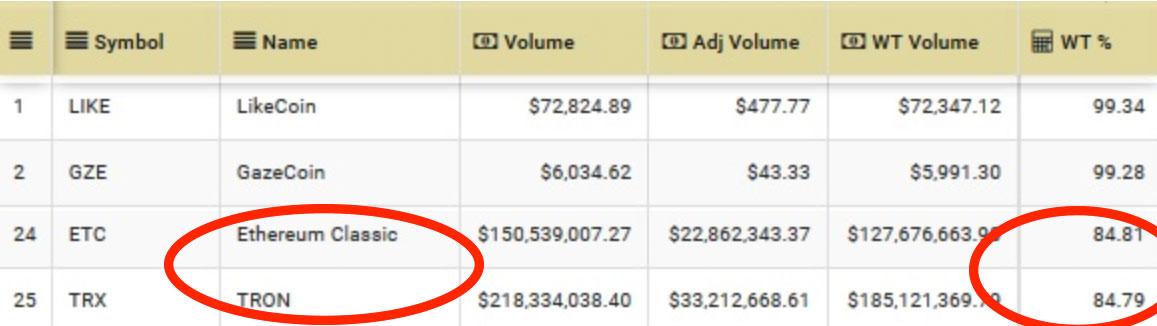

A recent report from the Blockchain Transparency Institute (BTI) has suggested that over 84% of the volume traded within the Tron and Ethereum Classic markets are completely fabricated. The reported trading volumes surrounding these 2 coins are a result of wash trading tactics that are designed to make trade volume seem much larger than it actually is.

85% Fake Volume in Tron and Ethereum Classic

In their report, the BTI alluded to the fact that out of the top 25 cryptocurrency projects, Tron and Ethereum Classic are the projects that present the highest fake volume.

According to the report, Ethereum Classic has a reported trading volume of over $150 million. However, only $22.8 million of this trading volume is real, meaning $127.6 million is wash trading. Similarly, Tron has a reported volume of $218 million, with only $33.2 million of this being real trading volume.

Image Source: Bti.live

It is unclear as to how wash trading may affect these projects. However, we can assume that traders will not take kindly to finding out that the majority trade volume of these 2 projects is fake, and may reassess their current positions.

A New Methodology

The BTI has been improving their methodology for identifying wash trading, which has already proven useful to exchanges. The BTI’s invaluable data is already being used by top exchanges to shut down wash trading accounts.

The BTI provide reports to exchanges, at a cost, which include data on trade execution times and sizes. The relevant exchange’s compliance team can then match this trade data to accounts on their exchanges to help combat the fake volume. In the recent report, the BTI have also stated that their methodology has proven to be much more accurate than traditional algorithms used by exchanges to identify wash trading.

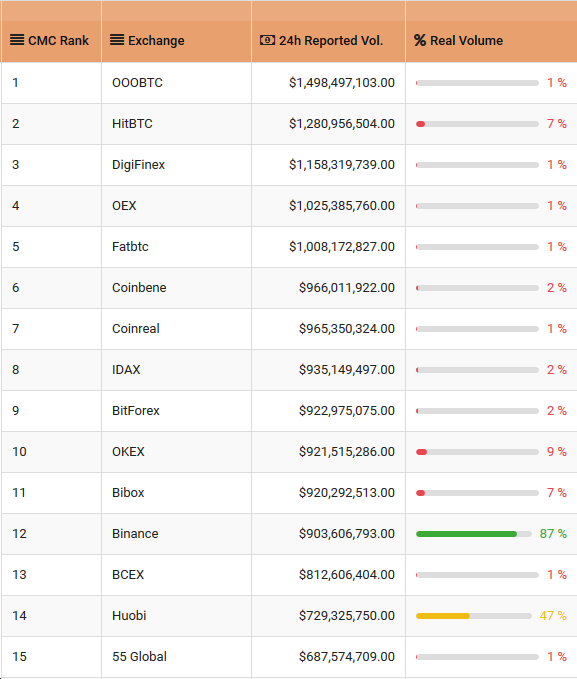

The report suggested that over 17 of the top 25 exchanges on CoinMarketCap have been found to be over 99% fake in terms of their daily trade volume.

Image Source: Bti.live

According to their data, some of the cleanest exchanges currently are Coinbase, Upbit, Bittrex, Poloniex, Liquid, Kraken, Gate, Bitso, and Lykke.

What Is Wash Trading?

Wash trading is a tactic used by exchanges and cryptocurrency projects to make it look like their token or exchange has a large amount of trading volume. For exchanges, this would signal to traders that their exchange is the best place to trade as the majority of the volume flows through them. For cryptocurrency projects, a high daily trading volume signals that there is a large amount of interest in that particular coin, which is a good sign for other traders/investors to get on board.

It is important to note that wash trading, in traditional financial markets, is highly illegal, as it provides an inaccurate look at the quality and popularity of an asset or exchange. Since the crypto market is still having growing pains with regard to regulation, it is in the process of best figuring out how to locate and eradicate wash trading. To help with this, the work done by BTI is extremely important within the industry, as wash trading greatly skews the statistics and harms the crypto economy as a whole.

What do you think about wash trading? How do you this the best route is to remove wash trading from the crypto industry? Let us know in the comments!