A deep analysis of Bitcoin (BTC) addresses conducted by China’s state-run financial news publication, National Business Daily (NBD), reveals that about 0.7% of BTC addresses currently control 86.9% of the flagship cryptocurrency’s circulating supply.

Moreover, analysts used data from BTC.com to conclude that this tiny 0.7% of BTC addresses own roughly $62 billion worth of BTC. To put this in perspective, Bitcoin’s total market cap is just $70.5 billion.

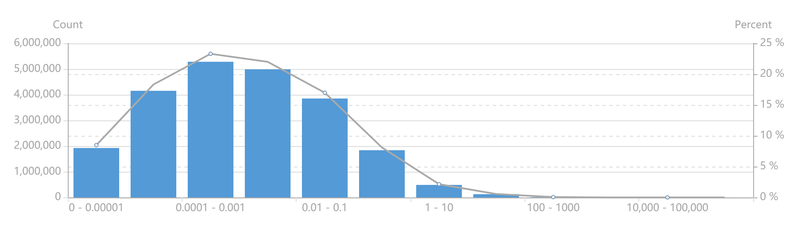

The analysis also showed that out of the 22.65 million addresses that hold at least some Bitcoin in them, 97.2% of these addresses have less than 1 BTC and only 0.7% have over 10 BTC in them.

According to further analysis from 8BTC, while 0.7% of addresses control $62 billion worth of Bitcoin, the other 97.2% with less than 1 BTC control just 4.6% of the cryptocurrency — that’s less than $4 billion.

Who Controls the 0.7% of BTC Addresses?

A minuscule number of BTC addresses could potentially induce monstrous effects on Bitcoin’s price as they own roughly 86.9% of the total circulating supply. Therefore, everybody wants to know who owns these addresses.

According to NBD’s study, the addresses with the most BTC belong to cryptocurrency exchanges like Binance, Bitfinex, and other major crypto exchanges.

The study also noted that the various large addresses may belong to more than one person or entity. After all, it only makes sense for large crypto exchanges to have multiple large BTC addresses if they’re holding funds for thousands of users.

While NBD’s analysis found that the major cryptocurrency exchanges control the largest BTC addresses, they don’t really know who the other large BTC addresses belong to.

The large addresses not controlled by exchanges are referred to as being controlled by “Bitcoin whales,” which are individuals or entities with significant amounts of Bitcoin.

Bitcoin Whales are Worrisome to Investors

The NDB report added that unknown large BTC addresses are likely to be controlled by Bitcoin whales, and this is very worrisome to investors looking to enter the market as they can influence it in a big way.

For instance, according to CryptoCompare data, if a Bitcoin whale sold 2,027 BTC worth $7.8 million, Bitcoin’s price would plummet 10% on Coinbase, the largest cryptocurrency exchange in North America.

To a Bitcoin whale, this amount of BTC would represent only a fraction of their holdings.

This is what scares many investors away from Bitcoin, and there has been much speculation that the price of Bitcoin is manipulated by whales in the top 0.7%.

At the beginning of September 2018, crypto enthusiasts keeping an eye out for large BTC transactions noticed a mysterious whale move over $100 million worth of Bitcoin to cryptocurrency exchanges. Shortly after, the price of Bitcoin dropped over $400 in just 90 minutes, presumably because of a large sell order.

Conclusion

NBD’s BTC address analysis is provides us with new insights and gives investors more perspective about the market. It also brings about many worries to investors and people who hold Bitcoin.

However, NBD’s report is not the first to bring up these centralization issues.

We recently reported on data by blockchain analytics firm Chainanalysis which showed that only 14% of all BTC addresses belong to private investors and that only 37% of BTC addresses are economically relevant.

The Chainanalysis report covered an array of other statistics surrounding BTC addresses, and is worth taking a look at if you found the analysis conducted by NBD interesting.

Will the distribution of Bitcoin between addresses improve in 2019, or will the 0.7% of BTC addresses only grow larger and more concentrated through time? Let us know what you think in the comment section below.