From an investor’s perspective, there are a few particular categories of blockchain projects that hold potentially lucrative returns. Heavily discussed niches include energy, distributed computing, finance, and real estate.

One that has sown some division among community members is privacy coins, such as Monero, Zcash, PivX, and Verge. Andreas Antonopolous, purveyor of quality crypto knowledge and blockchain proponent, is one of those expressing interest in privacy coins, mentioning both Monero and Zcash.

Any enthusiast with even a little understanding of cryptocurrencies should know that Bitcoin is not actually anonymous, merely pseudonymous. In fact, Satoshi Nakamoto noted this when developing the Bitcoin protocol (and suggested that an address be used only once). There is a hunger in the community for coins that provide complete privacy. The aforementioned coins (among others) are vying to become the go-to privacy coin, and each takes a different approach.

The motivation for privacy coins is obvious: security of holdings, masking transactions that you want to keep private, and the simple principle that privacy is a right everyone should be entitled to. Governments already have enormous power in surveying and recording citizen data. Cryptocurrency can offer a defence against overreaching government surveillance.

There lies one of the biggest problems, though – government reaction. It is no news that governments fear the use of cryptocurrencies for illegal purposes, including black market purchases and money laundering. They were worried about this with Bitcoin – which is traceable – and even more so with truly private coins.

While in practice, there is no way to outright stamp out the use of privacy coins, people would be dissuaded from using them if governments applied destructive regulation to them. This is speculation, but were that to happen, the privacy coin market would probably attract more illegal activity than if it were unregulated. It is not hard to imagine the majority of honest users resigning themselves to alternatives if, say, privacy coins were banned from exchanges.

Heavy handed regulation would direct criminals to those coins most immune to forensics. Privacy coins are are difficult to trace and if the world does become one dominated by digital currency, then privacy coins could become the equivalent of black money – untaxed, untraceable transactions.. This is an obstacle that all privacy coins are contending with.

Let’s focus instead on the fact that privacy is important and that many honest, well-meaning people use privacy coins to keep their identities and personal data safe. We take a look today at Zcash, one of these privacy coins, and what is in store for it in the future, including an examination of the roadmap and an analysis of its performance against that of its competitors.

What is Zcash?

Zcash inherits some of its nature from the Zerocoin protocol that was released in 2014. This protocol, published in a research paper by renowned scientists, considered the privacy flaws in Bitcoin and sought to improve it. The protocol advised a technique called “mixing,” which mixed users’ transactions with other transactions to obfuscate metadata. Professor Matthew D. Green of Johns Hopkins University created this project with a few students.

Zerocoin essentially created a new coin that could be purchased with bitcoins and then redeemed by sending it to a separate Bitcoin address. While successful in offering privacy, it did have its hiccups, not the least of which was an incident in which hackers created Zcoin tokens out of nothing, due to a bug.

Zerocoin then developed into Zcash, with the Zerocoin protocol mutating into the Zerocash protocol, which Zcash uses.

Zcash is open source, and as a result, the primary task of the developing team is to make improvements to it over time.

zk-SNARKs

The key technology that Zcash uses is a cryptographic technique called zero-knowledge proof, and this manifests in the form of something called zk-SNARKs. This is the unique method that Zcash uses to offer privacy. To keep it simple, zk-SNARKS permit people to prove that they hold funds without revealing any information beyond that – all without any direct interaction between the sender and the recipient.

This cryptographic method is one of the main methods in establishing privacy in cryptocurrencies (one of the others being ring signatures, which Monero uses). It shields information concerning the identities of the sender and recipient, as well as the transaction amount. We recommend reading Zcash’s comprehensible description of the zk-SNARKs protocol.

How Does Zcash Differ From Zcoin?

To distill it into quick and easy terms, Zcash differs from Zcoin in the following ways:

- Both Zcash and Zcoin hide the identities of the sender and recipient. However, Zcash additionally obfuscates the transaction amount.

- It is currently very difficult to detect hyperinflation in Zcash because of the obfuscation. It is unauditable, where Zcoin can be audited because its transaction history is available.

- Zcash’s technology is uncharted space, and there is hesitancy regarding the assumption that bad actors will not collude. Zcoin’s technology has undergone much peer review.

- Zcash uses more memory and has longer transaction times, while Zcoin requires more storage space

For a more in-depth explanation of the Zcash project, take a look at our investment guide on Zcash.

Development Milestones

Before we lay out the upcoming goals for the project, let’s take a look the goals Zcash has hit so far.

Zcash’s roadmap page describes general priorities, which is listed below. Their milestones page is a more detailed, technical description of their roadmap objectives and offers a microscopic view of their progress. We’ll examine the specific priorities, as well as some of their important releases.

- Security Incident Response

- Continuous Improvement

- Payment Disclosure

- Payment Offloading (technical name: Delegated Proving T)

- XCAT

- Core Circuit improvements (improved security, speed, or RAM w/out other degradations)

- User Issued Tokens (work in progress)

Public Alpha

In January 2016, Zcash announced a technology preview build of the Zcash protocol in their first blog post. This preview build allowed them to run the source code and work on the testnet. The tokens at the time, testnet-bux, were fully private and cryptographically protected. Stepping for the first time out of the lab and into the field, Zcash and its success with zk-SNARKs drew praise from many interested in privacy protection.

Vitalik Buterin was impressed, telling Fortune, “Personally, I think zk-SNARKs are a hugely important, absolutely game-changing technology… they are the single most under-hyped thing in cryptography right now.”

In September 2017, an upgrade added the zk-SNARKs feature into Ethereum.

Special thanks to the @zcashco team for all the help that made this happen! https://t.co/oNT1zfAuka

— Vitalik "Not giving away ETH" Buterin (@VitalikButerin) September 20, 2017

Launch – First Sprout Release

On October 28, 2016, Zcash officially entered the market by releasing the Zcash blockchain on the mainnet, part of a phase called “Sprout” (which we’ll get to shortly). This release had been delayed for some time. The team states this was because they wanted to polish the implementation and remove bugs. However, this release did not feature a Graphical User Interface. Zcash plans to offer a user-friendly GUI soon, though we have no details yet.

Payment Disclosure

Introduced in version 1.0.13, the payment disclosure goal sought to tackle a common problem among private coins: how can you verify that a payment was sent to a shield address without revealing metadata from the transaction? This may occur in a dispute relating to a merchant transaction. Zcash’s solution to this was to let senders generate a proof which could be used to verify that funds have been transferred to a receiver. Third parties can also use this proof for verification.

Payment Offloading

Payment offloading, known technically as “delegated proving,” allowed users of light wallets to send funds to shielded addresses without risking their funds. As the name suggests, this delegates the proving process, which light wallets cannot handle, to a third-party service. There are two variants to delegated proving – one for t-addresses (transparent addresses like Bitcoin) and another for z-addresses, which are fully private. This allowed light wallets to receive fully private funds.

Cross-chain Atomic Transactions (XCAT)

The XCAT feature allows transactions to span multiple blockchains. For example, this would allow direct atomic swaps (i.e. excluding the need for third party exchanges) of Zcash tokens for ether.

This is still under development and requires users to run full nodes of both Bitcoin and Zcash. A light client version is being created.

Security, Stability, and Continuous Improvements

Since the release on the mainnet, the Zcash team has devoted a portion of their time to making continuous improvements to the protocol, focusing on security and stability. As this is a work in progress, several security issues are only discovered as the technology develops. The team is transparent about security incidents, most notably providing users with a patch to version 1.0.10 that excluded connections to non-1.0.10 users.

Other goals in this category include dev support and infrastructure improvement.

Check Zcash’s milestone page to see the progress they’re making on their open milestones.

Zcash 2018 Roadmap

We saw how, in 2017, the team focused on some specific aspects of the project, including payment disclosure, payment off-loading, and cross-chain atomic transactions (XCAT). The Zcash team must be credited for hitting their 2017 priorities.

In December 2017, Zcash revealed their roadmap for the upcoming year.

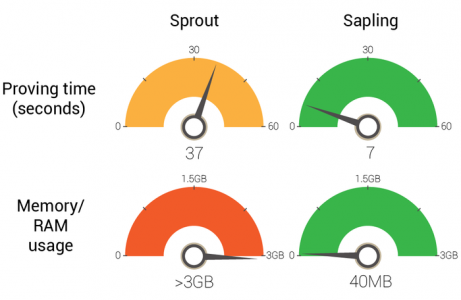

Zcash divides its progress into two phases: “Sprout” and “Sapling.” The first deals primarily with fixing bugs and improving usability, while the second is a long-term objective that will upgrade the network protocol, improving efficiency and delivering “user-issued tokens,” which allows users to issue, trade, and transfer protocols for whatever purposes.

The team is prioritizing security and reliability, and the issues mentioned in community feedback. It is good to hear that they take community feedback and response seriously, a vital element for any project to be successful.

On March 2, 2018, Zcash announced the “Overwinter” release, which prepares the network for future upgrades to the protocol. This is the first step towards the Sapling era of the project,which is expected to take place towards the end of the year. It also requires users to update their software, the first time Zcash has hard forked.

This process is currently accepting developer feedback and will go live in June. It has undergone a few delays, but again, the teams says they want to remove all bugs and offer the best version possible upon launch. For more information, visit Zcash’s “Overwinter” documentation page.

This Sapling network upgrade is the major agenda for 2018. It is slated for release in September 2018, which has the following on its chalkboard:

- Improved memory and performance time with shielded transactions

- Support for mobile wallets

- A communal ceremony of greater scale called the “Powers of Tau”

Naturally, current users will be supported as Zcash transitions into this next era of its growth.

The Post-Sapling Era

The following are a few additional points to consider regarding Zcash’s future:

- The team has stated that they may shift to a different Proof-of-Work algorithm or even Proof-of-Stake.

- To tackle the aforementioned problem of the creation of counterfeit currency, the team is deliberating security upgrades that might defend against this problem.

- Although not a priority, Zcash is working on end-user wallets, as well as ports for Windows, Mac, and mobile.

- They are putting the idea of a fork on the table, but will work towards supporting different branches of the coin and fostering collaboration.

- The team is mindful of how upgrades are correlated to scaling. If the user base is relatively small, they expect to expedite these upgrades; if large, they will take a more cautious approach.

Analysis: Can Zcash Win the Privacy Coin Battle?

We’ve seen that Zcash is doing plenty to keep itself in contention in the privacy coin contest. The development history is good, they frequently inform the community of their progress, they are backed by a solid team with research experience, and their Github page is active.

Zcash is also hosting a conference in Montreal, called Zcon0, at the end of June, the details of which we will shortly receive.

The big question is: how will they stand up against the many other privacy coins who are all (well, at least the various communities are) expecting 2018 to be their year?

For example, Monero is one of the hottest privacy coins. It utilizes a different system called ring signatures to ensure privacy, and it has the benefit of being on the market much longer than its competitors. Some believe Zcash’s Sapling upgrade will make scaling and mobile transactions possible, setting it up to overtake Monero. For that, we’ll have to wait until September. In the meantime, it will be interesting to see how the development of different privacy coins pans out.

So perhaps all we can do at the moment is watch and wait, especially given that in the privacy coin niche – unlike, say, a niche like the energy industry where the obstacles are different – the competition comes from the other coins more than anything else.

Which will best deliver as soon as possible? Can fatal flaws be avoided? And how will they respond to invariable governmental interference?

Performance

Zcash is currently ranked 24 on Coinmarketcap, with each token worth $238 and 0.02909950 BTC (at the time of writing). Its peak value was just under $5,000, or roughly 6 BTC (at the time), in October 2016.

For a brief while, it was even the most expensive coin. However, Zcash then followed a downward trajectory to spend much of 2017 in the 0.05 to 0.10 Satoshi levels. It is most commonly traded on LBank, HitBTC, Bitfinex, and Huobi.

Final Thoughts

Zcash is certainly an interesting privacy project, the first of its kind to implement the zk-SNARKs protocol. 2018 will be a decisive year for the project and, fortunately for its team and supporters, its developers’ track record leaves one optimistic that they’ll make the necessary upgrades for Zcash to become the top privacy coin.

No later developments will matter if the Sapling era is not successful – but we have every reason to assume it will be. The more interesting subplot is the victory of the privacy technique – we will know which fares better this year once different projects upgrade their different techniques. It will be similar to measuring the success of different approaches to quantum computing, and virtual and augmented reality.

In any case, we have another exciting cryptocurrency mini-battle to watch.