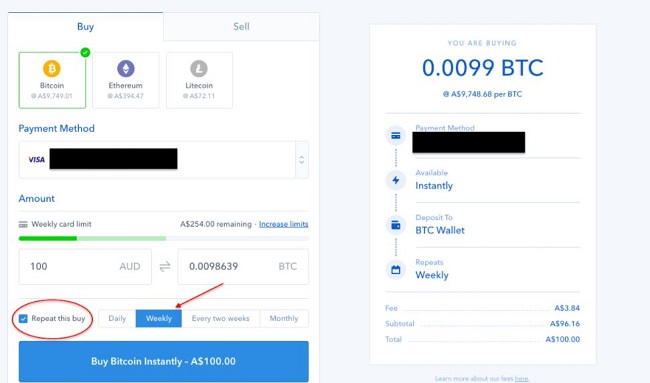

Do this by clicking your preferred coin (Coinbase currently offers the three most popular coins: Bitcoin, Ethereum and Litecoin), choosing your preferred amount, and clicking the “Repeat this buy” button at the bottom of the screen.

Once you hit Okay, the recurring purchase will be automatically set up!

Prices shown here are in AUD.

Diversify Your Investments

One of the best ways to mitigate your risk is to DIVERSIFY! Yes, I know you’ve heard this before, but you’re going to hear it again.

Diversifying your assets is the most important thing that you can do protect yourself against catastrophic downside while simultaneously increasing your upside.

Wait what? Wouldn’t investing in just a few coins increase your upside?

The short answer is no. In theory, if you got lucky and picked a winner, and put all of your money in that token, you would see substantial gains. There are a lot of people who are going for this approach, and it is easy to be enticed by the potential for a huge increase in wealth.

People have been “putting all of their eggs in one basket”; just look here for a case study on an accountant who put all of his money in Lisk.

But even Charlie Lee admitted in an interview that “right now there are just way too many” coins out there, and that in the future “there won’t be that many that will be useful”.

This means that there are a lot of coins out there that will fail.

So then how could it increase your upside? Because, by diversifying, you are placing more bets. Your chances of picking the next winner is much higher. This can be illustrated by comparing two investment strategies, a traditional strategy and a barbell strategy.

Traditional Investment Strategy

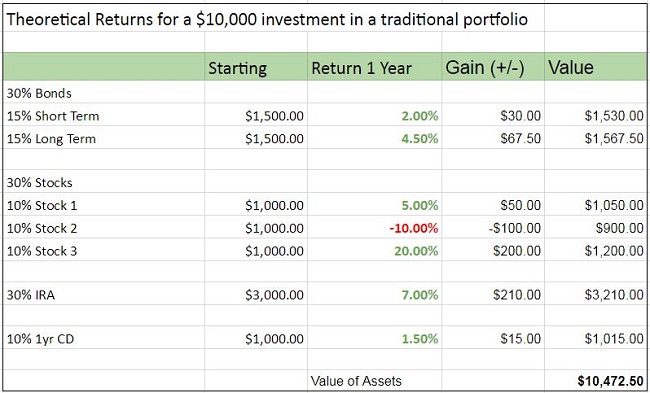

Here is the example of a ‘typical’ diversified investment portfolio, and some arbitrary but historically accurate theoretical gains and losses plugged in.

All of the investments in this portfolio went up, minus one stock, and to many investors these returns would be considered excellent.

The Barbell Investment Strategy

Nassim Taleb has been credited with popularizing the idea of ‘“barbell investing”. To summarize, it is the theory of putting all of your money in high-risk, high-reward investments (for example, cryptocurrencies) and the rest in very safe, low-risk, low-reward methods (bonds, CDs) and removing any middle-risk middle-reward investments (stocks).

Imagine a barbell that a weight lifter uses. There are two weights on each end with almost nothing in the middle.

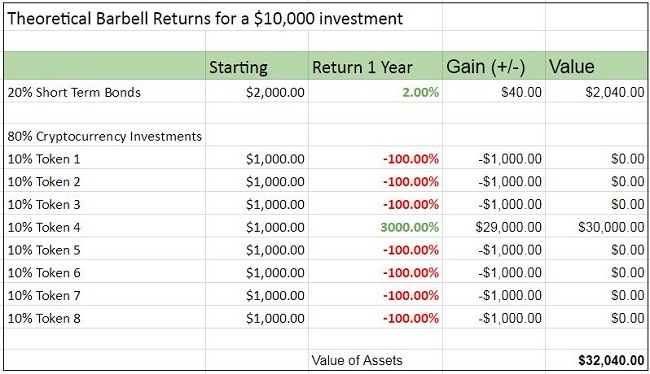

Here is an example barbell investment portfolio with some more arbitrary but also historically accurate theoretical returns plugged in.

In this example, the investor put 20% of his money into ‘safe’ bond investments, and the remaining 80% into ‘risky’ cryptocurrency investments. Of the 8 cryptocurrencies he chose, 7 of them went to zero, but one gained 3000% (the year-to-date gain on Ethereum). The investment in Token 4 caused the overall gains of the portfolio to skyrocket, and offset all the losses from the other investments.

What if you had two winners in there? Or what if instead of Ethereum, you had NEO (the “Ethereum of China”) instead with over 20,000% year to date gains?

You can play around for yourself with different investment amounts. For instance, you could put 50% into bonds and 50% into cryptocurrencies, or spread each cryptocurrency investment to 3-5%.

With numbers like these, you can’t help but wonder why major investment organizations which sell traditional securities such as JP Morgan have come out saying that “Bitcoin is a fraud”. They have a lot to lose by people changing their investment approach.

Invest Only What You Can Afford to Lose

Right now, the cryptocurrency world is the Wild West of investing. Things are changing almost daily, new currencies are appearing, and others are going away forever. A handful of the coins today have been found to be scams, with no hope of ever making anyone (but the scammers!) any money.

Don’t do something stupid like take out a second mortgage on your house which you have no hope of paying back if your investments fail.

Think of investing in cryptocurrencies like placing bets. It is a lot of speculation at this point and no one really knows exactly what is going to happen.

No one can doubt that that the future looks very bright for many of these coins. But no one also can doubt that many of these are going to fail. Some of your “bets” might pay off big, but many of them won’t pay off at all.

Last Thoughts

There is no such thing as a “sure thing” or “guaranteed returns”, especially in this market. But using simple strategies such as these can help mitigate the risks and set yourself up for success.

Disclaimer: None of this is investment advice. I am not a financial advisor, nor do I claim to be. This is what I’ve done. Use your head, do your research and HODL.