The United States Securities and Exchange Commission on June 4 filed a lawsuit against Kik Interactive, the company behind the messaging app which launched an ICO that raised $100 million for its token KIN. The Canadian company raised $55 million from US investors, and they have been charged with selling an unregistered securities token, an official statement by the SEC states.

The statement alleges that Kik was performing poorly with its messaging application, and that the management predicted that it would run out of funds in 2017, whereupon they decided to launch an ICO to fund a new kind of venture. It went to on to cast doubt on some of the statements made by Kik,

The statement alleges that Kik was performing poorly with its messaging application, and that the management predicted that it would run out of funds in 2017, whereupon they decided to launch an ICO to fund a new kind of venture. It went to on to cast doubt on some of the statements made by Kik,

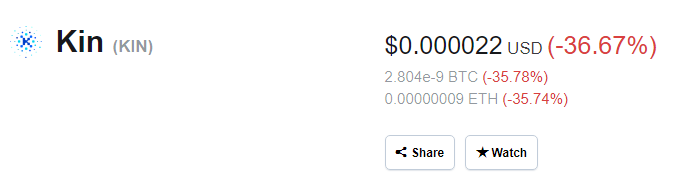

The complaint further alleges that Kik marketed the Kin tokens as an investment opportunity. Kik allegedly told investors that rising demand would drive up the value of Kin, and that Kik would undertake crucial work to spur that demand, including by incorporating the tokens into its messaging app, creating a new Kin transaction service, and building a system to reward other companies that adopt Kin. At the time Kik offered and sold the tokens, the SEC alleges these services and systems did not exist and there was nothing to purchase using Kin.

Steven Peikin, Co-Director of the SEC’s Division of Enforcement, said,

By selling $100 million in securities without registering the offers or sales, we allege that Kik deprived investors of information to which they were legally entitled, and prevented investors from making informed investment decisions. Companies do not face a binary choice between innovation and compliance with the federal securities laws.

Kik appears to have known that this was coming, as the company launched a crowdsourced campaign to raise $5 million to fight a case against the SEC, arguing that it was not a security.