While new projects continue to be launched and we move closer to scalability solutions for Bitcoin and Ethereum, there’s one important statistic that’s bearish enough to outweigh all the positives. Unfortunately, there are still very few signs of real-world adoption for cryptocurrencies.

The number of merchants accepting Bitcoin isn’t really growing, hardly anybody is using the dapps built on Ethereum, nobody has built anything interesting on EOS yet, and global interest in cryptocurrencies is dwindling along with the total market cap.

But there’s no use being discouraged or dwelling on the shrinking market caps and shrinking portfolios. You may not hear about them much, but there are actually plenty of up and coming cryptocurrencies out there solving real problems and achieving real growth.

In this article, we’ll tell you about some of the projects that are keeping us incredibly optimistic about the future of the blockchain industry. These aren’t projects about fancy technology that sound great on paper but have no application in real life. No, these cryptocurrencies are building blockchain solutions that can actively improve people’s lives around the world.

Hopefully reading about under-the-radar projects and the problems they are addressing will encourage and inspire you to learn more. Better yet, maybe you’ll actually count yourself a new user in one or more of these growing project communities.

Disclaimer: This article is not intended to be investment advice, but rather is meant to introduce you to some lesser-known cryptocurrency projects with real-world use cases and room for growth. As always, you should do your own research thoroughly before investing.

5 Up and Coming Cryptocurrencies to Watch

SureRemit ($RMT)

If you were fortunate enough to be born in a developed country with decent economic circumstances, you probably don’t know much about remittance payments.

In fact, I’d wager that I’ll be saving quite a few people the trouble of a Google search by including the definition (via Investopedia) here:

A remittance is the funds an expatriate sends to his or her country of origin via wire, mail, or online transfer. These peer-to-peer transfers of funds across borders are economically significant for many of the countries that receive them.

In other words, remittance payments are typically international transfers between family members where one or more of the family members has left their country of origin for better economic opportunities elsewhere. For many children and elderly people in poor countries, remittance payments are a means of survival.

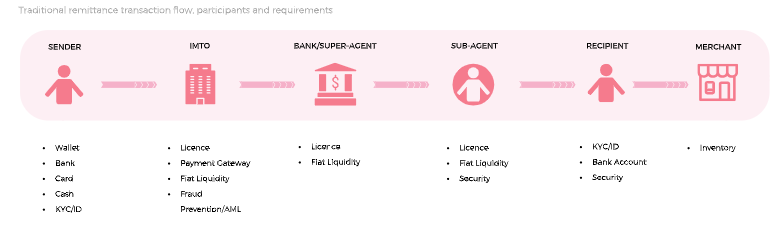

Now, as much as I like Investopedia, their definition isn’t the best here. You see, calling modern-day remittance payments peer-to-peer is very inaccurate. The actual payment process looks something more like the figure below, from the SureRemit whitepaper.

With all those middlemen involved in the process, it’s no surprise that traditional remittance payments are both extremely costly and slow. It’s common for the cost of sending a remittance to be 10% or more of the total value, while the time taken to complete the transactions ranges from 24-72 hours.

That’s not to mention the fact that, once funds have been sent, both the sender and the intended recipient are left in the dark about what’s happening in between, a stressful time for many who have valid concerns about security or fraud.

So we’ve got exploitative and inefficient middlemen, lack of security, and lack of transparency in a global marketplace. Put those things together, and what we’ve found is a market that’s ripe for disruption by blockchain technology.

Enter SureRemit, the solution to the problems that have long plagued the remittance payment market.

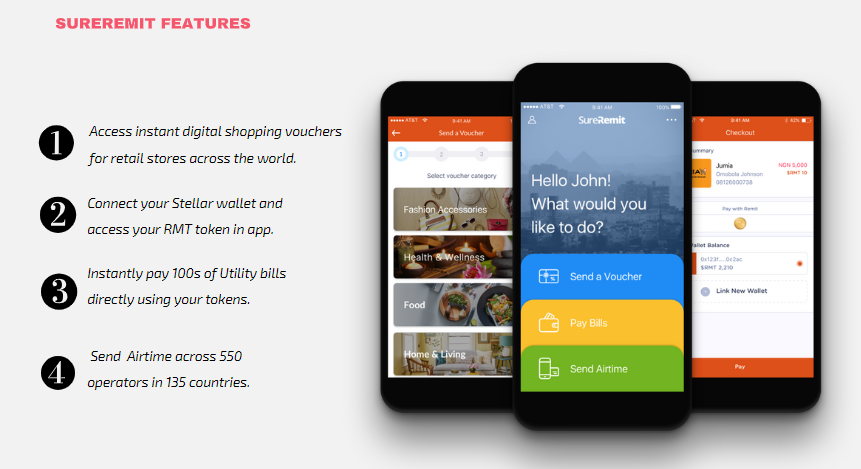

SureRemit allows users to bypass excessive remittance fees involved in sending transfers through banks or traditional international money transfer services, paying 0-2% rather than 7-12%. On top of that, it gives senders more control over how the money they’ve earned is being spent back home.

Most of all, SureRemit provides peace of mind by allowing payments to be processed in mere seconds via a mobile app (available for iOS and Android) that allows recipients to receive the transfer via SMS or email, eliminating inefficiency, high cost, and potential fraud in the process.

Key to all of this is the fact that SureRemit isn’t trying to be a blockchain-based money transfer service.

Instead, the project capitalizes on the fact that an estimated 60% of the value transferred via remittances is used for consumptive purposes, including food, clothing, utility bills, education, and health, all of which can be paid for via mobile vouchers rather than cash so long as there are merchants willing to accept the vouchers.

That leaves the question, why will merchants accept vouchers in the first place?

The answer — at least for merchants in developing countries where remittances are common — is that accepting these vouchers enables them to boost sales and customer acquisition without needing to do any marketing. They have lots of upside with next to zero downside, so it’s a no brainer for most.

Moreover, merchants are still being paid in fiat, so implementing local blockchain infrastructure for converting cryptocurrency into fiat isn’t a concern.

So far this has proven to be an effective incentive, as SureRemit has already built a global network of more than 690 merchants in Africa and the Middle East. With expansion efforts underway, that number is sure to grow quickly in the coming months, and may even soon include merchants in other focus markets where remittances are common, such as Asia and Latin America.

Meanwhile, awareness about SureRemit should be growing fast alongside the merchant network, as marketing and bounty programs are getting underway.

As an up-and-coming project in the $600 billion remittance payment market, SureRemit is worth a look from investors. More importantly, as a blockchain project with a real-world use case that can out-compete existing service providers on cost, efficiency, and trust, SureRemit is worth spreading the word about.

Scorum ($SCR)

In the same vein as Steemit and Golos, Scorum is a blockchain-based media platform that rewards active users and creators of quality content with the platform’s native currency, in this case SCR tokens.

What makes Scorum different from its blockchain competitors is that it’s focused on a specific niche: sports.

There are 4 components of Scorum’s site:

- Sports blogging platform

- Commission-free betting platform

- Fantasy sports platform

- Statistics center

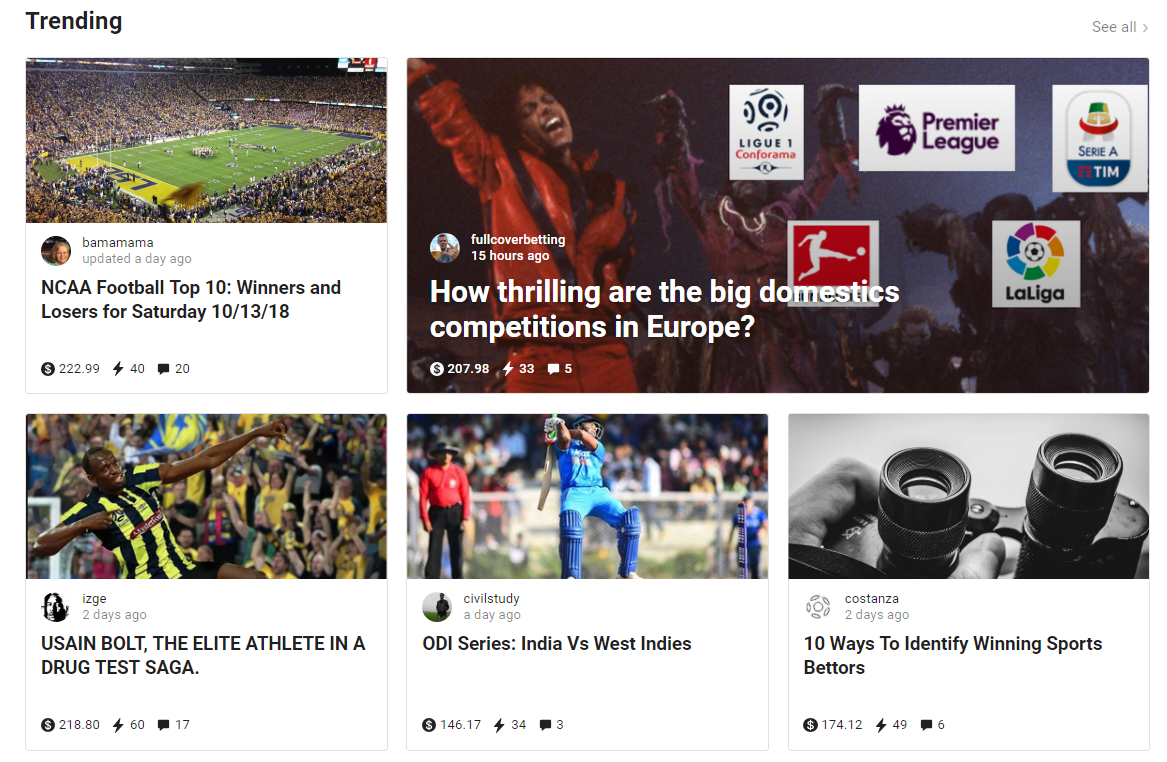

The sports blogging platform is probably the most exciting part of the project right now, as it already has over 30,000 users and 200,000 monthly visits to browse and read articles. Considering that Scorum’s open crowdsale was held from January to February 2018, that’s some impressive growth in a short time period.

On top of that, Scorum is already the 13th most active blockchain in the entire ecosystem according to independent analysis by Block’tivity. That’s all the more impressive when you factor in the fact that Scorum has by far the smallest market cap (just under $7 million as of writing) of any cryptocurrency on the list.

And finally, to solidify Scorum’s case as an up-and-coming cryptocurrency even further, it’s also worth pointing out that some of the top-trending posts on Scorum are already earning upwards of $200.

This provides some early evidence that the open model can attract talented writers as well as readers who are willing to contribute for quality content.

Sports journalism is a tough industry to break into, as there is no shortage of sports fanatics out there who would love to make their biggest passion and their profession one and the same. Rather than starting out with a WordPress blog that gets zero traffic or a YouTube channel with zero subscribers, those bloggers can now get started on a platform with an established and rapidly growing user base that gives them the chance to monetize their content right away.

It’s almost as if ESPN or Yahoo Sports are holding an open competition to find who is actually worthy of a job in the industry. But who knows, maybe this permissionless model that incentivizes content creation and allows users to to determine what content is the best will eventually grow far bigger than ESPN or Yahoo Sports ever could. Crazier things happen in sports all the time.

Looking beyond the sports blogging platform, Scorum’s 3 other use cases also present plenty of promise.

The commission-free betting platform has some unique advantages over other sports gambling businesses such as FanDuel and DraftKings. One is that it can be truly international due to cryptocurrencies being borderless, giving Scorum the chance to reach a far bigger market than just the gamble-happy Americans.

Another is that Scorum’s open-source platform enables independent developers and groups to build their own custom solutions on top of Scorum, making it far more adaptable than the traditional model.

Admittedly, the fantasy sports platform still has a long way to come before it can gain any considerable adoption. But given that Scorum has zero transaction fees while providing a trustless and transparent means of storing money and distributing it to top performers, they could well break into the $7 billion per year fantasy sports industry within a couple of years if they develop this part of the platform well.

The stats center is likewise in its very early stages. The hope is that it will one day go beyond the typical stats you see on sports websites to provide unique analytics tools that Scorum’s content creators can use to create interactive visuals and effectively take their articles to the next level.

All things considered, Scorum stands out as a project that’s achieving notable real-world adoption for cryptocurrencies during the bear market. Its current market cap is larger than the $5.63 raised in the early 2018 crowdsale, something very few other projects can say. If you’re a sports fan and cryptocurrency enthusiast in search of a real-world use case for cryptocurrencies, look no further than Scorum.

Ravencoin ($RVN)

Ravencoin has the largest market cap of any project on this list, but it’s still very much an up-and-coming cryptocurrency with immense potential for the future. The project was launched on January 3, 2018, and the manner in which it was launched has a lot to do with why it belongs in this article.

This was a clear-cut case of addition by subtraction. You see, Ravencoin managed to separate itself from the pack by avoiding many of the common pitfalls that other projects fall into. There wasn’t an ICO for RVN, nor was there a pre-mine, both of which helped prevent inequitable balance of power and unethical personal enrichment for the coin’s creators – things which are highly likely to occur with the majority of other projects.

On top of that, Ravencoin operates without a CEO so that power is distributed among the project’s developers, just as it is for Bitcoin.

As for what Ravencoin actually is, here are some of the main functions and features of the project:

- Enables users to issue and transfer assets on a decentralized and secure blockchain

- Provides a secure messaging channel where users can communicate with each other

- Decentralizes project governance by allowing users to vote on important protocol decisions

- Pays dividends to users

- Has ASIC resistance through a unique mining algorithm, enabling truly democratized mining

- Is substantially more energy efficient than Bitcoin

Where Bitcoin aims to be a global currency, Ravencoin aims to be a protocol for global asset transfers.

As stated in the introduction of the project whitepaper:

In an age where people can move significant amounts of wealth instantly using Bitcoin, global consumers will likely demand the same efficiency for their securities and similar asset holdings.

Indeed, Ravencoin builds on what Bitcoin does well (e.g. censorship resistance and privacy) and improves on some of its weaker points at the same time. Considering its superior energy efficiency, more transparent and democratic mining, and 1-minute block reward times as opposed to Bitcoin’s 10, there is a lot to like about this project.

In fact, Overstock CEO and early adopter of Bitcoin Patrick Byrne has invested heavily in the development of Ravencoin by way of Medici Ventures, contributing millions of dollars to support its development teams.

For more information about how Ravencoin achieves its ASIC resistance, how to issue and transfer tokens on the Ravencoin blockchain, how dividends are paid with RVN, and a whole lot more, we highly suggest you give the Ravencoin whitepaper (linked above) a read. It’s one of the best-written and most concise whitepapers you’ll ever come across.

Oh, and Ravencoin has had some very positive price action lately too. All the more reason to check it out!

GET Protocol ($GET)

The cryptocurrency industry is built largely on the idea of replacing “trusted” third parties with trustless and transparent blockchains.

Transaction intermediaries are a costly and often inadequate solution that allows strangers to exchange value without knowing and trusting each other. The hope for the blockchain revolution is that trustlessness can be delivered affordably and at scale, so that all sorts of different transactions become more efficient and less risky.

GET Protocol is such a stellar example of a straightforward use case for blockchain technology that I’m kicking myself for not thinking of it myself. Here’s the idea behind GET in a nutshell: facilitate trustless ticketing for concerts, sporting events, festivals, conferences, and other such live events, and do it on a global scale.

Ticket fraud and dishonest reselling are huge problems. There are no doubt tens of thousands of people out there who can tell you about the time they bought tickets from a reseller and never received them, or showed up at the ticket gate only to learn their tickets were invalid.

Entire businesses such as SeatGeek, StubHub, Ticketmaster, Ticketfly, and others exist predominantly because they make ticket exchanges more trustworthy. But their solutions come at a cost, which is both factored into ticket prices and paid directly through service fees.

Probably the most frustrating part of it all is just how common it is for people to purchase tickets for events that they never intend to go to, and then resell them at higher prices on secondary markets. This happens for just about every high-price ticket item in the world, making it more expensive for real fans everywhere to attend these events.

GET Protocol can solve this problem once and for all, and eliminate the need for those costly trusted third parties in the process. The solution is a smart ticketing system that’s made secure and transparent with a blockchain protocol.

Tickets issued through GET cannot be duplicated thanks to a self-updating, rotating QR code. The tickets are easily traceable, giving event managers complete control over both the primary and secondary ticket markets, eliminating the problems of ticket fraud and predatory scalpers with massive upcharges.

Best of all, the GET ticketing process is as simple and easy for users as any other ticketing app, meaning that no tech savviness or blockchain awareness whatsoever are required. That’s rare for most blockchain projects today, and it’s very good for adoption of the GET platform.

So far, though, I’ve only told you about the theory behind GET. In order to qualify as an up-and-coming cryptocurrency, there needs to be some proof that the project is practical and being used in the real world. Fortunately, GET has that too.

The first commercial company to implement the GET Protocol is a Netherlands-based ticketing service called GUTS Tickets. As of mid-October 2018, GUTS has used the GET Protocol to sell over 121,000 tickets to more than 57,000 different customers. That’s 57,000 people who have benefited from the existence of blockchain technology.

In the future, the GET Protocol will be made open-source, and an SDK (software development kit) will be released for easy frontend implementation. By Q2 2019, GET and GUTS will be ready for international expansion, bringing trustless ticketing to the masses.

For more information about GET and where they are headed, you can check out their project roadmap.

Metal ($MTL)

The fifth and final up-and-coming cryptocurrency to make this list is Metal. Now, if you’ve been around crypto for a while, you might be wondering how a coin that once had a Top 50 market cap qualifies as up and coming?

To address that question, I’d like to make 2 points. First, the values of all cryptocurrencies are built predominantly on speculation at this point, so market cap is not an accurate indication of a project’s real worth so much as it’s an indication that a project has good marketing. Second, a couple of much better indicators of a project’s worth than market cap are its engineering development and user-base growth.

With that being said, what’s changed about Metal that makes it a significantly better project now than it was as a Top 50 market cap back in 2017? Well, first and foremost, it has transformed from vaporware into a real solution with the launch of the Metal Pay App in September 2018.

Metal Pay is a US-based competitor for Venmo and the Cash App, services which enable free and instantaneous money transfers between friends and family. What sets Metal Pay apart is that its users actually get paid with MTL every time they transfer money through the app. That’s about as strong of an incentive to drive user adoption as you can get!

As we move closer to becoming a cashless society, these types of services are replacing the functions of cash and checks for millennials across America and the world, essentially allowing everybody to make and accept debit card transactions from one another. Even with growing concerns about the negative repercussions of going fully cashless, it’s clear that this trend isn’t going to reverse anytime soon.

Indeed, China can offer the rest of the world a glimpse into what the future will look like if we continue to replace cash with mobile transfers. Their mobile payment apps – WeChat Pay (600 million monthly active users) and AliPay (100 million daily active users) – are used not just to transfer between friends and family, but also to pay bills and in retail transactions.

In fact, credit cards have become almost impossible to use in most of the country, with retailers unwilling to pay monthly fees to support them when just about all Chinese citizens in urban areas use WeChat.

Time will tell if Western mobile payment apps can ever reach the scale of the Chinese ones, but it seems like a decent probability that they will. And in the event that they do, having cryptocurrencies integrated into those apps for easy use could make all the difference in driving mainstream adoption.

With its official app launch just over a month ago, Metal still has a long way to go (and to make a dent in the mobile transfer market). But the foundation is finally in place, so now it’s just a matter of ironing out the kinks in the app and spreading awareness about it.

Ultimately, I’m optimistic about the future of Metal and Metal Pay for the same reason that I’m optimistic about Basic Attention Token and Brave browser. Both Metal Pay and Brave can gain substantial user adoption simply by being superior alternatives to existing centralized solutions, regardless of their association with cryptocurrencies.

You can download Metal Pay today on the Apple App Store. And hold tight if you’re an Android user, the Android version is coming soon!

To learn more about Metal and keep up to date on new launches, visit the Metal website.

The Future of Cryptocurrencies Is Brighter Than Ever

It’s been a really rough year in the cryptocurrency space, and crypto-skeptics seem to getting stronger and spreading more FUD with each day that the bear market drags on. The reality, though, is that there has never been more reason to feel encouraged about the future of this industry than there is right now.

For example, let’s take famous economist Nouriel and his seemingly endless list of criticisms for cryptocurrencies in the past couple of weeks.

To be honest, he makes some good points (and some ridiculous ones, too). But his main conclusion that the legacy financial system is superior to the one that is being built with supposedly “useless” blockchain technology now is about as short-sighted as it gets, which I hope this article shows.

Will the legacy financial system ever make international transfers fast and free? Will it ever enable fairer models for producing and monetizing online content? Will it provide transparency and trustlessness for online commerce at the protocol level?

We can go on and on, but there’s no point. The legacy financial system won’t do a single one of those things until the day when the sun rises in the west and swarms of pigs fly across the horizon.

On the other hand, the possibilities for programmable money are practically limitless, and we have only just begun to realize them.

We’ll certainly never convince Nouriel of the efficacy of blockchain technology with theoretical arguments. The only way to win that argument is to replace speculation with actual user adoption, and lots of it. It’s up-and-coming blockchain projects like SureRemit, Scorum, Ravencoin, GET Protocol, and MetalPay that can win over millions of users and change the world for the better.

Download the Brave Browser.