As we near the end of Q1 2019, there are plenty of things to be encouraged about throughout the cryptocurrency market.

The bear market has been difficult, claiming more than a few casualties. The real story, however, has been the noteworthy progress made by many of the top projects in the industry.

Where past bear markets have seen much of the industry grind to a near standstill, the pace of development in this bear market has remained steady and even accelerated in some cases. That seems especially true with several of the leading Ethereum-based projects.

Just look at what’s changed during the past 15 months for Ethereum. In late 2017, the hottest story was the CryptoKitties game. Fun, yes. But far from revolutionary.

Now, the activity on Ethereum is both more interesting and more meaningful.

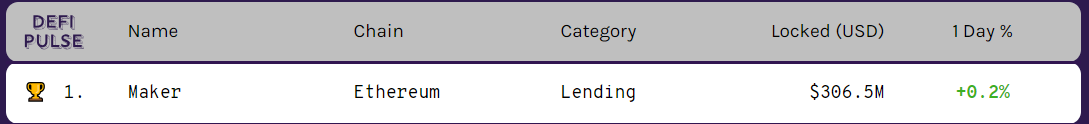

According to DeFi Pulse, more than $340 million worth of ETH is locked in Decentralized Finance (DeFi) apps alone. For perspective, that would cumulatively give Ethereum-based DeFi apps the 23rd largest market cap in all of crypto on their own. And that says nothing about what’s been happening with other leading Ethereum dapps outside of the DeFi space, many of which have been climbing the market cap rankings in the past year as well.

In this article, we’ll discuss 3 Ethereum projects that have been making waves in recent months, and why they’re worth keeping a close eye on in the rest of 2019. Let’s get started!

Top 3 Ethereum Tokens to Watch in 2019

Basic Attention Token (BAT)

In order for Basic Attention Token to have any chance at success, the first thing that had to happen was widespread adoption of Brave Browser as an alternative to incumbents such Chrome and Firefox.

So far, so good.

2019 started with the exciting news that there are now more than 5.5 million monthly active users on Brave, indicating an impressive growth of 450% during 2018. Then, in March, Brave passed another huge milestone, reaching 20 million downloads on Android.

Of course, not all of those active users are cryptocurrency enthusiasts. But that’s a big reason why Brave’s progress is so encouraging.

As one of the only browsers on the market that stores user data client-side rather than on their own servers, people who are tired of having their data mined and sold by giant tech companies have good reason to switch over to Brave regardless of what they know about cryptocurrencies.

Add to that Brave’s native ad and tracker blocking capabilities, plus a constantly improving UX, and it would be a surprise to see user growth stop accelerating anytime soon.

![]()

Indeed, things are going undeniably well for Brave lately — and BAT by association. Even the co-founder of Wikipedia, Larry Sanger, has made the switch to Brave and announced it publicly on his personal website.

As a long time Brave user myself, I’ve begun earnestly recommending the browser to friends and family over the past couple of months. That’s something I wasn’t doing 6 months to a year ago because it was still a bit too buggy and rough on the edges, but it’s certainly come a long way since then.

There’s a big elephant in the room that I haven’t mentioned yet, though. That is, for all of Brave’s success, what about the actual cryptocurrency tied to it: BAT?

The waters do get a bit murkier here. BAT’s success is highly dependent on the success of the BAT advertising model (explained here), in which advertisers pay users to opt-in to seeing targeted ads.

Phase 1 of the Brave Ads roadmap hasn’t yet been introduced, so it’s still hard to guess how it will be received.

With that said, the upcoming launch of Brave Ads is probably the biggest reason to watch BAT in 2019.

The Brave user base is large enough at this point that the novel advertising model actually has a fighting chance at success, so now it’s just a matter of watching (and using!) Brave in the months ahead to see how it all unfolds.

One thing is already undeniable, though. Brave Browser is one of the best working products to be delivered by any cryptocurrency project out there.

iExec (RLC)

As it currently sits outside the top 100 market cap, you may not have heard of this project before.

iExec is a French startup that’s building a decentralized marketplace for trading cloud computing resources. The name is short for “I Execute”, which describes the way that iExec empowers users to execute their computing tasks on the cloud at competitive speeds.

For the vast majority of people, cloud computing resources have never been necessary. But in the age of Big Data and artificial intelligence, you can rest assured that computing power is a resource that’s very much in demand.

As is the case with file storage, the cloud is being utilized at an increasing rate to meet the computing needs of individuals and big businesses alike. Buying, storing, and maintaining hardware is simply too costly in many situations, and the cloud is a more efficient alternative.

By cutting out the centralized middleman and replacing it with a peer-to-peer marketplace, iExec can make this cloud computing alternative even more efficient for buyers, while also providing new opportunities for businesses to profit from their idle computing resources.

What makes iExec really intriguing, however, is that it has a few partners that you’ve surely heard of before: Intel and Alibaba.

In a blog post on March 12, iExec team member Blair Maclennan describes the collaboration between these three companies:

On this [iExec blockchain-based] Marketplace, Alibaba Cloud now provides Encrypted Computing, powered by Intel® SGX, to support the iExec Trusted Execution Environment (TEE) solution. This iExec TEE solution provides end-to-end protection of data for blockchain-based computing.

In the blog post, Maclennan goes on to describe how this solution supported by Alibaba and Intel allows a hospital to ‘rent’ medical data to researchers studying Alzheimer’s Disease while ensuring that no third parties — not even the researchers themselves — can inspect or copy any of the data used.

There’s no telling how many doors iExec’s solution might open in the world of data mining and AI, but it’s certainly worth keeping a close eye on the project in 2019 to see where it goes.

Maker (MKR)

As a whole, stablecoins are about as boring as cryptocurrencies get. Most of them are nothing more than tokenized fiat being stored in traditional bank accounts — necessary bridges between crypto and the legacy system, but not innovative from a technical perspective at all.

As a whole, stablecoins are about as boring as cryptocurrencies get. Most of them are nothing more than tokenized fiat being stored in traditional bank accounts — necessary bridges between crypto and the legacy system, but not innovative from a technical perspective at all.

Maker (MKR) and Dai (DAI) are the one huge exception to that.

Dai’s value is pegged 1:1 with the U.S. Dollar. Unlike other stablecoins, though, Dai is not simply backed by dollars sitting in banks, but rather it’s backed by a non-stable cryptocurrency: Ether.

In short, Dai achieves its stability thanks to collateralized debt positions (CDPs), which essentially means that every dollar’s worth of Dai has more than a dollar’s worth of ETH locked up as collateral. (This is a big oversimplification. For more information, check out the Dai whitepaper.)

The exact amount that needs to be locked up is determined by the Liquidation Ratio, which is currently set at 150%. In other words, somebody who wants to get $100 worth of DAI would need to have more than $150 worth of ETH locked up to do so.

If the amount that’s locked up dips below the 150% threshold, the CDP is automatically liquidated, meaning that the the locked up ETH will be sold as necessary to cover the debt position plus a liquidation fee, with the remainder being returned to the CDP owner.

This is the milder smart contract equivalent to your bank repossessing your house if you can’t keep up with your mortgage payments.

Thus far, the stability mechanisms have proven themselves resilient through a >90% drop in ETH’s value during the bear market. And as trust in Dai’s stability has increased, so too has the stablecoin’s utilization.

With a market cap fast approaching $100 million, that means that the amount of ETH locked up is growing quickly too.

In fact, that amount currently exceeds $300 million, according to DeFi Pulse.

So, that’s all the background.

Now it’s time to explain why it matters. There are actually 3 reasons.

First is that Dai’s success and increasing utilization is very good for the value of MKR.

The reason for that is that each CDP comes with a yearly maintenance fee, and that fee is used to buy MKR, which is then burned (i.e. permanently removed from the supply). Going back to elementary economics, we know that if demand stays constant while supply is decreasing, price increases.

If you believe there will be greater demand for Dai in the future, buying some MKR is your chance to get skin in the game.

The second reason that Dai’s increasing utilization matters is that it’s also good for the value of ETH.

Each new CDP that’s added to the books removes more ETH from the circulating supply, meaning that less ETH is available for use throughout the rest of the Ethereum ecosystem. Again, the law of supply and demand says that what’s good for Dai is good for ETH as well.

Finally, there’s one last reason to keep an eye on Maker in 2019 that’s worth mentioning. That is, the launch of multi-collateral CDPs.

At some point this year, an additional ERC-20 token or tokens will be made available for use as collateral in exchange for Dai. An upgrade to multi-collateral Dai has been the plan from the very beginning for Maker, and it will be a big milestone to see it realized in the months ahead.