Chris Roper

Chris Roper

Communications Manager at Constant

Venezuela is in chaos.

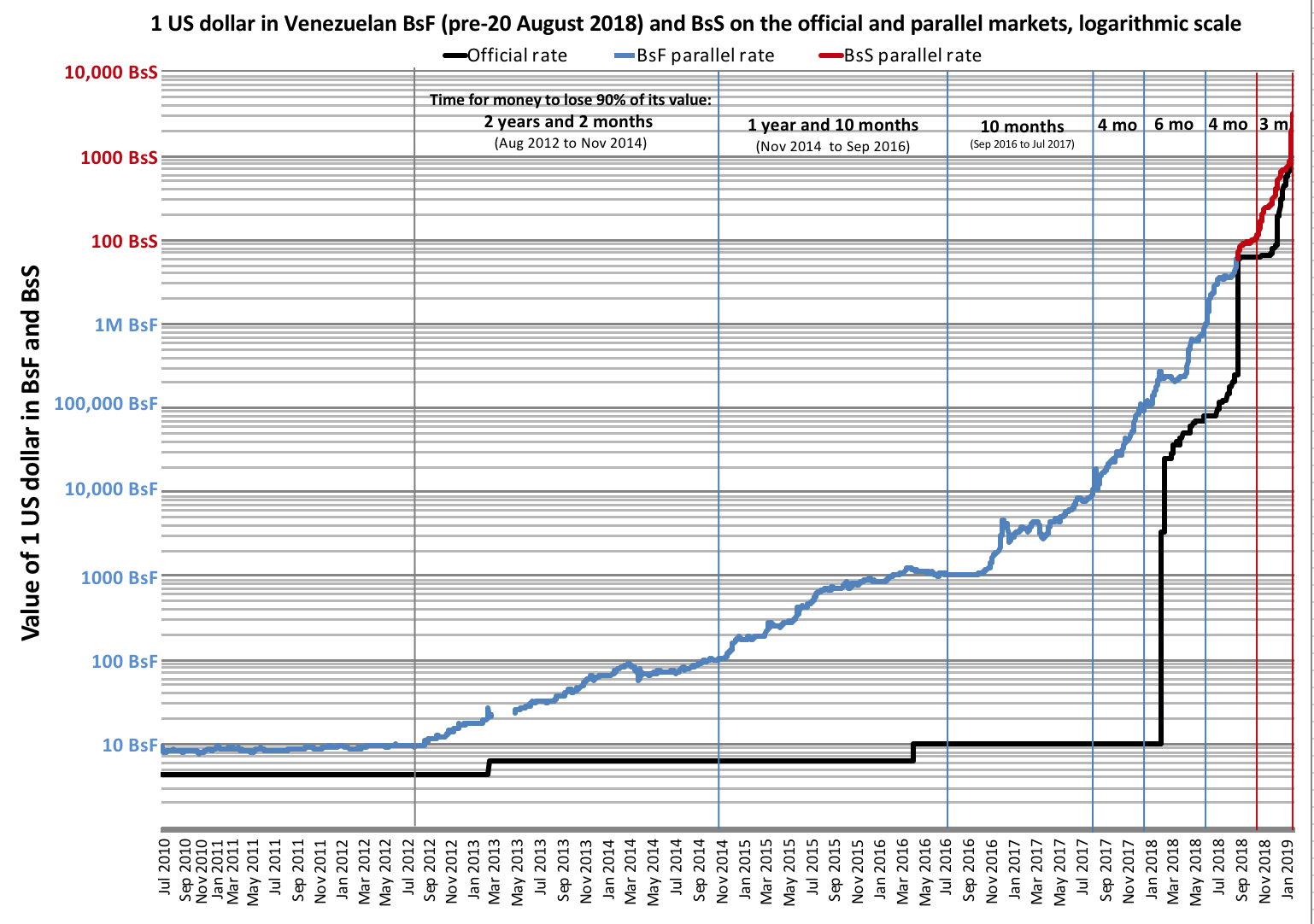

A decade of economic mismanagement has left the formerly prosperous nation starving, lacking basic necessities like food and medicine. As hyperinflation skyrockets to nearly 3 million percent, people are turning to cryptocurrency to stabilize their money.

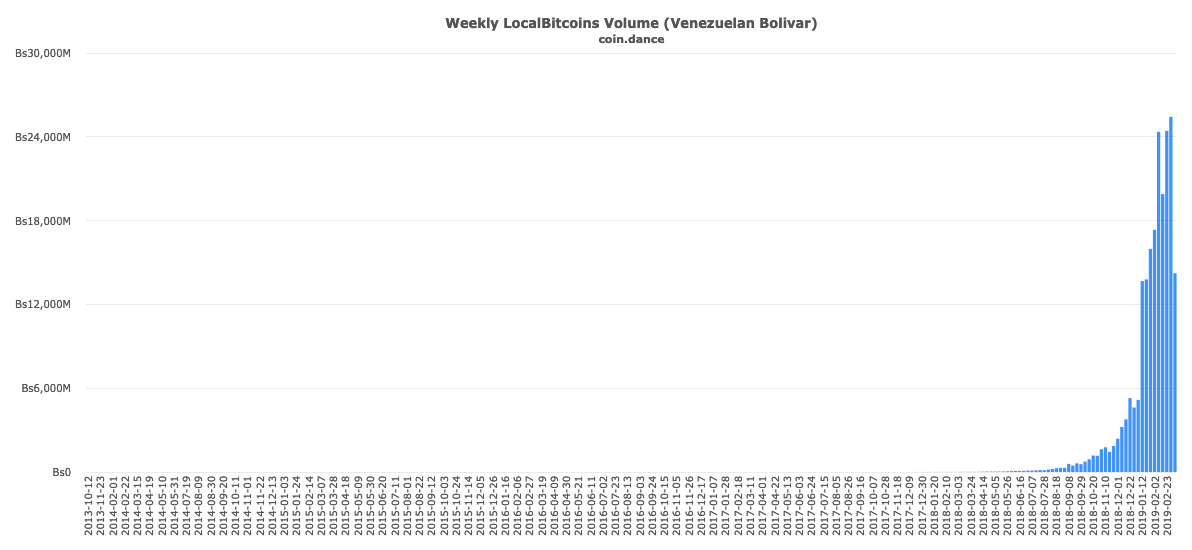

Venezuela is currently the second largest Bitcoin trader by volume, and many claim Bitcoin’s success as proof of a superior economic system.

Bitcoin trading volume in Venezuela has exploded in the last two years (Source)

Bitcoin trading volume in Venezuela has exploded in the last two years (Source)

But while Bitcoin has proven a lifeline for some Venezuelans, the U.S. Dollar is the currency of choice for those who can get it.

Many own USD bank accounts, and for those who don’t, a thriving black market is ready to exploit their need for a stable yet familiar currency. With such high demand for the world’s most stable fiat, the push to transform Venezuela into a Bitcoin-driven economy might be misguided.

However, a digital asset backed by the USD could be the bridging currency Venezuelans need.

While it’s generally easy to open a U.S. bank account, and, arguably, easier than learning Bitcoin, owning USD is illegal.

Venezuelans can, however, buy USD-backed digital assets and store them in a wallet. This would secure the value of their income in the long term, provide an efficient conversion gateway between USD and Bolivar, and make it easier to transfer USD into the country.

Throwing the Baby Out With the Bathwater?

Venezuelans need stability, but that doesn’t mean replacing the fiat system with an entirely digital one.

For one, not every Venezuelan understands what Bitcoin is nor has the means to obtain it. There’s a lack of understanding, and crucially, trust.

“A lot of people here lost their savings on Bitcoin,” said Carlos, a Venezuelan engineer. “Also, Bitcoin is still quite new for most people – not everyone knows how it works.”

Despite some retailers accepting Bitcoin in Caracas, the majority of Venezuelan transactions are still done in fiat.

So is the Venezuelan Bitcoin bonanza all hype?

Fortune asked Argentinian economist Rafael Mathus Ruiz whether Bitcoin could save Venezuela’s beleaguered economy:

I’d say it’s tech bro bullshit and a lame attempt to try to promote Bitcoin. Ultimately, people need hard currency to buy groceries. So unless you tell me there’s a way for people to buy groceries with Bitcoins, I can’t see how it would work.

Those wanting a Bitcoin-driven economy are swimming treacherous waters.

The government’s tolerance for Bitcoin is mercurial at best. Trading is generally condoned, but the few daring individuals who mine Bitcoin risk extortion or worse. Venezuela’s electricity is among the cheapest in the world, so the rewards offset the cost of mining equipment (bought on the black market), but not the repercussions of being caught.

Despite the crackdown, rumors of state mining are rife, and if correct, what is it funding?

Ask Venezuelans about cryptocurrency and they’ll think of the Petro: a government-issued stablecoin supposedly pegged to the price of Venezuelan oil.

Many ICO rating sites have labeled it a scam and its value fluctuates almost as wildly as the Bolivar. Despite a lack of interest, Maduro’s government is forcing the Petro down the nation’s throat, demanding it in return for new passports and even converting the nation’s pension funds.

As cryptocurrencies become just another tool of oppression under Maduro’s rule, it’s hardly surprising people are looking to USD, the world reserve currency, for freedom.

Fiat Still Drives the Economy

Three million people have fled Venezuela, but life goes on for those remaining.

Whether it’s queuing for hours to buy a loaf of bread or scouring the black market for medicine, life is unbelievably tough. A pint of milk can cost a day’s wages. Few carry Bolivar anymore as it’s just too impractical, instead relying on debit cards for almost all transactions.

Venezuelan inflation on the black market on a logarithmic scale (Source)

“It’s hard to get cash, so people use debit cards. However, many services still require cash, such as taxis and some stores, so people are stuck at ATMs that only allow you to take out $3 at once, in some cases,” said Carlos.

Whether it’s cash or card, Venezuelans need a secure and stable store of value to draw upon for immediate use, and Bitcoin’s volatility makes this hard.

Bolivar prices change hourly. Restaurants and shops often forgo printed price lists in favor of erasable chalk or whiteboards, but many businesses have defaulted to the USD, favored for its stability.

“Some dentists and doctors advertise only USD prices, even though the transaction goes through in Bolivar,” said Carlos.

Digitizing Fiat Could Help Those Most in Need

Many Venezuelans have U.S. bank accounts or know people that do.

Inbound remittances can incur fees and delays, however, and the rates offered by Venezuelan banks are far from desirable. Most convert their USD into Bolivar before it enters the country. And as the government flags inbound transfers valued at over $50, Venezuelans tend to withdraw only what they need.

Empty shelves are increasingly common in Venezuela (Source)

While USD is a convenient yardstick for determining the true price of Venezuelan goods and services, getting it into the country is impossible unless you transport it personally (or ask someone to do it for you).

Digital assets are therefore easier to manage, and an asset backed by real USD would meet demand without forcing people to the black market where they risk being scammed.

For those without U.S. bank accounts, a digital asset backed by USD would act as a proxy for something they’ve been unable to attain.

They could then sell the asset to local buyers for fair exchange rates with both buyer and seller confident in its value over the long term. Bitcoin’s value proposition may be technically sound, but if people are already thinking in USD, why not offer them a digital asset that represents it?

Synergy for the Win

There’s no doubt that Bitcoin has helped people survive in Venezuela, but it is no panacea. W

ith stable fiat like the USD being the preferred unit of account, it would make more sense to bridge the gap between fiat and cryptocurrency with a digital asset 100% backed by USD.

Maduro has blocked desperately needed aid at the border (Source)

It is important to remember that Venezuela is in crisis.

President Maduro, whom many believe responsible for the country’s troubles, has recently blocked humanitarian aid, worsening the plight of his citizens and nudging the nation towards total collapse.

Asking Venezuelans to trust in the intrinsic value of a cryptographic asset is a tough sell when you don’t know where your next meal is coming from.

Maybe they would benefit from a USD-backed stablecoin instead.

Chris Roper, Communications Manager at Constant

Chris Roper, Communications Manager at Constant

Chris Roper has been writing about blockchain and cryptocurrencies for over three years. In that time, he’s written for several top tier publications and worked with various cryptocurrency and decentralized blockchain projects, including BitCash, Altcoin, and Constant. Chris is currently focusing on stablecoins and their impact on both fiat and crypto economies.