There are 2 things we can say for sure about Tether (USDT).

One, it’s the most popular stablecoin on the cryptocurrency market by far, being the 8th largest cryptocurrency by market cap and boasting the second highest daily trading volumes of any cryptocurrency, just after Bitcoin.

And two, it’s one of the most controversial cryptocurrencies to ever exist.

In fact, many people in the crypto community have become familiar with the term “The Great Tether Controversy.” This refers to the fact that many have become suspicious that, while Tether claims they back every single USDT coin with $1 USD, that they actually only hold a small fraction of the dollars that they claim they hold.

The reason many people suspect Tether of lying about their USD holdings is because Tether has never agreed to a transparent audit of their bank reserves.

They did release a document in September 2017 entitled, “Proof of Funds,” but the document is far from transparent — the names of the banks have been blacked out and it was hardly a full audit.

To further the controversy, the firm that conducted that audit, Friedman LLP, dissolved their relationship with Tether just a few months later.

Despite these numerous suspicions, nobody has proven one way or the other whether Tether has been creating tons of unbacked USDT coins, or whether this whole controversy is just FUD (fear, uncertainty, and doubt).

To see what the greater crypto community believes, we conducted some research to dig deeper and find out what investors think.

“Is Tether Fully Backed by USD?”: Poll Results

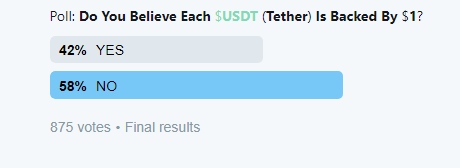

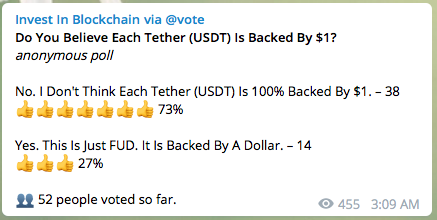

We asked the Invest in Blockchain community on both Twitter and Telegram to answer one simple question: Do you believe each USDT is backed by $1?

On Twitter, a total of 875 people voted. 42% said they do believe each USDT is backed by $1, while 58% said they do not believe Tether has been backing up every single USDT.

In our Invest in Blockchain Telegram channel, the results were a bit different. A total of 52 people voted, and a majority of 73% said that they do not think each USDT is 100% backed by $1.

If we combine these polls together, we find that the final results are:

- Yes: 41%

- No: 59%

Tether’s Future Looks Uncertain

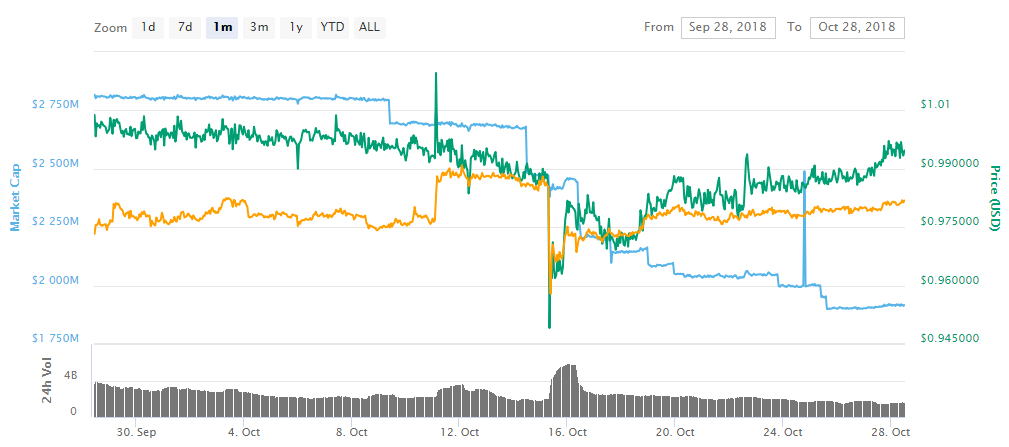

All this controversy surrounding Tether can easily be seen in their recent charts.

USDT’s coin market capitalization has steadily dropped from the beginning of the month, from $2.8 billion down to $1.9 billion at the time of writing.

The stablecoin has not been so stable lately, either. USDT has been selling at below its supposed $1.00 value for most of the month, dipping as low as $0.94 on October 15, 2018.

Tether’s popularity has been declining as a direct result of people distrusting the project’s non-transparent practices.

Moreover, lots of new stablecoins have been entering the market lately which is causing increased competition in the stablecoin scene.

Among these competitors include 2 stablecoins — the Paxos Standard (PAX) and the Gemini Dollar (GUSD) — that have been approved and regulated by the New York State Department of Financial Services, making them the first regulated cryptocurrencies to come to market.

One competitor to Tether is Circle’s USD Coin (USDC). Circle CEO Jeremy Allaire has stated that he believes the crypto market will start moving away from controversial Tether and quickly begin supporting more transparent stablecoins in the near future:

Market infrastructure like stablecoins will become the base layer that supports every financial application. It has to be legitimate, trustworthy, built on open standards. We are solving a lot of these fundamental problems that exist. That’s a huge difference from something like Tether, and we think the market will very quickly gravitate to that.

Tether certainly still takes the prize for being the most popular and highly used stablecoin out there by far.

But with all these new transparent — and some even regulated — competitors rising up, it could spell trouble for Tether’s future if they don’t prove to the public that they’re trustworthy soon.