The future of cryptocurrency is still clouded with heavy fog, and settling on a project on which to sail into the future has a high probability of ending in a wreck. The market is so detached from reality and so incomparable to the traditional financial market that investors are more or less proceeding with gut feeling with respect to the majority of their investment choices.

The lack of concrete fundamentals with which to measure the market’s true value makes any recommendation beyond Bitcoin and Ethereum an action that leaves the speaker open to ridicule, if and when the outcome is wrong, or worse, liable for the losses suffered by those who heeded his or her word.

This problem is compounded by the fact that the majority of the 1,500 or so projects themselves have dubious motivations, spurred by the easy fundraising and cash-out mechanisms of ICOs.

But not all blockchain projects are sketchy, and one need only be correct about a select few projects to gain handsomely from the market. The technicals of the cryptocurrency market may differ from the stock market, but the psychological mindset remains the same—the best investments are those that involve sensible companies with sound management and business strategies.

And there are few projects that possess these characteristics more strongly than OmiseGO. With absolutely no concern for how the market fluctuates, or the news of regulatory bombshells, the OmiseGO team, led by Vansa Chatikavanij and advised by Vitalik Buterin and Thomas Greco, are steadfastly building a project for the target group that stands to gain the most from decentralized systems.

Sizing Up the Situation

South East Asia is one of fastest growing economic regions, with the ASEAN network host to 10 countries that have seen rapid growth in their economy since the rippling effects of globalization have been accelerated with the spread of the internet.

Despite the enormous workforce and increasingly educated population, the citizens are to a great extent disconnected from the global economy—even until 2015, nearly two-thirds of the population were without a bank account, largely because of a lack of documentation. And of course, without a bank account, an individual is deprived from the world’s economy—from investing in traditional financial assets and all of the services that are unfortunately only at a bank’s disposal to serve.

It is not the fault of the bankless that they lack accounts. Indeed, they are well aware of the dire circumstances that they are in and dislike having to store cash in their homes. As someone who lives in one of these countries afflicted by this documentation barrier, where many are not even issued birth certificates at birth, I am well aware of the great portion of human capital that is removed from the economy.

These individuals are wily, however, and find clever solutions to band-aid their desperate situation. Nearly all of them possess the essential item of modern times that is the smartphone and conduct financial transactions via the numerous digital wallets that are available as apps. These wallets can be “recharged” or “topped up”—credited with cash at a local store. The several apps that fight for market share are evidence of how popular these digital wallets are.

Combined with China and India, the ASEAN nations possess nearly half of the world’s population, with a great part of them hovering dangerously close to the poverty line. The existence of a system like OmiseGO could be the catalyst that the South East Asian region needs to meet its potential as the next economic superpower of the word by lifting this unbanked population out of financial limbo, and connecting them with the global economy.

Unbanking the Banked with OmiseGO

The idea of self-sovereign financial operation for the masses is precisely what OmiseGO is striving to achieve, and is something decentralized technology is perfectly suited for.

The simplest way to describe the practical realization of this is as follows: The funds that users normally have stored in their digital wallets are “frozen” in those accounts—they can only be used with compatible services and are transactable through that wallet only. The problem with this is that a great deal of funds locked in these accounts are unusable anywhere else. OmiseGO’s platform will make it possible for users to enable wallet-to-wallet transactions that include not just fiat currency and cryptocurrencies, but such things as loyalty points, frequent flyer miles, and game credits.

The liquidity creation here is enormous. With this platform, users can access any financial service with a smartphone and app alone, all operating on a peer-to-peer basis. The OmiseGO token, OMG, is an ERC-20 token that will be the first to utilize the Plasma network, a notable scaling solution which we shall talk about shortly.

Remittances is another area where OmiseGO has incredible potential. Many South East Asians work abroad and transfer an amount of their salaries back to their families in their native country. The large fees and delays associated with cross-border payments greatly affect those already in dire straits. A global decentralized ledger that is interoperable among blockchains is a solution to this problem.

These goals are obviously ambitious, but within the realm of possibility—another distinction that sets OmiseGO apart from the many projects with outlandish goals that have no doubt jumped on the bandwagon of blockchain technology.

That said, how will the OmiseGO platform realize these goals?

The OmiseGO Platform Features

To create this global ledger that allows various currencies and rewards points to be transmuted and allow this across blockchains, and link this to traditional financial services, OmiseGO has designed the following features:

Wallet SDK

OmiseGO does not want to completely upend the status quo of finance and act as a replacement for banks. Rather, it wants to work with them to serve the people. This would require allowing a wide variety of teams and developers the ability to work with their platform in order to integrate OmiseGO with existing systems.

Consequently, they have released the Software Development Kit (SDK) for their white-label wallet which allows existing businesses to connect seamlessly to the OmiseGO network, which would then make it possible for them to enable transactions with different wallets and services. This makes it easier for developers to develop apps for Ethereum.

Furthermore, this SDK will permit integration with debit and credit cards for “topping up” via ATMs or over the counter for cash deposits or withdrawals. This would necessitate a web of businesses, retailers, and hardware partners that facilitate this new means of transaction—a goal that is on OmiseGO’s agenda.

Decentralized Exchange

Decentralized exchanges are all the rage at the moment, with both projects and market enthusiasts salivating over the several benefits its offers—lower fees, direct P2P transactions, security, and more.

While the Wallet SDK is what will bridge the gap between consumers, businesses, and service providers, the decentralized exchange is the true heart of the OmiseGO platform. The reason for this is that for the exchange of assets between wallets to occur, there must be a highly liquid market that accounts for the disparity in rates between the underlying assets.

The transactions that occur on the OMG DEX are validated by OmiseGO’s stakers in its Proof-of-Stake network, and these nodes determine the trading fees. As we mentioned, OMG will allow for trading across both Bitcoin and Ethereum chains, so any asset can be traded.

The OmiseGO DEX improves upon other similar solutions by not having to rely on named validators (like Ripple) or possessing full custody of assets.

The DEX will work in conjunction with the clearing house, the detailing of which follows.

Clearing House

To facilitate exchanges with Bitcoin blockchains, OmiseGO is designing a clearing house that effectively acts as an oracle that lets external assets be traded. The technical details of this are quite complex, but it can be understood as follows:

If User A would like to sell some Bitcoin to User B on the OMG chain, the two of them would have to go through User C, who acts as the clearing house. C locks up funds in a smart contract according to the network’s consensus rules, and simultaneously creates a hash and signature. When A wants to sell Bitcoin, they make a payment that is contingent upon C’s hash value. Similarly, when B wishes to receive Bitcoin, it is contingent upon this hash value. If C refuses to conduct the transaction, the funds locked in the smart contract are distributed to A and B.

You can read about the technicalities in OmiseGO’s whitepaper.

The Plasma Network

Last, but certainly not the least, is the much-hyped Plasma network, co-created by Joseph Poon, co-founder of the Lightning Network.

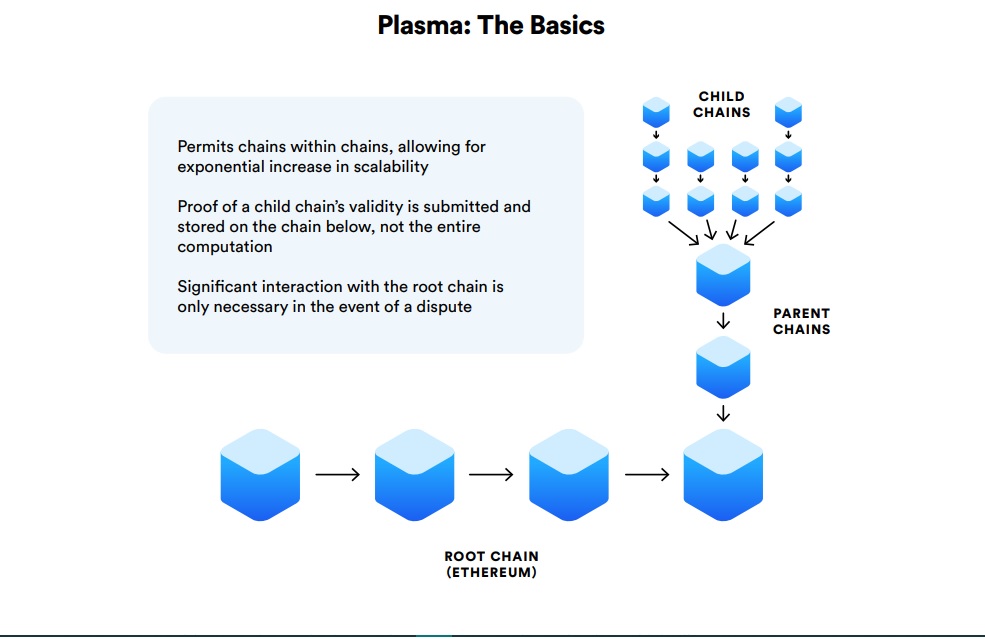

The Plasma network architecture hopes to solve the scalability issue that is plaguing cryptocurrencies, and is not all that dissimilar from Bitcoin’s Lightning Network. First detailed by Vitalik Buterin and Joseph Poon in a paper titled “Plasma: Automated Smart Contracts”, the solution employs child chains to take transactions off of the main chain, which reduces the burden on it. Theoretically, it would be possible for Plasma to allow for billions of transactions per second.

A Plasma network can be thought of as having blockchains within blockchains. These child chains operate independently, but if there is a dispute in the validity of a transaction, then the child chain can take it up with the main Ethereum network chain and have it settled—sort of like taking the dispute to court.

The uniqueness of the network kicks in when there is a disagreement between blocks. The smart contract possesses a feature called exit protocols, which lets the user exit the child chain and refer to the main chain whenever a dispute has occurred.

The Plasma network takes much effort to reduce the burden on the main chain. A user with a dispute will first broadcast the conflicting information to the parent block of the non-cooperative block, and all participants there get booted to the previous block, and the block involving the faulty transaction gets removed.

In case all members of the faulty block are non-cooperative, then the user has the opportunity to take it up with the main chain. The advantage here is that the main chain can be unburdened for as long as possible, which is a boost to performance.

Partnerships

The team has made efforts to establish a network of partners and, indeed, will have to do so if they want their platform to serve consumers, businesses, and merchants.

2017 saw them establish many partnerships and expand their reach. They have confirmed collaborations with Global Brain, the Siam Cement Group, Thai Airways International, and DTAC, Thailand’s third largest mobile phone provider. Perhaps more significantly, however, they have also partnered with McDonald’s in Thailand (with stores numbering at 100,000) and secured investment from Krungsri Bank.

They have also signed a Memorandum of Understanding with Korea’s Shinhan Card, a major credit card company in the nation. The Thai Ministry of Digital Affairs is also working with the platform—and a nation’s backing would be an enormous boost to the project.

There are several other partnerships that OmiseGO has landed, which can be viewed in this comprehensive Reddit post.

Roadmap Progress

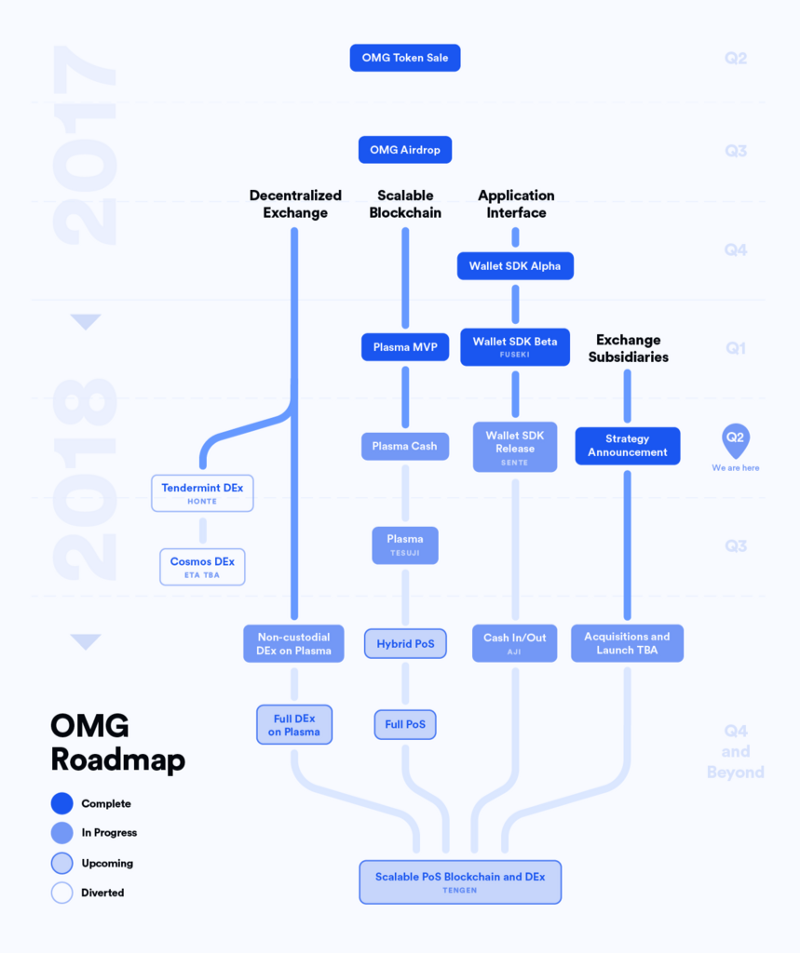

OmiseGO’s approach to their development is pretty straightforward: get it right. The team has made attempts in recent months to be more transparent, even releasing a revamped version of their roadmap. The path to self-sovereign financial capability has been split across four roads: the decentralized exchange, scalable blockchain, application interface and exchange subsidiaries.

Regarding the DEX, the team has decided to split the development across two phases: the first will not be decentralized, matching orders through a centralized service. This is expected to be ready by Q4 2018. The full-featured DEX will follow sometime after, though no release date has been mentioned so far.

The team will also slowly implement PoS, beginning with Proof-of-Authority. Furthermore, when Plasma is initially implemented, it will feature atomic swaps, which is expected in Q3 2018.

The eWallet SDK has already been made open source and the first version is slated to arrive by the end of Q2 2018.

A list of miscellaneous but important objectives include the exchange of non-fungible tokens, recurrent payments and order blinding—these have no release dates yet.

The last two quarters of 2018 are by far the most important periods for the project, given the significance of the developments arriving at the time. This is the time where one might hope for an increase in token value, though you can be sure that the team will not be paying attention to that.

Final Thoughts

In my mind, there are few projects more honestly and diligently using blockchain technology to effect a genuinely altruistic goal than OmiseGO. They seem to be marrying the traditional work ethic and attitude of pre-ICO era companies with the exciting possibilities of decentralized networks, and the market is in some desperate need of mature business operations.

The team is clear about the careful approach they need to take to “liberate money”, saying:

OmiseGO isn’t about convincing people to adopt new or better (crypto) currencies. Instead, it is about creating infrastructure which facilitates free transfer of value, no matter what form that value may take. Value is not in the money, it’s in the freedom to use it.

Some might say criticize OmiseGO’s slow and methodical approach, but that may be a result of the immature, instant gratification that so many investors expect to receive, never more apparent than in mentions of “When moon?”

But silly desires aside, OmiseGO knows that any vast, permanent blockchain infrastructure takes time and understanding of the market, stating in a recent AMA:

We’re building relationships, asking questions, and learning about the use cases people are looking for in order to build a platform that is as flexible and customizable as possible…We are continuing to explore how we can collaborate with existing mobile payment providers to create the most optimal experience for the most users. This includes ground research – for example, we are currently conducting a multi-year field study in Indonesia to better understand payment values and behaviors, existing infrastructure and the impacts that decentralized payment systems are likely to have on the environment.

As for the project’s product, service, and use case itself, they are insightfully working on a major pain point for a market that is especially suited for the applications of blockchain. Not a hint of self-serving agenda appears in their development, and they understand precisely what they are doing.

For all this, and the comprehensive technology created to serve the purpose, OmiseGO seems to be an excellent choice for investment. Do you want to make a quick buck? Then perhaps OmiseGO is not the project for you. Do you want to invest in and support a project that is designing a network to benefit those who need it the most? Then there are few comparable to OmiseGO.

Disclaimer: I own OMG tokens, if that isn’t clear already. This is not financial advice.