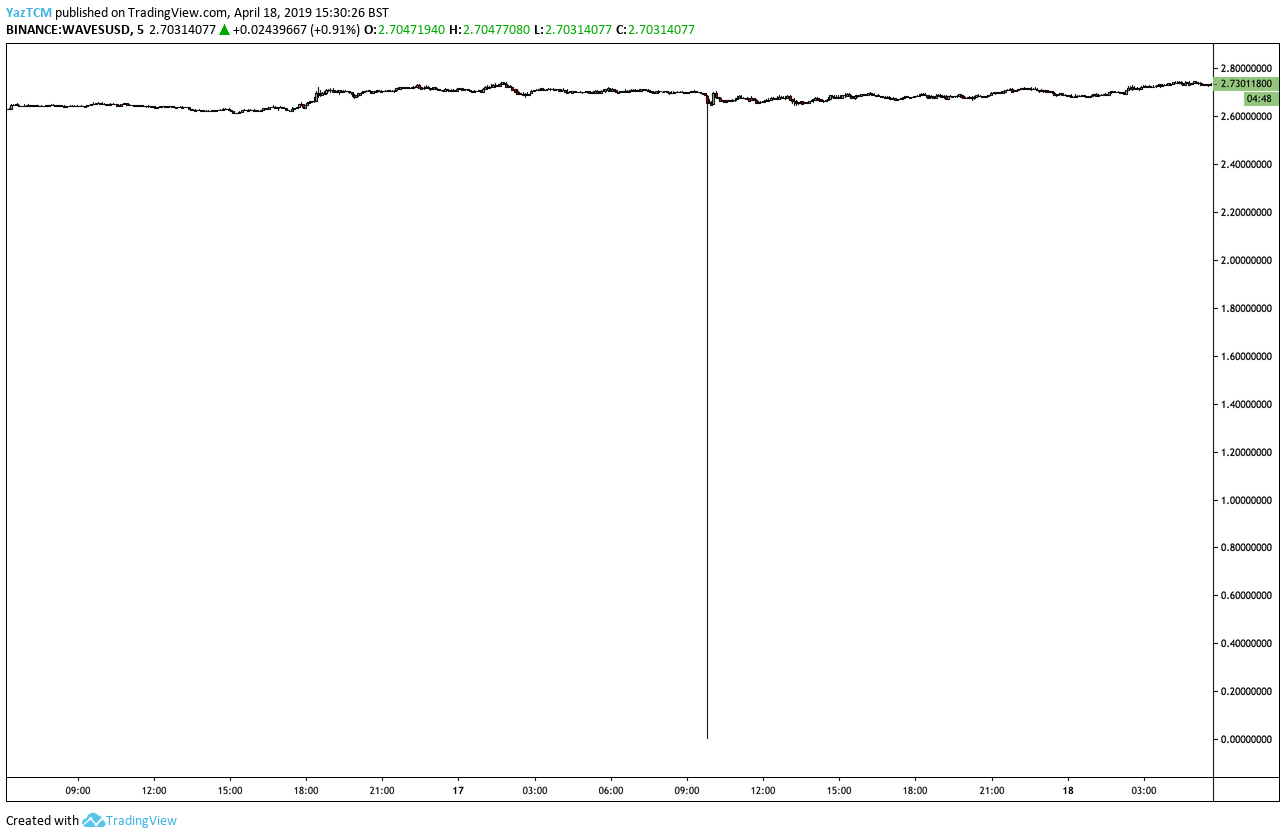

If you are a WAVES holder and the type of trader that loves to keep an eye on the charts, you may have had a small panic attack yesterday after the WAVES market flash crashed by 99% to the value of 1 Satoshi on Binance;

As seen on the chart above, at 9:50 AM (UTC+1) on April 18, the Binance market flash crashed all the way down to 1 Satoshi, this translates into a price of around $0.00052.

It is still unclear as to what caused the flash crash, but according to CryptoPotato, an order of 506,000 WAVES was placed and executed. This order was presumably placed, perhaps accidentally, as a market order. If this was the case, all 506,000 WAVES would have been sold at the market rate, which would have cleared the entire Binance “buy side” of their order book, resulting in the market flash crashing down to 1 Satoshi. What is apparent is that the order books were very thin on Binance, which led to the resulting drop to 1 Satoshi with relatively low volume.

This flash crash was not apparent on any other exchanges, and the price recovered within seconds to trade back at its original value around the 52,000 SATS level.

An Opportunity That Is Hard To Catch

Nevertheless, the orders were filled and the WAVES were sold all the way down to the 1 SATS mark. This meant that some very lucky traders, who had previously placed buy orders at the very low levels around 1 SATS (and higher), were able to snatch a great deal at such low prices.

In fact, those who managed to catch some WAVES at 1 Satoshi saw a 5,200% increase in price in their positions when the market recovered moments later. A very impressive rate of return for any trader in any market!

Placing very low bids on the order books is a very common trading strategy as traders take their chances and leave very low bids to be filled in the case of a flash crash. However, in the majority of cases, these orders are never filled.

Will you be placing any orders at low prices anytime soon in the hopes of a future “flash crash?” If so, let us know which market in the comments below!