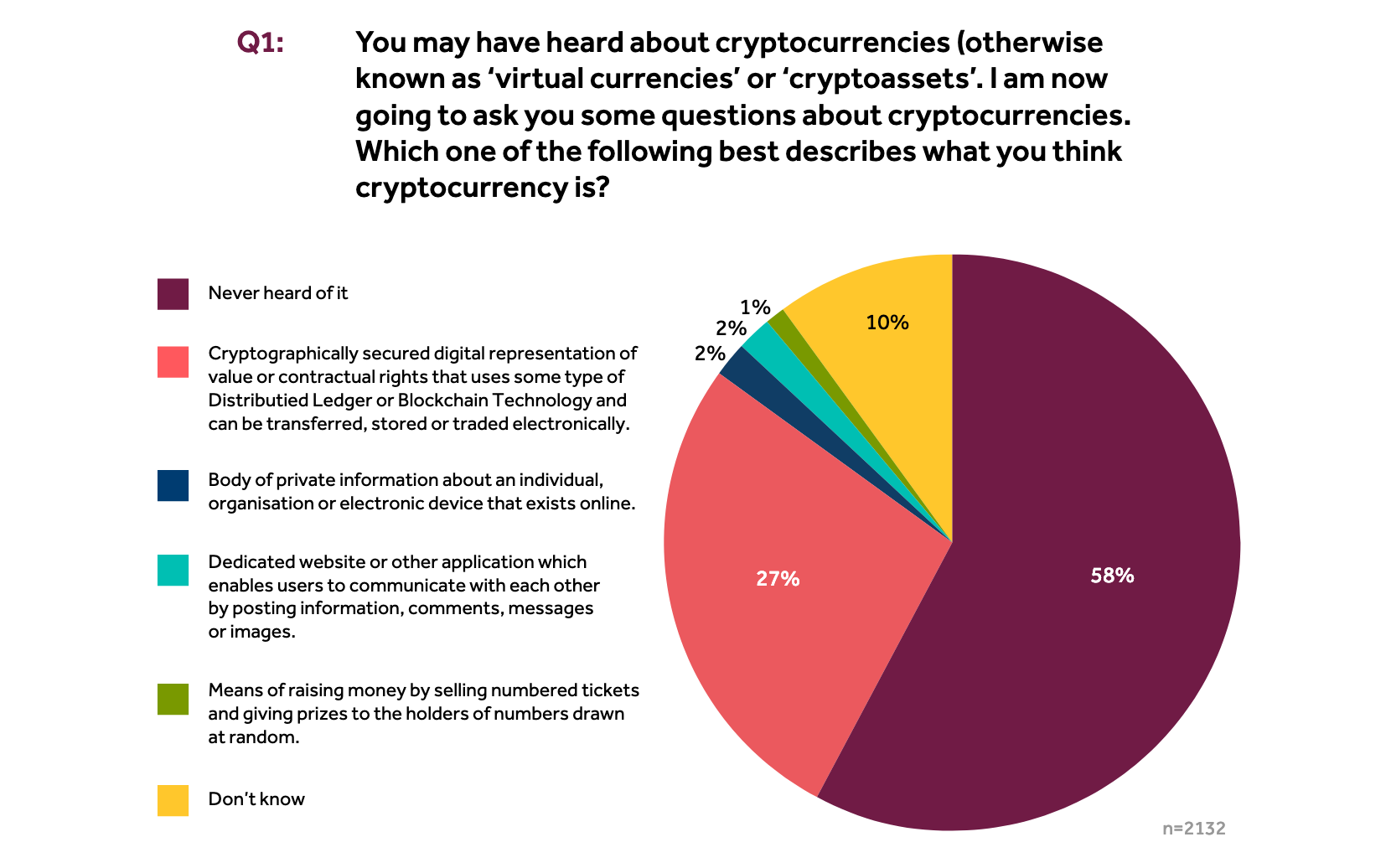

A survey conducted by the United Kingdom’s Financial Conduct Authority (FCA) has shown some interesting results — 73% of UK consumers are unaware of what cryptocurrencies are.

Titled “Cryptoassets: Ownership and attitudes in the UK”, the report was conducted with the objectives of “[gathering] gather more information about the cryptoassets market in the UK, to understand the behaviours and motivations among consumers purchasing cryptoassets and to identify areas of potential harm.”

The agency conducting the survey, Kantar TNS, questioned over 2,100 individuals from Britain and Northern Ireland face-to-face.

The most notable finding is that nearly three quarters of individuals surveyed were unaware of what cryptocurrencies are.

This is despite the fact that the crypto market and Bitcoin have grown in public exposure in recent times, especially since the boom of 2017 and the increasing coverage of the space by mainstream media outlets like Forbes, Bloomberg and CNBC.

Another interesting result is the fact that only 7% of respondents would consider investing in digital assets in the future. That said, 8% of those who have invested in it have conducted “deep research,” while 50% did general research on the internet before buying crypto.

One bit of information that could be seen as a positive view on cryptocurrencies is that 40% of those who have invested in crypto would hold it for 3 years or longer, though half of this group is already selling it.

Those who were aware of cryptocurrencies were mostly men aged between 20 to 44, which is a trend in keeping with other such surveys that have been conducted (though women appear to be better at predictions.) Furthermore, it is also those who live in the more urban areas that know of cryptocurrencies.

Bitcoin (BTC) remains by far the most well-known and most-bought cryptocurrency, with over half of those who have invested in crypto purchasing it. Other major coins like Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH) are still some distance behind.

Furthermore, not many respondents regret buying cryptocurrencies and it was a risk that they were willing to take.

However, those who haven’t invested don’t do so because they believe that the market is too risky. A possible inference from this is that individuals seem to be divided into two halves — one strongly believing in digital assets and another that does not.