Cryptocurrency has presented the world an opportunity to democratize the distribution of money. Lots of projects in the crypto world show promise of an upward trend in value in the future. However, some projects will stand out in the coming years as producing a multiple fold return. It is difficult to predict which those will be, but having a good insight into projects that show promise can help predict with better accuracy.

The definition of “long term” in this article is 10 years and beyond. While prices will definitely remain volatile in the near term when the whole crypto world is still seeking global validation, the future will likely present much more stability, especially when the crypto reality has been embraced by institutions and the average person.

One blockchain project that looks promising is Modum.

Disclaimer: This analysis is not intended to be financial advice — rather it is an opinion article written to enlighten and educate. Always do your own research before investing.

What is Modum?

Modum is a supply chain solution that uses blockchain and Internet of Things (IoT) technology to provide a better and more cost-effective way for companies to guarantee the transport conditions of their merchandise. This is especially suited for pharmaceutical companies that have to transport their products under specified conditions and prove that those conditions were not breached.

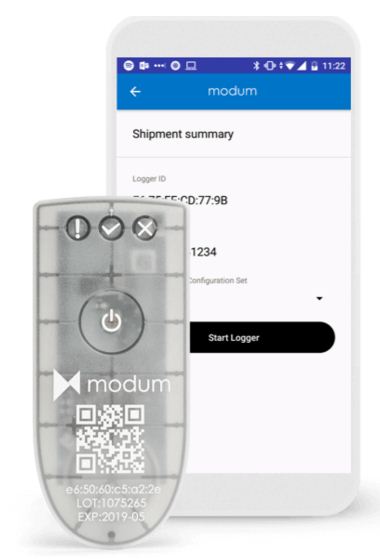

Modum has a hardware component and a software interface.

The Modum IoT sensor device is known as the MODsense TM Temperature Logger. It enables trusted temperature monitoring of high-volume shipments of pharmaceutical products. It also records other events, such as motion. The Modum dashboard and mobile app enables easy interaction with the device and offers instant notification of temperature variations. The client dashboard is designed to provide quality control at an industrial scale.

Modum was conceived in 2016 by several members of their board of directors and advisors. The CEO is Simon Dossegger, a former senior manager at GoPro. Other top members of management include Stefan M. Weber (COO), Sacha Uhlmann (CTO), and Michael Taylor (Marketing and Communications).

Why Invest in Modum for the Long Term?

Now that we’ve established what Modum does, here are 4 factors that make it a solid choice for a long-term cryptocurrency investment.

1. European Regulation Concerning Big Pharma

In November 5, 2013, a regulation was published by the European Commission for the Good Distribution Practice of medicinal products for human use (GDP 2013/C 343/01). Chapter 9 of this regulation requires proof that shipped medicinal products have not been exposed to conditions, particularly temperature, that may have compromised their quality.

This regulation is enforced throughout the European Union and has made pharmaceutical companies rely on expensive logistics to comply with this regulation.

Pharmaceutical companies transport their medicinal products via temperature-stabilized trucks and containers just to meet this regulatory requirement. There are many medicinal products that are not temperature sensitive, and hence do not need to be transported in these expensive trucks.

However, because there is no other way to provide proof of stable temperature, as the regulation states, these expensive trucks were the only option until Modum.

Modum, headquartered in Zurich, Switzerland, is rightly positioned to provide a way for pharmaceutical companies to comply with this regulation in a much more cost-effective way. Medicinal products that do not require active cooling can be transported the usual way with the Modum sensor, providing the proof that the GDP regulation requires.

The data from the sensor is recorded into the Ethereum blockchain, which ensures absolute transparency and data integrity every step of the way. If the product encounters a temperature deviation at any point, the sender and receiver will be notified.

A solution like this tailored for pharmaceutical companies operating in the European Union is hard to turn down, as it offers a more effective, cost-efficient method of transporting pharmaceuticals for a highly lucrative and influential industry. If the pharmaceutical companies embrace this solution, it will go a long way in increasing the value of Modum.

2. Profit-Sharing with Token Holders in Ether

MOD (the cryptocurrency of Modum) is an ERC-20 token with a unique feature. When Modum fully becomes operational, the board of directors of the company will declare dividends yearly according to the profit. This dividend is then converted to ETH and sent to the Modum smart contract. The smart contract evaluates the holdings of each token holder and sends them their share of the dividends in ETH.

This feature makes Modum very likely to be classified as a financial security. This is because of its similarity to how company shares work. However, ownership of MOD tokens does not equate ownership of the company shares. Regardless, the fact that MOD promises passive income in ETH is reason enough to consider investing in the cryptocurrency.

3. Small Token Supply of Only 27 Million

Scarcity is a very important concept in business. The smaller the total supply of the token, the more influence demand has in boosting its price. When supply is too large, demand will not have much of an effect on price.

The total supply of most cryptocurrencies is in hundreds of millions and billions. Modum has chosen a modest 27 million total supply of tokens, with over 17 million already in circulation. More information concerning their token economics can be seen in the whitepaper.

This small total supply of tokens will have significant impact on the price in the coming years when the company becomes fully functional and starts paying dividends in ETH. The demand for the cryptocurrency in such a future time makes it worth considering as a long-term investment.

4. Modum Partnerships

Adoption of a cryptocurrency can be fueled by having solid partnerships. Seeing a cryptocurrency form strong partnerships with enterprises creates more surety that the blockchain solution will be put to use as intended.

On the academic front, Modum is partners with the University of Zurich and University of St. Gallen (both in Switzerland), basically for research purposes.

On the industry front, Modum has announced partnerships with Swiss Post (the national postal service of Switzerland) and SAP (in this article by SAP VP). It has also been announced that Modum is in the process of partnering with Deloitte. Although Modum has been careful about information dissemination, there have also been rumors of partnerships with big pharmaceutical companies in the works, such as Novartis and Roche.

Another speculative partnership fact about Modum is that members of the board of directors are well-connected in Europe, especially with big pharmaceutical companies. For example, Pascal Degen, who is a member of the Modum board, is also head of Sterile Assembly and Packaging at Novartis.

Conclusion

There are other blockchain projects focusing on supply chain logistics, such as VeChain and Ambrosus, but Modum is different in the sense that it is regulatory-inspired and primarily focused on pharmaceuticals. While the worldwide supply chain market is big and expected to grow in coming years, Modum operates a business model at a scale that will make it easy to deliver returns to token holders.

MOD tokens can be purchased on Binance and KuCoin. It is currently priced around US$0.90. Visit their website to learn more about the project. You can stay in touch with Modum via Twitter and Telegram.

Related: 5 Sub-$50 Million Market Cap Coins That Have Promise