Out of the top 10 projects by market cap value, Ripple has seen the most sluggish performance over the past 90 days of trading. The cryptocurrency has barely managed to achieve a price increase of 1% over the stated period. In comparison, the rest of the competition in the top 10 have increased by over 50% over the same period, with some even increasing by over 100% such as Litecoin and EOS.

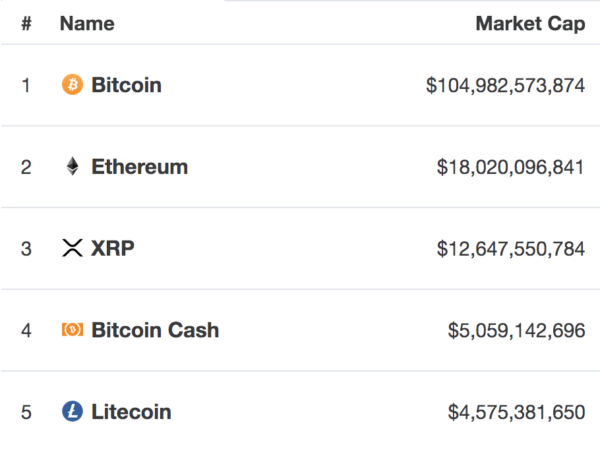

Ripple remains ranked in 3rd position, as it presently holds a $12.67 billion market cap value. It sits a comfortable $7 billion ahead of 4th place holder, Bitcoin Cash. However, it is still a solid $5 billion behind 2nd position Ethereum.

In this article, we will take a look at the potential for Ripple to reach the $0.34 level by the end of the week. Ripple has been rather sluggish over the recent period, and has even dropped by a total of 30% over the past 30 trading days. Furthermore, Ripple has also been consistently falling against Bitcoin over the course of 2019. In fact, Ripple has dropped over 45% from its yearly opening value against Bitcoin.

If we would like to see Ripple rise and hit our $0.34 target, we need to see XRP/BTC hold at 5,000 SATS and reverse. For Ripple to reach $0.34 by the end of the week, price action would need to increase by 9%. $0.34 has been chosen because this level would see Ripple break above the 100-day moving average level and above the recent sluggish sideways movement range.

Ripple Price Analysis

XRP/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Analysing XRP/USD above, we can’t really say too much about the market, which remains sluggish and very neutral. We can see that the cryptocurrency attempted to break above the 100-day moving average during the start of April 2019 but was unable to sustain itself above this level.

Toward the end of April 2019, we can see that Ripple also managed to find a level of support at the $0.2898 level, which should continue to provide a solid level of support moving forward.

What Is the Current Short-Term Trend?

The current short-term trend for Ripple is neutral. If the market was able to break above the $0.34 level, the condition would turn into a bullish trading condition.

Where Can We Go From Here?

If the buyers can keep the price for XRP/USD above the $0.31 level and push higher, we can expect immediate resistance above the market to be located at the $0.32 level, followed with more resistance at the short-term bearish .382 Fibonacci Retracement level (drawn in orange), priced at $0.3225.

If the buyers continue further higher, we can expect more resistance above to be located at the 100-day moving average level around a price of $0.33. If the bullish pressure continues above here, the next level of resistance is located at the short-term bearish .5 Fibonacci Retracement level (drawn in orange), priced at $0.3366.

If the bulls can break above here, they will be clear to tackle the $0.34 target level. Above $0.34, higher resistance is then located at $0.35, $0.36, and $0.37.

What If the Bears Regain Control?

Alternatively, if the sellers start to push the market lower and break beneath the $0.31 support level, we can expect further strong support to be located at $0.30. Beneath $0.30, further support is then expected at the $0.289 level, which is bolstered by a downside 1.272 Fibonacci Extension level. Beneath this, more support lies at $0.2811.

What Are the Technical Indicators Showing?

The RSI has been hovering around the 50 level over the past 2 weeks, which indicates the extreme indecision within the market. Neither the bulls nor the bears can make any headway and push the market in either direction. If we would like to hit the $0.34 target level, we would need the RSI to rise above the 50 level and continue to climb.

Conclusion

Ripple certainly has the potential to break above $0.34 by the end of the week and start a fresh bullish trading condition. However, this will largely depend on whether XRP/BTC can hold the support at 5,000 SATS.